Google 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

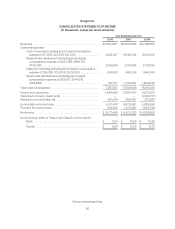

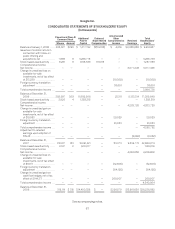

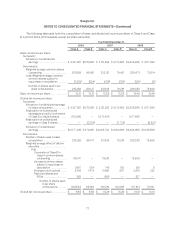

Google Inc.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands)

Class A and Class B

Common Stock Additional

Paid-In

Capital

Deferred

Stock-Based

Compensation

Accumulated

Other

Comprehensive

Income Retained

Earnings

Total

Stockholders’

EquityShares Amount

Balance at January 1, 2006 .... 293,027 $293 $ 7,477,792 $(119,015) $ 4,019 $2,055,868 $ 9,418,957

Issuance of common stock in

connection with follow-on

public offering and

acquisitions, net ........... 7,689 8 3,236,778 — — — 3,236,786

Stock-based award activity .... 8,281 8 1,168,336 119,015 — — 1,287,359

Comprehensive income:

Net income .................. — — — — — 3,077,446 3,077,446

Change in unrealized loss on

available-for-sale

investments, net of tax effect

of $13,280 ................ — — — — (19,309) — (19,309)

Foreign currency translation

adjustment ................ — — — — 38,601 — 38,601

Total comprehensive income . . — — — — — — 3,096,738

Balance at December 31,

2006 ..................... 308,997 309 11,882,906 — 23,311 5,133,314 17,039,840

Stock-based award activity .... 3,920 4 1,358,315 — — — 1,358,319

Comprehensive income:

Net income .................. — — — — — 4,203,720 4,203,720

Change in unrealized gain on

available-for-sale

investments, net of tax effect

of $19,963 ................ — — — — 29,029 — 29,029

Foreign currency translation

adjustment ................ — — — — 61,033 — 61,033

Total comprehensive income . . — — — — — — 4,293,782

Adjustment to retained

earnings upon adoption of

FIN48.................... — — — — — (2,262) (2,262)

Balance at December 31,

2007 ..................... 312,917 313 13,241,221 — 113,373 9,334,772 22,689,679

Stock-based award activity .... 2,197 2 1,209,117 — — — 1,209,119

Comprehensive income:

Net income .................. — — — — — 4,226,858 4,226,858

Change in unrealized loss on

available-for-sale

investments, net of tax effect

of $8,871 ................. — — — — (12,506) — (12,506)

Foreign currency translation

adjustment ................ — — — — (84,195) — (84,195)

Change in unrealized gain on

cash flow hedges, net of tax

effect of $144,371 .......... — — — — 209,907 — 209,907

Total comprehensive income . . — — — — — — 4,340,064

Balance at December 31,

2008 ..................... 315,114 $ 315 $14,450,338 $ — $ 226,579 $13,561,630 $28,238,862

See accompanying notes.

67