Google 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

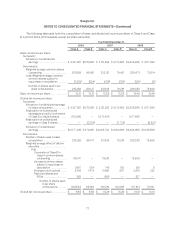

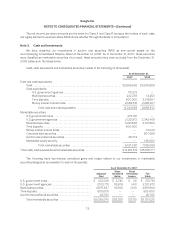

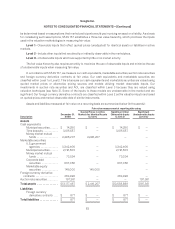

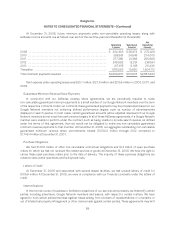

The following table presents our assets measured at fair value on a recurring basis using significant

unobservable inputs (Level 3) as defined in SFAS 157 at December 31, 2008 (in thousands):

Level 3

Balance at December 31, 2007 ..................................................... $ —

Transfers to Level 3 ............................................................... 311,225

Unrealized loss included in other comprehensive income ............................... (35,485)

Net settlements ................................................................... (78,379)

Balance at December 31, 2008 ..................................................... $197,361

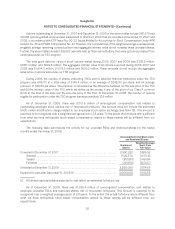

Asset measured at fair value on a nonrecurring basis is summarized below (in thousands):

Description December 31,

2008

Quoted Prices in Active

Markets for Identical Assets

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable Inputs

(Level 3) Total Loss

Investment in

AOL .......... $274,000 $— $— $274,000 $726,000

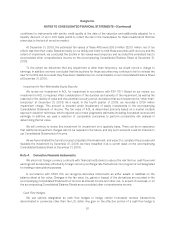

In accordance with the provisions of FSP 115-1, our investment in AOL with a carrying value of $1.0 billion was

written down to its fair value of $274.0 million, resulting in an “other-than-temporary” impairment charge of

$726.0 million, which was included in our results of operations for the year ended December 31, 2008 (See

Note 3).

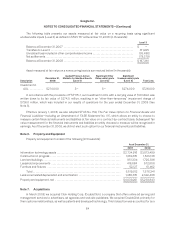

Effective January 1, 2008, we also adopted SFAS No. 159, The Fair Value Option for Financial Assets and

Financial Liabilities—Including an Amendment of FASB Statement No. 115, which allows an entity to choose to

measure certain financial instruments and liabilities at fair value on a contract-by-contract basis. Subsequent fair

value measurement for the financial instruments and liabilities an entity chooses to measure will be recognized in

earnings. As of December 31, 2008, we did not elect such option for our financial instruments and liabilities.

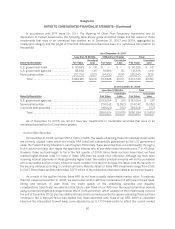

Note 6. Property and Equipment

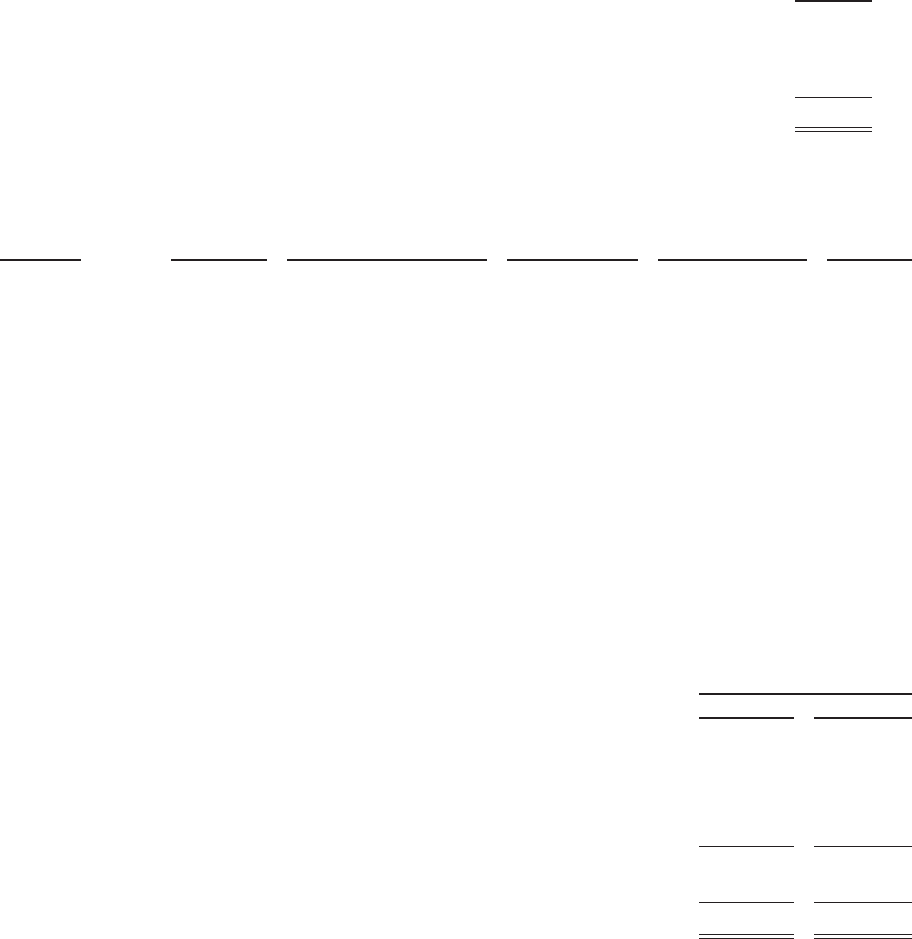

Property and equipment consist of the following (in thousands):

As of December 31,

2007 2008

Information technology assets ................................................. $2,734,916 $3,573,499

Construction in progress ...................................................... 1,364,651 1,643,136

Land and buildings ........................................................... 951,334 1,725,336

Leasehold improvements ..................................................... 416,884 572,908

Furniture and fixtures ........................................................ 52,127 61,462

Total ................................................................... 5,519,912 7,576,341

Less accumulated depreciation and amortization ................................ 1,480,651 2,342,498

Property and equipment, net .................................................. $4,039,261 $5,233,843

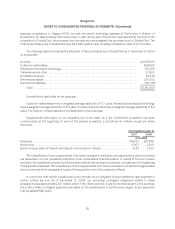

Note 7. Acquisitions

In March 2008, we acquired Click Holding Corp. (DoubleClick), a company that offers online ad serving and

management services to advertisers, ad agencies and web site publishers. We acquired DoubleClick primarily for

their customer relationships, as well as patents and developed technology. This transaction was accounted for as a

84