Google 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

performance. There are no segment managers who are held accountable by our chief operating decision-makers,

or anyone else, for operations, operating results and planning for levels or components below the consolidated unit

level. Accordingly, we consider ourselves to be in a single reporting segment and operating unit structure.

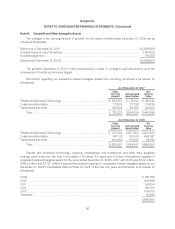

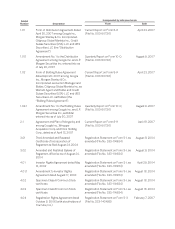

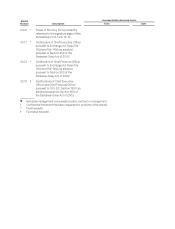

Revenues by geography are based on the billing address of the advertiser. The following table sets forth

revenues and long-lived assets by geographic area (in thousands):

Year Ended December 31,

2006 2007 2008

Revenues:

United States ........................................... $6,030,140 $ 8,698,021 $10,635,553

United Kingdom ......................................... 1,603,842 2,530,916 3,038,488

Rest of the world ........................................ 2,970,935 5,365,049 8,121,509

Total revenues ...................................... $10,604,917 $16,593,986 $21,795,550

As of December 31,

2007 2008

Long-lived assets:

United States .......................................................... $7,334,877 $ 9,782,825

International ........................................................... 711,791 1,806,568

Total long-lived assets ............................................. $8,046,668 $11,589,393

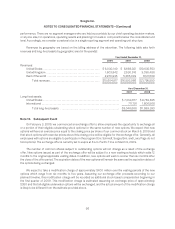

Note 16. Subsequent Event

On February 3, 2009, we commenced an exchange offer to allow employees the opportunity to exchange all

or a portion of their eligible outstanding stock options for the same number of new options. We expect that new

options will have an exercise price equal to the closing price per share of our common stock on March 6, 2009 and

that stock options with exercise prices above this closing price will be eligible for the exchange offer. Generally, all

employees with options are eligible to participate in the program (Eric Schmidt, Sergey Brin, and Larry Page do not

hold options). The exchange offer is currently set to expire at 6 a.m. Pacific Time on March 9, 2009.

The number of common shares subject to outstanding options will not change as a result of the exchange

offer. New options issued as part of the exchange offer will be subject to a new vesting schedule which adds 12

months to the original applicable vesting dates. In addition, new options will vest no sooner than six months after

the close of the offer period. The expiration dates of the new options will remain the same as the expiration dates of

the options being exchanged.

We expect to take a modification charge of approximately $400 million over the vesting periods of the new

options which range from six months to five years. Assuming our exchange offer proceeds according to our

planned timeline, this modification charge will be recorded as additional stock based compensation beginning in

the first quarter of 2009. This modification charge is estimated assuming an exchange price of approximately

$350 and that all eligible underwater options will be exchanged, and the actual amount of the modification charge

is likely to be different from the estimate provided above.

96