Google 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The net income per share amounts are the same for Class A and Class B because the holders of each class

are legally entitled to equal per share distributions whether through dividends or in liquidation.

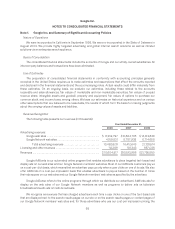

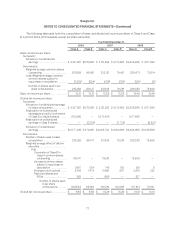

Note 3. Cash and Investments

We have classified our investments in auction rate securities (ARS) as non-current assets on the

accompanying Consolidated Balance Sheet at December 31, 2008. As of December 31, 2007, these securities

were classified as marketable securities. As a result, these amounts have been excluded from the December 31,

2008 balances in the tables below.

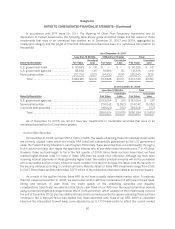

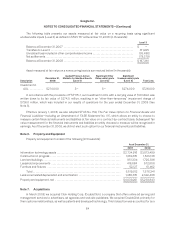

Cash, cash equivalents and marketable securities consist of the following (in thousands):

As of December 31,

2007 2008

Cash and cash equivalents:

Cash .................................................................. $2,869,528 $3,330,658

Cash equivalents:

U.S. government agencies ........................................... 110,272 —

Municipal securities ................................................ 232,278 14,250

Time deposits ...................................................... 500,000 3,015,557

Money market mutual funds ......................................... 2,369,515 2,296,207

Total cash and cash equivalents ................................. 6,081,593 8,656,672

Marketable securities:

U.S. government notes .................................................. 475,781 —

U.S. government agencies ............................................... 2,120,972 3,342,406

Municipal securities ..................................................... 4,991,564 2,721,603

Time deposits .......................................................... 500,000 —

Money market mutual funds ............................................. — 73,034

Corporate debt securities ................................................ — 907,056

Auction rate preferred securities .......................................... 48,703 —

Marketable equity security ............................................... — 145,000

Total marketable securities ..................................... 8,137,020 7,189,099

Total cash, cash equivalents and marketable securities .......................... $14,218,613 $15,845,771

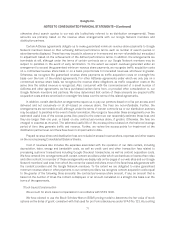

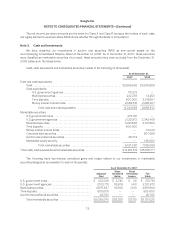

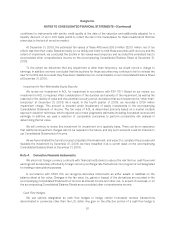

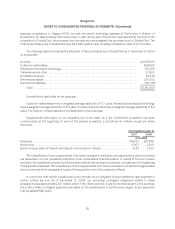

The following table summarizes unrealized gains and losses related to our investments in marketable

securities designated as available-for-sale (in thousands):

As of December 31, 2007

Adjusted

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses Fair

Value

U.S. government notes ................................. $ 472,040 $ 3,745 $ (4) $ 475,781

U.S. government agencies .............................. 2,102,710 18,306 (44) 2,120,972

Municipal securities ................................... 4,975,587 16,308 (331) 4,991,564

Time deposits ......................................... 500,000 — — 500,000

Auction rate preferred securities ........................ 48,703 — — 48,703

Total marketable securities ........................ $8,099,040 $38,359 $(379) $8,137,020

78