Google 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

any foreign income taxes previously paid on these earnings. As of December 31, 2008, the cumulative amount of

earnings upon which U.S. income taxes have not been provided is approximately $7.7 billion. Determination of the

amount of unrecognized deferred tax liability related to these earnings is not practicable.

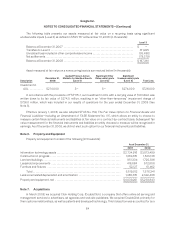

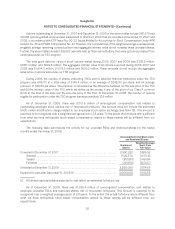

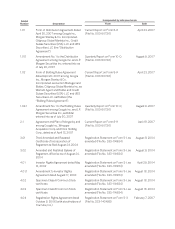

Deferred Tax Assets

Deferred income taxes reflect the net effects of temporary differences between the carrying amounts of

assets and liabilities for financing reporting purposes and the amounts used for income tax purposes. Significant

components of our deferred tax assets and liabilities are as follows (in thousands):

As of December 31,

2007 2008

Deferred tax assets:

Stock-based compensation ................................................. $ 118,297 $ 211,311

State taxes ............................................................... 86,256 132,827

Capital loss from impairment of equity investments ............................ — 446,770

Settlement with the Authors Guild and AAP ................................... — 38,810

Depreciation .............................................................. 53,900 19,666

Vacation accruals .......................................................... 18,868 24,903

Deferred rent .............................................................. 17,498 38,048

Accruals and reserves not currently deductible ................................ 9,824 32,080

Acquired net operating losses ............................................... — 60,306

Other ..................................................................... 14,674 10,442

Total deferred tax assets ............................................... 319,317 1,015,163

Valuation allowance ................................................... — (364,529)

Total deferred tax assets net of valuation allowance ....................... 319,317 650,634

Deferred tax liabilities:

Identified intangibles ....................................................... (127,700) (249,679)

Undistributed earnings of foreign subsidiaries ................................. (55,329) —

Unrealized gains on investments and other ................................... (30,187) (123,231)

Other ..................................................................... (4,344) (4,134)

Total deferred tax liabilities ............................................. (217,560) (377,044)

Net deferred tax assets ......................................................... $ 101,757 $ 273,590

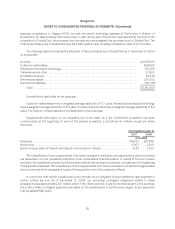

As of December 31, 2008, our federal and state net operating loss carryforwards for income tax purposes

were approximately $186.7 million and $92.6 million. If not utilized, the federal net operating loss carryforwards will

begin to expire in 2025 and the state net operating loss carryforwards will begin to expire in 2011. The net

operating loss carryforwards are subject to various limitations under Section 382 of the Internal Revenue Code.

On October 3, 2008, the United States enacted a law, the “Emergency Economic Stabilization Act of 2008,”

which contains the “Tax Extenders and Alternative Minimum Tax Relief Act of 2008”. Under this act, the federal

research and development credit was retroactively extended for amounts paid or incurred after December 31,

2007 and before January 1, 2010. During the fourth quarter, there were various changes to the income tax laws in

the states where we conduct business. The tax effects of these changes were determined and recognized in the

fourth quarter.

In the fourth quarter of 2008, we recorded $1.09 billion impairment charge related primarily to our

investments in AOL and Clearwire. For tax purposes, the impairment generated an equal amount of capital loss of

94