Google 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Google Inc.

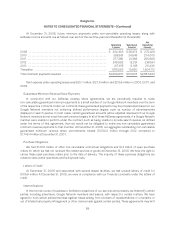

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

amounts is unnecessary, the reversal of the liabilities would result in the recognition of tax benefits in the period we

determine the liabilities are no longer necessary. If our estimates of the federal, state, and foreign income tax

liabilities are less than the ultimate assessment, a further charge to expense would result.

Note 12. Stockholders’ Equity

Convertible Preferred Stock

Our Board of Directors has authorized 100,000,000 shares of convertible preferred stock, $0.001 par value,

issuable in series. At December 31, 2007 and 2008, there were no shares issued or outstanding.

Class A and Class B Common Stock

Our Board of Directors has authorized two classes of common stock, Class A and Class B. At December 31,

2008, there were 6,000,000,000 and 3,000,000,000 shares authorized and there were 240,099,511 and

75,040,973 shares legally outstanding of Class A and Class B common stock. The rights of the holders of Class A

and Class B common stock are identical, except with respect to voting. Each share of Class A common stock is

entitled to one vote per share. Each share of Class B common stock is entitled to 10 votes per share. Shares of

Class B common stock may be converted at any time at the option of the stockholder and automatically convert

upon sale or transfer to Class A common stock. We refer to Class A and Class B common stock as common stock

throughout the notes to these financial statements, unless otherwise noted.

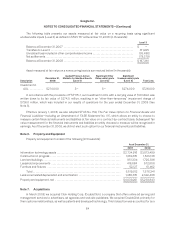

At December 31, 2007 and December 31, 2008, there were 14,533,423 and 23,236,325 shares of common

stock reserved for future issuance.

Stock Plans

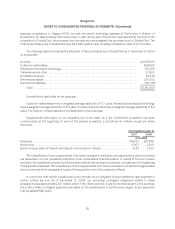

We maintain the 1998 Stock Plan, the 2000 Stock Plan, the 2003 Stock Plan, the 2003 Stock Plan (No. 2),

the 2003 Stock Plan (No. 3), the 2004 Stock Plan and plans assumed through acquisitions, all of which are

collectively referred to as the “Stock Plans.” Under our Stock Plans, incentive and nonqualified stock options or

rights to purchase common stock may be granted to eligible participants. Options are generally granted for a term

of 10 years. Options granted under the Stock Plans generally vest 25% after the first year of service and ratably

each month over the remaining 36 month period contingent upon employment with us on the date of vest. Options

granted under Stock Plans other than the 2004 Stock Plan may be exercised prior to vesting.

Under the stock plans, we have also issued RSUs and restricted shares. An RSU award is an agreement to

issue shares of our stock at the time of vest. RSUs issued to new employees vest over four years with a yearly cliff

contingent upon employment with us on the dates of vest. These RSUs vest from zero to 37.5 percent of the grant

amount at the end of each of the four years from date of hire based on the employee’s performance. RSUs under

the Founders’ Award programs are issued to individuals on teams that have made extraordinary contributions to

Google. These awards vest quarterly over four years contingent upon employment with us on the dates of vest.

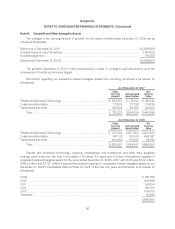

We estimated the fair value of each option award on the date of grant using the BSM option pricing model.

Our assumptions about stock-price volatility have been based exclusively on the implied volatilities of publicly

traded options to buy our stock with contractual terms closest to the expected life of options granted to our

employees applying the guidance provided by Staff Accounting Bulletin No. 107, Share-Based Payment. Through

the third quarter of 2007, our assumptions about the expected term had been based on that of companies that

had option vesting and contractual terms, expected stock volatility and employee demographics and physical

locations that were similar to ours because we had limited relevant historical information to support the expected

sale and exercise behavior of our employees who had been granted options recently. Commencing in the fourth

quarter of 2007, we began to estimate the expected term based upon the historical exercise behavior of our

90