Google 2008 Annual Report Download - page 76

Download and view the complete annual report

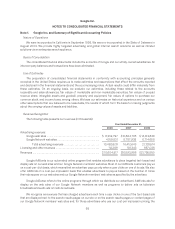

Please find page 76 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.measuring fair value and expands disclosures about fair value measurements. FSP 157-2 partially defers the

effective date of SFAS 157 to fiscal years beginning after November 15, 2008, and interim periods within those

fiscal years for items within the scope of this FSP. The adoption of SFAS 157 for all nonfinancial assets and

nonfinancial liabilities is effective for us beginning January 1, 2009. We do not expect the impact of this adoption to

be material.

In April 2008, the FASB issued FSP SFAS 142-3, Determination of the Useful Life of Intangible Assets (FSP

142-3). This guidance is intended to improve the consistency between the useful life of a recognized intangible

asset under SFAS No. 142, Goodwill and Other Intangible Assets (SFAS 142), and the period of expected cash

flows used to measure the fair value of the asset under SFAS 141R when the underlying arrangement includes

renewal or extension of terms that would require substantial costs or result in a material modification to the asset

upon renewal or extension. Companies estimating the useful life of a recognized intangible asset must now

consider their historical experience in renewing or extending similar arrangements or, in the absence of historical

experience, must consider assumptions that market participants would use about renewal or extension as adjusted

for SFAS 142’s entity-specific factors. FSP 142-3 is effective for us beginning January 1, 2009. We do not expect

the impact of the adoption of FSP 142-3 to be material.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are exposed to financial market risks, including changes in currency exchange rates and interest rates.

Foreign Exchange Risk

Economic Exposure

We transact business in various foreign currencies and have significant international revenues as well as

costs denominated in foreign currencies. This exposes us to foreign currency risk. We purchase foreign exchange

option contracts to reduce the volatility of cash flows primarily related to forecasted revenue denominated in

certain foreign currencies. The objective of the foreign exchange contracts is to better ensure that the U.S. dollar-

equivalent cash flows are not adversely affected by changes in the U.S. dollar/foreign currency exchange rate. In

accordance with SFAS No. 133, Accounting for Derivative Instruments and Hedge Activities (SFAS 133), these

contracts are designated as cash flow hedges. The gain on the effective portion of a cash flow hedge is initially

reported as a component of accumulated other comprehensive income and subsequently reclassified into

revenues when the hedged exposure affects revenues or as interest income and other, net, if the hedged

transaction becomes probable of not occurring. Any gain after a hedge is de-designated because the hedged

transaction is no longer probable of occurring or related to an ineffective portion of a hedge is recognized as

interest income and other, net, immediately. At December 31, 2008, the notional principal and fair value of foreign

exchange contracts to purchase U.S. dollars with Euros were €1.9 billion (or approximately $2.6 billion) and $152.0

million; the notional principal and fair value of foreign exchange contracts to purchase U.S. dollars with British

pounds were £1.1 billion (or approximately $1.8 billion) and $277.9 million; and the notional principal and fair value

of foreign exchange contracts to purchase U.S. dollars with Canadian dollars were C$229.7 million (or

approximately $202.2 million) and $21.9 million. These foreign exchange options have maturities of 18 months or

less. There are no other foreign exchange contracts designated as cash flow hedges. However, we may enter into

similar contracts in other foreign currencies in the future.

We considered the historical trends in currency exchange rates and determined that it was reasonably

possible that changes in exchange rates of 20% for our foreign currencies instruments could be experienced in the

near term.

If the U.S. dollar weakened by 20%, the amount recorded in accumulated other comprehensive income

before tax effect would have been approximately $325 million lower at December 31, 2008, and the total amount

recorded as interest income and other, net, would have been approximately $15 million lower in the year ended

December 31, 2008. If the U.S. dollar strengthened by 20%, the amount recorded in accumulated other

60