Google 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Google Inc.

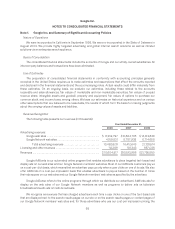

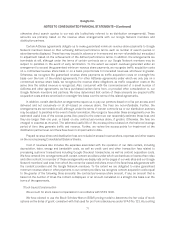

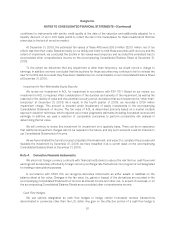

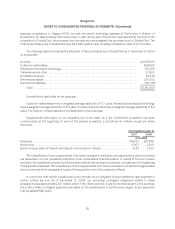

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

recorded in accumulated other comprehensive income as a component of stockholders’ equity. We recorded

$38.6 million and $61.0 million of net translation gains in 2006 and 2007, and $84.2 million of net translation

losses in 2008. Net gains and losses resulting from foreign exchange transactions are recorded as a component of

interest income and other, net. These gains and losses are net of those realized on forward foreign exchange

contracts. We recorded $5.3 million of net gains, $16.2 million and $35.6 million of net losses in 2006, 2007 and

2008 from assets and liabilities denominated in a currency other than the local currency.

Legal Costs

Legal costs are expensed as incurred.

Advertising and Promotional Expenses

We expense advertising and promotional costs in the period in which they are incurred. For the years ended

December 31, 2006, 2007 and 2008, promotional and advertising expenses totaled approximately $188.4 million,

$236.7 million and $266.4 million.

Effect of Recent Accounting Pronouncements

In December 2007, the FASB issued SFAS 141R. SFAS 141R establishes principles and requirements for how

an acquirer recognizes and measures in its financial statements the identifiable assets acquired, the liabilities

assumed, any noncontrolling interest in the acquiree and the goodwill acquired. SFAS 141R also establishes

disclosure requirements to enable the evaluation of the nature and financial effects of the business combination.

This statement is effective for us beginning January 1, 2009. The impact of the adoption of SFAS 141R on our

consolidated financial position, results of operations will largely be dependent on the size and nature of the

business combinations completed after the adoption of this statement.

In December 2007, the FASB issued SFAS 160. SFAS 160 establishes accounting and reporting standards

for ownership interests in subsidiaries held by parties other than the parent, the amount of consolidated net

income attributable to the parent and to the noncontrolling interest, changes in a parent’s ownership interest, and

the valuation of retained noncontrolling equity investments when a subsidiary is deconsolidated. SFAS 160 also

establishes disclosure requirements that clearly identify and distinguish between the interests of the parent and

the interests of the noncontrolling owners. This statement is effective for us beginning January 1, 2009. We do not

expect the impact of the adoption of SFAS 160 to be material.

In February 2008, the FASB issued FSP 157-2, which delays the effective date of SFAS 157 for all

nonfinancial assets and nonfinancial liabilities, except those that are recognized or disclosed at fair value in the

financial statements on a recurring basis (at least annually). SFAS 157 establishes a framework for measuring fair

value and expands disclosures about fair value measurements. FSP 157-2 partially defers the effective date of

SFAS 157 to fiscal years beginning after November 15, 2008, and interim periods within those fiscal years for

items within the scope of this FSP. The adoption of SFAS 157 for all nonfinancial assets and nonfinancial liabilities

is effective for us beginning January 1, 2009. We do not expect the impact of this adoption to be material.

In April 2008, the FASB issued FSP 142-3. This guidance is intended to improve the consistency between the

useful life of a recognized intangible asset under SFAS 142, and the period of expected cash flows used to

measure the fair value of the asset under SFAS 141R when the underlying arrangement includes renewal or

extension of terms that would require substantial costs or result in a material modification to the asset upon

renewal or extension. Companies estimating the useful life of a recognized intangible asset must now consider

their historical experience in renewing or extending similar arrangements or, in the absence of historical

75