Google 2008 Annual Report Download - page 58

Download and view the complete annual report

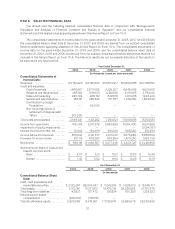

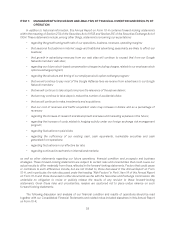

Please find page 58 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We continue to invest in building the necessary employee and systems infrastructures required to manage

our growth and develop and promote our products and services, and this may cause our operating margins to

decrease. We have experienced and expect to continue to experience growth in our operations as we build our

research and development programs, expand our base of users, advertisers, Google Network members, and

content providers, and increase our presence in international markets. Also, we have acquired and expect to

continue to acquire businesses and other assets from time to time. These acquisitions generally enhance the

breadth and depth of our expertise in engineering and other functional areas, our technologies and our product

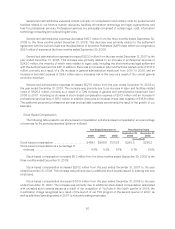

offerings. Our full-time employee headcount has increased over the last 12 months, growing from 16,805 at

December 31, 2007 to 20,222 at December 31, 2008. We have recently made efforts to improve the discipline of

our hiring process and to focus on better managing our expense growth. However, we expect to continue to invest

in our business, and this may cause our operating margins to decrease.

We expect our cost of revenues to continue to increase in dollars and may increase as a percentage of

revenues in 2009 and in future periods, primarily as a result of forecasted increases in traffic acquisition costs,

data center costs and credit card and other transaction fees, as well as content acquisition costs. In particular,

traffic acquisition costs as a percentage of advertising revenues may increase in the future if we are unable to

continue to improve the monetization or generation of revenue from traffic on our web sites and our Google

Network members’ web sites, particularly with those members to whom we have guaranteed minimum revenue

share payments.

Our international revenues have grown as a percentage of our total revenues to 51% in 2008 from 48% in

2007. This increase in the portion of our revenues derived from international markets results largely from

increased acceptance of our advertising programs, increases in our direct sales resources and customer support

operations and our continued progress in developing localized versions of our products in these international

markets, as well as an increase in the value of the Euro, the Japanese yen and other foreign currencies relative to

the U.S. dollar in 2008 compared to 2007. The increase in the proportion of international revenues derived from

international markets increases our exposure to fluctuations in foreign currency to U.S. dollar exchange rates. For

example, in the fourth quarter of 2008, the strengthening of the U.S. dollar relative to other foreign currencies

(primarily the Euro and the British pound) had an unfavorable impact on our international revenues. We have a

foreign exchange hedging program that is designed to reduce our exposure to fluctuations in foreign currencies,

however this program will not fully offset the effect of fluctuations on our revenues and earnings.

Recent Developments

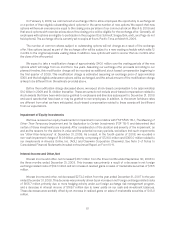

On February 3, 2009, we commenced an exchange offer to allow employees the opportunity to exchange all

or a portion of their eligible outstanding stock options for the same number of new options. We expect that new

options will have an exercise price equal to the closing price per share of our common stock on March 6, 2009 and

that stock options with exercise prices above this closing price will be eligible for the exchange offer. Generally, all

employees with options are eligible to participate in the program (Eric Schmidt, Sergey Brin, and Larry Page do not

hold options). The exchange offer is currently set to expire at 6 a.m. Pacific Time on March 9, 2009.

The number of common shares subject to outstanding options will not change as a result of the exchange

offer. New options issued as part of the exchange offer will be subject to a new vesting schedule which adds 12

months to the original applicable vesting dates. In addition, new options will vest no sooner than six months after

the close of the offer period.

We expect to take a modification charge of approximately $400 million over the vesting periods of the new

options which will range from six months to five years. Assuming our exchange offer proceeds according to our

planned timeline, this modification charge will be recorded as additional stock-based compensation beginning in

the first quarter of 2009. This modification charge is estimated assuming an exchange price of approximately

$350 and that all eligible underwater options will be exchanged, and the actual amount of the modification charge

is likely to be different from the estimate provided above.

42