Google 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.statutory tax rates. Our effective tax rate could also fluctuate due to the net gains and losses recognized by legal

entities on certain hedges and related hedged intercompany and other transactions under our foreign exchange

risk management program, changes in the valuation of our deferred tax assets or liabilities, or changes in tax laws,

regulations, accounting principles, or interpretations thereof. In addition, we are subject to the continuous

examination of our income tax returns by the Internal Revenue Service (IRS) and other tax authorities. We regularly

assess the likelihood of adverse outcomes resulting from these examinations to determine the adequacy of our

provision for income taxes.

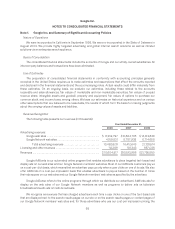

Stock-Based Compensation

We account for stock-based compensation in accordance with SFAS No. 123R, Share-Based Payment (SFAS

123R). Under the provisions of SFAS 123R, stock-based compensation cost is estimated at the grant date based

on the award’s fair value as calculated by the Black-Scholes-Merton (BSM) option-pricing model and is recognized

as expense over the requisite service period. The BSM model requires various highly judgmental assumptions

including volatility and expected option life. If any of the assumptions used in the BSM model change significantly,

stock-based compensation expense may differ materially in the future from that recorded in the current period. In

addition, we are required to estimate the expected forfeiture rate and only recognize expense for those shares

expected to vest. We estimate the forfeiture rate based on historical experience. Further, to the extent our actual

forfeiture rate is different from our estimate, stock-based compensation expense is adjusted accordingly.

Impairment of Marketable and Non-Marketable Securities

We periodically review our marketable securities, as well as our non-marketable equity securities for

impairment. If we conclude that any of these investments are impaired, we determine whether such impairment is

“other-than-temporary” as defined under FSP 115-1. Factors we consider to make such a determination include the

duration and severity of the impairment, the reason for the decline in value and the potential recovery period, and

our intent and ability to hold an investment. If any impairment is considered “other-than-temporary,” we will write

down the asset to its fair value and take a corresponding charge to our Consolidated Statement of Income.

Effect of Recent Accounting Pronouncements

In December 2007, the FASB issued SFAS No. 141 (revised 2007), Business Combinations (SFAS 141R).

SFAS 141R establishes principles and requirements for how an acquirer recognizes and measures in its financial

statements the identifiable assets acquired, the liabilities assumed, any noncontrolling interest in the acquiree and

the goodwill acquired. SFAS 141R also establishes disclosure requirements to enable the evaluation of the nature

and financial effects of the business combination. This statement is effective for us beginning January 1, 2009.

The impact of the adoption of SFAS 141R on our consolidated financial position, results of operations will largely be

dependent on the size and nature of the business combinations completed after the adoption of this statement.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial

Statements—an amendment of Accounting Research Bulletin No. 51 (SFAS 160). SFAS 160 establishes

accounting and reporting standards for ownership interests in subsidiaries held by parties other than the parent,

the amount of consolidated net income attributable to the parent and to the noncontrolling interest, changes in a

parent’s ownership interest, and the valuation of retained noncontrolling equity investments when a subsidiary is

deconsolidated. SFAS 160 also establishes disclosure requirements that clearly identify and distinguish between

the interests of the parent and the interests of the noncontrolling owners. This statement is effective for us

beginning January 1, 2009. We do not expect the impact of the adoption of SFAS 160 to be material.

In February 2008, the FASB issued Financial Staff Position (FSP) SFAS 157-2, Effective Date of FASB

Statement No. 157 (FSP 157-2), which delays the effective date of SFAS No. 157, Fair Value Measurement (SFAS

157), for all nonfinancial assets and nonfinancial liabilities, except those that are recognized or disclosed at fair

value in the financial statements on a recurring basis (at least annually). SFAS 157 establishes a framework for

59