Google 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

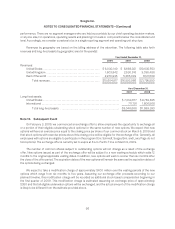

Note 8. Goodwill and Other Intangible Assets

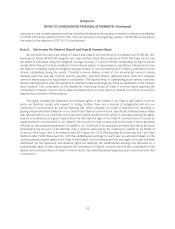

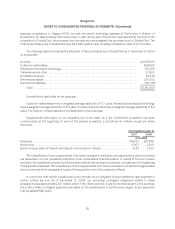

The changes in the carrying amount of goodwill for the twelve months ended December 31, 2008 are as

follows (in thousands):

Balance as of December 31, 2007 .......................................................... $2,299,368

Goodwill acquired, net of divestiture ......................................................... 2,364,128

Goodwill adjustment ...................................................................... 176,358

Balance as of December 31, 2008 .......................................................... $4,839,854

The goodwill adjustment of $176.4 million was primarily a result of contingent payments earned upon the

achievement of certain performance targets.

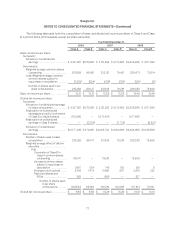

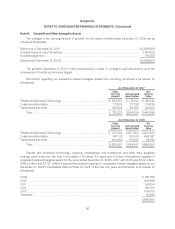

Information regarding our acquisition-related intangible assets that are being amortized is as follows (in

thousands):

As of December 31, 2007

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Value

Patents and developed technology ................................. $ 364,937 $ 179,102 $ 185,835

Customer relationships ............................................ 171,876 37,738 134,138

Tradenames and other ............................................ 196,392 69,769 126,623

Total ....................................................... $ 733,205 $286,609 $446,596

As of December 31, 2008

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Value

Patents and developed technology ................................. $ 551,332 $ 297,428 $253,904

Customer relationships ............................................ 800,113 153,516 646,597

Tradenames and other ............................................ 209,492 113,303 96,189

Total ....................................................... $1,560,937 $ 564,247 $996,690

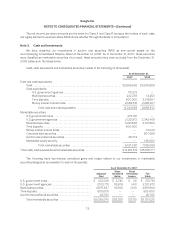

Patents and developed technology, customer relationships, and tradenames and other have weighted

average useful lives from the date of purchase of 4.0 years, 6.4 years and 4.9 years. Amortization expense of

acquisition-related intangible assets for the years ended December 31, 2006, 2007 and 2008 was $74.2 million,

$158.2 million and $279.7 million. Expected amortization expense for acquisition-related intangible assets on our

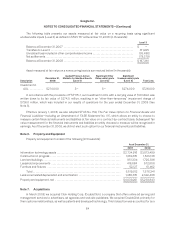

December 31, 2008 Consolidated Balance Sheet for each of the next five years and thereafter is as follows (in

thousands):

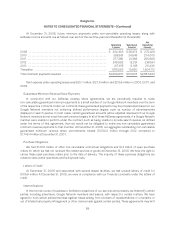

2009 ..................................................................................... $ 251,769

2010 ..................................................................................... 220,896

2011 ...................................................................................... 169,154

2012 ...................................................................................... 129,700

2013 ..................................................................................... 104,005

Thereafter ................................................................................. 121,166

$996,690

86