Google 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

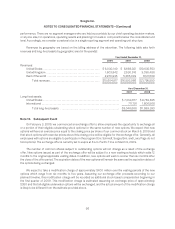

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

which $201.7 million was realized for tax purpose, and resulted in a tax benefit of $82.3 million in the fourth

quarter. However, we determined based on all positive and negative evidence available that it is more likely than

not that the tax-benefit of $364.5 million related to the remaining capital loss of $893.2 million cannot be realized

and therefore a valuation allowance was established. We are required to reassess the valuation allowance

quarterly, if future evidence allows for a partial or full release of the valuation allowance, a tax benefit will be

recorded accordingly.

Uncertain Tax Positions

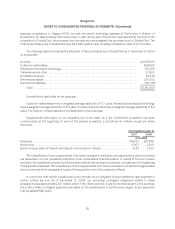

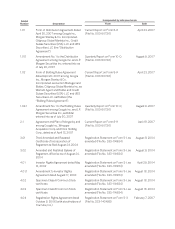

The following table summarizes the activity related to our gross unrecognized tax benefits from January 1,

2007 to December 31, 2008 (in thousands):

Balance as of January 1, 2007 ................................................................ $243,588

Increases related to prior year tax positions .................................................... 29,854

Decreases related to prior year tax positions ................................................... (18,997)

Increases related to current year tax positions .................................................. 132,742

Balance as of December 31, 2007 ............................................................ 387,187

Increases related to prior year tax positions .................................................... 111,872

Decreases related to prior year tax positions ................................................... (14,563)

Increases related to current year tax positions .................................................. 236,564

Balance as of December 31, 2008 ............................................................ $721,060

Our total unrecognized tax benefits that, if recognized, would affect our effective tax rate were $283.5 million

and $561.3 million as of December 31, 2007 and December 31, 2008.

As of December 31, 2008, we had accrued $32.1 million for payment of interest. Interest included in our

provision for income taxes was not material in all the periods presented. We have not accrued any penalties related

to our uncertain tax positions as we believe that it is more likely than not that there will not be any assessment of

penalties.

We and our subsidiaries are routinely examined by various taxing authorities. Although we file U.S. federal,

U.S. state, and foreign tax returns, our two major tax jurisdictions are the U.S. and Ireland. During the fourth quarter

ended December 31, 2007, the IRS completed its examination of our 2003 and 2004 tax years. We have filed an

appeal with the IRS for certain issues related to this audit, but we believe we have adequately provided for these

items and any adverse results would have an immaterial impact on our unrecognized tax benefit balance within the

next twelve months. The IRS commenced its examination of our 2005 and 2006 tax years in early 2008. We do

not expect the examination to be completed within the next twelve months, therefore we do not anticipate any

significant impact to our unrecognized tax benefit balance in 2009, related to 2005 and 2006 tax years.

Our 2007 and 2008 tax years remain subject to examination by the IRS for U.S. federal tax purposes, and our

2002 through 2008 tax years remain subject to examination by the appropriate governmental agencies for Irish

tax purposes. There are various other on-going audits in various other jurisdictions that are not material to our

financial statements.

Note 15. Information about Geographic Areas

Our chief operating decision-makers (i.e., chief executive officer, certain of his direct reports and our

founders) review financial information presented on a consolidated basis, accompanied by disaggregated

information about revenues by geographic region for purposes of allocating resources and evaluating financial

95