Google 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Google Inc.

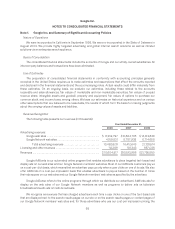

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

No advertiser or Google Network member generated greater than 10% of revenues in 2006, 2007 and 2008.

Fair Value of Financial Instruments

The carrying amounts of our financial instruments, including cash and cash equivalents, marketable

securities, accounts receivable, accounts payable and accrued liabilities, approximate fair value because of their

generally short maturities.

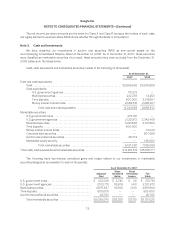

Cash and Cash Equivalents and Marketable Securities

We invest our excess cash primarily in highly liquid debt instruments of U.S. government and its agencies,

municipalities in the U.S., time deposits, money market mutual funds and corporate securities. All highly liquid

investments with stated maturities of three months or less from date of purchase are classified as cash

equivalents; all highly liquid investments with stated maturities of greater than three months are classified as

marketable securities.

We determine the appropriate classification of our investments in marketable securities at the time of

purchase and reevaluate such designation at each balance sheet date. Our marketable securities have been

classified and accounted for as available-for-sale. We may or may not hold securities with stated maturities greater

than 12 months until maturity. After consideration of our risk versus reward objectives, as well as our liquidity

requirements, we may sell these securities prior to their stated maturities. As these securities are viewed by us as

available to support current operations, based on the provisions of Accounting Research Bulletin No. 43, Chapter

3A, Working Capital-Current Assets and Liabilities, securities with maturities beyond 12 months are classified as

current assets under the caption marketable securities in the accompanying Consolidated Balance Sheets. These

securities are carried at fair value, with the unrealized gains and losses, net of taxes, reported as a component of

stockholders’ equity, except for unrealized losses determined to be other than temporary which are recorded as

interest income and other, net, in accordance with our policy and FASB Staff Position (FSP) Nos. SFAS 115-1 (FSP

115-1) and SFAS 124-1, The Meaning of Other-Than-Temporary Impairment and Its Application to Certain

Investments. Any realized gains or losses on the sale of marketable securities are determined on a specific

identification method, and such gains and losses are reflected as a component of interest income and other, net.

Non-Marketable Equity Securities

We have accounted for non-marketable equity security investments at historical cost because we do not have

significant influence over the underlying investees. These investments are subject to a periodic impairment review.

To the extent any impairment is considered other-than-temporary, the investment is written down to its fair value

and the loss is recorded as a component of interest income and other, net.

Accounts Receivable

Accounts receivable are recorded at the invoiced amount and are non-interest bearing. We maintain an

allowance for doubtful accounts to reserve for potentially uncollectible receivables. We review the accounts

receivable by amounts due by customers which are past due to identify specific customers with known disputes or

collectability issues. In determining the amount of the reserve, we make judgments about the creditworthiness of

significant customers based on ongoing credit evaluations. We also maintain a sales allowance to reserve for

potential credits issued to customers. The amount of the reserve is determined based on historical credits issued.

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation and amortization. Depreciation is

computed using the straight-line method over the estimated useful lives of the assets, generally two to five years.

73