Google 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Google Inc.

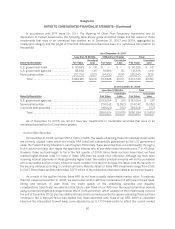

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

fees charged advertisers each time an ad is displayed on our members’ sites. In accordance with Emerging Issues

Task Force (EITF) Issue No. 99-19, Reporting Revenue Gross as a Principal Versus Net as an Agent, we report our

Google AdSense revenues on a gross basis principally because we are the primary obligor to our advertisers.

Google TV Ads enables advertisers, operators and programmers to buy, schedule, deliver and measure ads on

television. We recognize as revenue the fees charged advertisers each time an ad is displayed on television in

accordance with the terms of the related agreements. Google Audio Ads enables the distribution of our advertisers’

ads for broadcast on radio programs. We recognize as revenue the fees charged advertisers each time an ad is

broadcasted or a listener responds to that ad. We consider the television providers and radio stations that

participate in these programs to be members of our Google Network.

In 2008 we acquired DoubleClick, a company that offers online ad serving and management services to

advertisers, ad agencies and web site publishers. Fees derived from hosted, or web-based applications are

recognized as licensing and other revenues in the period the advertising impressions are delivered.

Google Checkout is our online shopping payment processing system for both consumers and merchants. We

recognize as revenues any fees charged to merchants on transactions processed through Google Checkout.

Further, cash ultimately paid to merchants under Google Checkout promotions, including cash paid to merchants

as a result of discounts provided to consumers on certain transactions processed through Google Checkout, are

accounted for as an offset to revenues in accordance with EITF Issue No. 01-9, Accounting for Consideration

Given by a Vendor to a Customer (Including a Reseller of the Vendor’s Products).

We generate fees from search services on a per-query basis. Our policy is to recognize revenues from

per-query search fees in the period we provide the search results.

We also generate fees from the sale and license of our Search Appliance, which includes hardware, software

and 12 to 24 months of post-contract support. We recognize revenue in accordance with Statement of Position

97-2, Software Revenue Recognition, as amended. As the elements are not sold separately, sufficient vendor-

specific objective evidence does not exist for the allocation of revenue. As a result, the entire fee is recognized

ratably over the term of the post-contract support arrangement. We also generate fees through the license of our

Google Apps product. We recognize as revenue the fees we charge customers for hosting the related enterprise

applications and services ratably over the term of the service arrangement.

Revenues realized through Google TV Ads, Google Audio Ads, DoubleClick, Google Checkout, search services,

Search Appliance and Google Apps were not material in any of the years presented.

We recognize revenues as described above because the services have been provided, and the other criteria

set forth under Staff Accounting Bulletin Topic 13: Revenue Recognition have been met, namely, the fees we

charge are fixed or determinable, we and our advertisers or other customers understand the specific nature and

terms of the agreed-upon transactions and collectability is reasonably assured.

Deferred revenue is recorded when payments are received in advance of our performance in the underlying

agreement on the accompanying Consolidated Balance Sheets.

Cost of Revenues

Cost of revenues consists primarily of traffic acquisition costs. Traffic acquisition costs consist of amounts

ultimately paid to our Google Network members under AdSense arrangements and to certain other partners (our

distribution partners) who distribute our toolbar and other products (collectively referred to as access points) or

70