Google 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Google Inc.

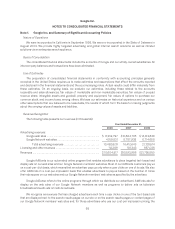

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

for Stock-Based Compensation. Restricted Stock Units (RSUs) are measured based on the fair market values of

the underlying stock on the dates of grant. Shares are issued on the dates of vest net of the statutory withholding

requirements to be paid by us on behalf of our employees. As a result, the actual number of shares issued will be

less than the actual number of RSUs outstanding. Furthermore, in accordance with SFAS 123R, the liability for

withholding amounts to be paid by us will be recorded as a reduction to additional paid-in capital when paid.

We recognize stock-based compensation using the straight-line method for all stock awards issued after

January 1, 2006. For stock awards issued prior to January 1, 2006, we continue to recognize stock-based

compensation using the accelerated method, other than RSUs issued to new employees that vest based on the

employee’s performance for which we use the straight-line method in accordance with Financial Accounting

Standards Board (FASB) Interpretation No. 28, Accounting for Stock Appreciation Rights and Other Variable

Stock Option or Award Plans.

In compliance with SFAS 123R, we included as part of cash flows from financing activities the benefits of tax

deductions in excess of the tax-effected compensation of the related stock-based awards for the options

exercised and RSUs vested. During the year ended December 31, 2008, the amount of cash received from

exercise of stock options was $72.5 million and the total direct tax benefit realized, including the excess tax

benefit, from stock-based award activity was $250.9 million. We have elected to account for the indirect effects of

stock-based awards—primarily the research and development tax credit—through the income statement.

We account for stock awards issued to non-employees other than members of our board of directors in

accordance with the provisions of SFAS 123R and EITF Issue No. 96-18, Accounting for Equity Instruments That

Are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services (EITF 96-18).

Under SFAS 123R and EITF 96-18, we use the BSM method to measure the value of options granted to

non-employees at each vesting date to determine the appropriate charge to stock-based compensation.

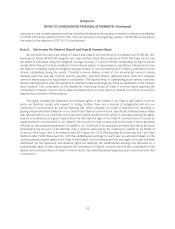

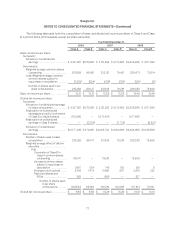

In the years ended December 31, 2006, 2007 and 2008, we recognized stock-based compensation and

related tax benefits of $458.1 million and $108.9 million, $868.6 million and $143.0 million, and $1,119.8 million

and $231.7 million, respectively.

Certain Risks and Concentrations

Our revenues are principally derived from online advertising, the market for which is highly competitive and

rapidly changing. In addition, our revenues are generated from a multitude of vertical market segments in countries

around the globe. Significant changes in this industry or changes in customer buying or advertiser spending

behavior, including those changes that may result from the current general economic downturn, could adversely

affect our operating results.

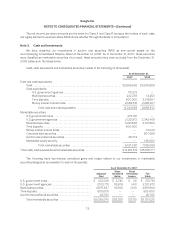

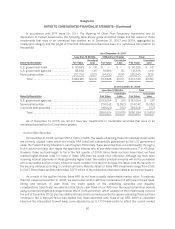

Financial instruments that potentially subject us to concentrations of credit risk consist principally of cash

equivalents, marketable securities, foreign exchange contracts and accounts receivable. Cash equivalents and

marketable securities consist primarily of highly liquid debt instruments of U.S. government and its agencies,

municipalities in the U.S., time deposits, money market funds and corporate securities. Foreign exchange

contracts are transacted with various major corporations and financial institutions with high credit standing.

Accounts receivable are typically unsecured and are derived from revenues earned from customers located around

the globe. In 2006, 2007 and 2008, we generated approximately 57%, 52% and 49% of our revenues from

customers based in the U.S., with the majority of customers outside of the U.S. located in Europe and Japan. Many

of our Google Network members are in the internet industry. We perform ongoing evaluations to determine

customer credit and limit the amount of credit extended, but generally no collateral is required. We maintain

reserves for estimated credit losses and these losses have generally been within our expectations.

72