Google 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

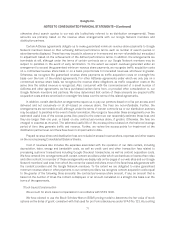

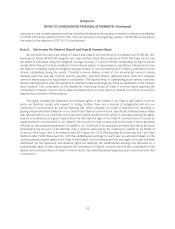

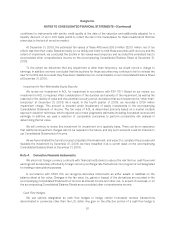

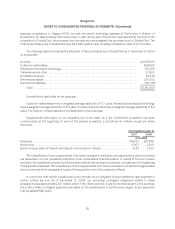

In accordance with EITF Issue No. 03-1, The Meaning of Other-Than-Temporary Impairment and Its

Application to Certain Investments, the following table shows gross unrealized losses and fair value for those

investments that were in an unrealized loss position as of December 31, 2007 and 2008, aggregated by

investment category and the length of time that individual securities have been in a continuous loss position (in

thousands):

As of December 31, 2007

Less than 12 Months 12 Months or Greater Total

Security Description Fair Value Unrealized

Loss Fair Value Unrealized

Loss Fair Value Unrealized

Loss

U.S. government notes ................ $ 30,525 $ (4) $ — $ — $ 30,525 $ (4)

U.S. government agencies ............. 98,682 (41) 19,993 (3) 118,675 (44)

Municipal securities ................... 270,708 (227) 54,832 (104) 325,540 (331)

Total ........................... $399,915 $(272) $74,825 $(107) $474,740 $(379)

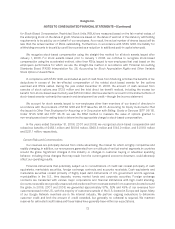

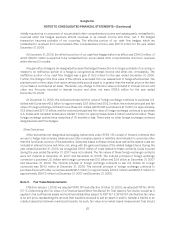

As of December 31, 2008

Less than 12 Months Total

Security Description Fair Value Unrealized

Loss Fair Value Unrealized

Loss

U.S. government agencies .................................. $183,054 $ (91) $ 183,054 $ (91)

Municipal securities ........................................ 274,042 (3,352) 274,042 (3,352)

Corporate debt securities ................................... 199,828 (172) 199,828 (172)

Total ................................................ $656,924 $ (3,615) $656,924 $ (3,615)

As of December 31, 2008, we did not have any investments in marketable securities that were in an

unrealized loss position for 12 months or greater.

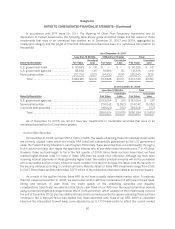

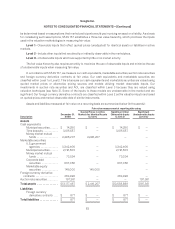

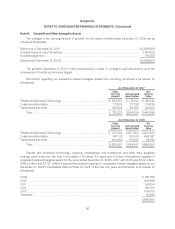

Auction Rate Securities

At December 31, 2008, we held $197.4 million of ARS. The assets underlying these 36 individual investments

are primarily student loans which are mostly AAA rated and substantially guaranteed by the U.S. government

under the Federal Family Education Loan Program. Historically, these securities have provided liquidity through a

Dutch auction process that resets the applicable interest rate at pre-determined intervals every 7 to 49 days.

However, these auctions began to fail in the first quarter of 2008. Since these auctions have failed, we have

realized higher interest rates for many of these ARS than we would have otherwise. Although we have been

receiving interest payments at these generally higher rates, the related principal amounts will not be accessible

until a successful auction occurs, a buyer is found outside of the auction process, the issuer calls the security, or

the security matures according to contractual terms. Maturity dates for these ARS investments range from 2025

to 2047. Since these auctions have failed, $37.5 million of the related securities were called at par by their issuers.

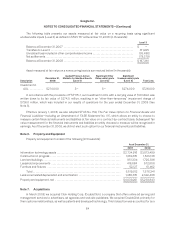

As a result of the auction failures, these ARS do not have a readily determinable market value. To estimate

their fair values at December 31, 2008, we used a discounted cash flow model based on estimated interest rates,

timing and amount of cash flows, the credit quality of the underlying securities and illiquidity

considerations. Specifically, we estimated the future cash flows of our ARS over the expected workout periods

using a projected weighted average interest rate of 3.4% per annum, which is based on the forward swap curve at

the end of December 2008 plus any additional basis points currently paid by the issuers assuming these auctions

continue to fail. A discount factor was applied over these estimated cash flows of our ARS, which is calculated

based on the interpolated forward swap curve adjusted by up to 1,100 basis points to reflect the current market

80