Google 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

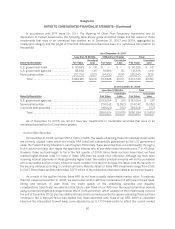

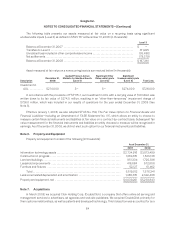

conditions for instruments with similar credit quality at the date of the valuation and additionally adjusted for a

liquidity discount of up to 400 basis points to reflect the risk in the marketplace for these investments that has

arisen due to the lack of an active market.

At December 31, 2008, the estimated fair values of these ARS were $35.5 million ($21.0 million, net of tax

effect) less than their costs. Based primarily on our ability and intent to hold these securities until recovery and the

extent of impairment, we concluded the decline in fair values was temporary and recorded the unrealized loss to

accumulated other comprehensive income on the accompanying Consolidated Balance Sheet at December 31,

2008.

To the extent we determine that any impairment is other-than-temporary, we would record a charge to

earnings. In addition, we have concluded that the auctions for these securities may continue to fail for at least the

next 12 months and as a result, they have been classified as non-current assets on our Consolidated Balance Sheet

at December 31, 2008.

Investment in Non-Marketable Equity Security

We review our investment in AOL for impairment in accordance with FSP 115-1. Based on our review, our

investment in AOL is impaired. After consideration of the duration and severity of the impairment, as well as the

reasons for the decline in value and the potential recovery period, we believe that such impairment is “other-than-

temporary” at December 31, 2008. As a result, in the fourth quarter of 2008, we recorded a $726 million

impairment charge. This amount is included under impairment of equity investments in the accompanying

Consolidated Statement of Income. The fair value of AOL is determined primarily based on a market multiple

approach valuation technique, which required us to make judgmental estimates including forecasted revenue and

earnings. In addition, we used a selection of comparable companies to perform comparative risk analysis in

determining the fair value.

We will continue to review this investment for impairment on a quarterly basis. There can be no assurance

that additional impairment charges will not be required in the future, and any such amounts could be material to

our Consolidated Statements of Income.

As we have initiated the formal process to liquidate this investment, and expect to complete this process and

liquidate the investment by December 31, 2009, we have classified it as a current asset on the accompanying

Consolidated Balance Sheet at December 31, 2008.

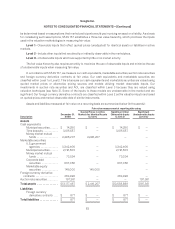

Note 4. Derivative Financial Instruments

We enter into foreign currency contracts with financial institutions to reduce the risk that our cash flows and

earnings will be adversely affected by foreign currency exchange rate fluctuations. Our program is not designated

for trading or speculative purposes.

In accordance with SFAS 133, we recognize derivative instruments as either assets or liabilities on the

balance sheet at fair value. Changes in the fair value (i.e., gains or losses) of the derivatives are recorded in the

accompanying Consolidated Statements of Income as interest income and other, net, or as part of revenues, or on

the accompanying Consolidated Balance Sheets as accumulated other comprehensive income.

Cash Flow Hedges

We use options designated as cash flow hedges to hedge certain forecasted revenue transactions

denominated in currencies other than the U.S. dollar. Any gain on the effective portion of a cash flow hedge is

81