Google 2008 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

employees. The risk-free interest rate for periods within the contractual life of the award is based on the U.S.

Treasury yield curve in effect at the time of grant.

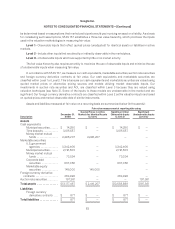

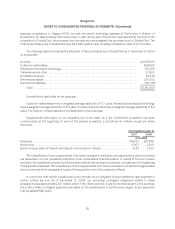

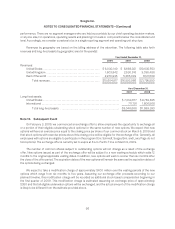

The following table presents the weighted average assumptions used to estimate the fair values of the stock

options granted in the periods presented:

Year Ended December 31,

2006 2007 2008

Risk-free interest rate ......................................................................... 4.7% 4.4% 3.2%

Expected volatility ............................................................................ 34% 34% 35%

Expected life (in years) ........................................................................ 3.6 5.1 5.3

Dividend yield ................................................................................ — — —

Weighted average estimated fair value of options granted during the year ........................... $158.59 $213.56 $203.58

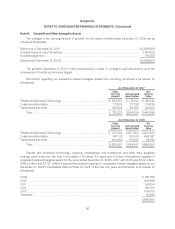

The following table summarizes the activity for our options for the twelve months ended December 31, 2008:

Options Outstanding

Number of

Shares

Weighted

Average

Exercise Price

Weighted

Average

Remaining

Contractual

Term

(in years)

Aggregate

Intrinsic

Value

(in millions) (1)

Balance at December 31, 2007 .................................. 12,892,886 $333.62

Options granted ........................................... 3,177,238 $500.07

Exercised (2) .............................................. (1,536,860) $ 58.66

Canceled/forfeited ........................................ (561,826) $ 450.19

Balance at December 31, 2008 .................................. 13,971,438 $ 391.40 7.0 $632.0

Vested and exercisable as of December 31, 2008 ............. 7,026,688 $295.02 6.7 $544.6

Vested and exercisable as of December 31, 2008 and expected

to vest thereafter (3) ..................................... 13,388,416 $ 387.33 7.0 $624.9

(1) The aggregate intrinsic value is calculated as the excess, if any, of the closing price of $307.65 of our Class A common stock on

December 31, 2008 over the exercise price of the underlying awards.

(2) Includes options vested during the period that were early exercised.

(3) Options expected to vest reflect an estimated forfeiture rate.

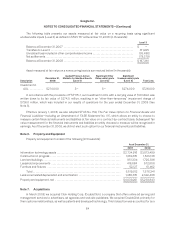

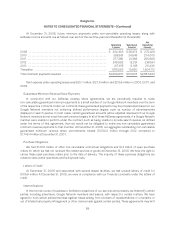

The following table summarizes additional information regarding outstanding, exercisable, and exercisable

and vested stock options at December 31, 2008:

Options Outstanding Options Exercisable Options Exercisable

and Vested

Range of Exercise

Prices

Total

Number of

Shares

Unvested

Options

Granted and

Exercised

Subsequent to

March 21,

2002 Number of

Shares

Weighted

Average

Remaining

Life

(in years)

Weighted

Average

Exercise

Price Number of

Shares

Weighted

Average

Exercise

Price Number of

Shares

Weighted

Average

Exercise

Price

$0.30 – $94.80 ...... 1,340,732 26,068 1,314,664 4.8 $ 19.69 1,244,880 $ 18.32 1,067,206 $ 19.65

$117.84 – $198.41 .... 1,576,111 — 1,576,111 4.2 $ 176.66 1,505,304 $ 176.11 1,503,441 $ 176.09

$205.96 –$298.91 . . . 1,370,309 — 1,370,309 5.2 $274.70 1,122,558 $273.70 1,121,722 $273.68

$300.97 – $399.00 . . 1,759,907 — 1,759,907 5.8 $329.97 1,255,409 $ 327.37 1,252,719 $ 327.32

$401.78 – $499.07 . . . 1,656,645 — 1,656,645 7.5 $450.82 738,304 $445.53 735,828 $444.56

$500.00 – $594.05 . . 6,016,466 — 6,016,466 8.7 $ 545.51 1,294,967 $ 546.19 1,290,628 $546.32

$615.95 – $699.35 . . . 200,564 — 200,564 8.9 $655.23 40,814 $ 662.13 40,814 $ 662.13

$707.00 – $732.94 . . 50,704 — 50,704 8.8 $ 718.20 14,330 $ 718.31 14,330 $ 718.31

$0.30 – $732.94 ..... 13,971,438 26,068 13,945,370 7.0 $ 391.40 7,216,566 $ 288.18 7,026,688 $295.02

91