Google 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.representing approximately 68% of the voting power of our outstanding capital stock. Larry, Sergey and Eric

therefore have significant influence over management and affairs and over all matters requiring stockholder

approval, including the election of directors and significant corporate transactions, such as a merger or other sale

of our company or its assets, for the foreseeable future. This concentrated control limits our stockholders’ ability to

influence corporate matters and, as a result, we may take actions that our stockholders do not view as beneficial.

As a result, the market price of our Class A common stock could be adversely affected.

Provisions in our charter documents and under Delaware law could discourage a takeover that

stockholders may consider favorable.

Provisions in our certificate of incorporation and bylaws may have the effect of delaying or preventing a

change of control or changes in our management. These provisions include the following:

• Our certificate of incorporation provides for a dual class common stock structure. As a result of this

structure our founders, executives and employees have significant influence over all matters requiring

stockholder approval, including the election of directors and significant corporate transactions, such as a

merger or other sale of our company or its assets. This concentrated control could discourage others

from initiating any potential merger, takeover or other change of control transaction that other

stockholders may view as beneficial.

• Our board of directors has the right to elect directors to fill a vacancy created by the expansion of the

board of directors or the resignation, death or removal of a director, which prevents stockholders from

being able to fill vacancies on our board of directors.

• Our stockholders may not act by written consent. As a result, a holder, or holders, controlling a majority of

our capital stock would not be able to take certain actions without holding a stockholders’ meeting.

• Our certificate of incorporation prohibits cumulative voting in the election of directors. This limits the

ability of minority stockholders to elect director candidates.

• Stockholders must provide advance notice to nominate individuals for election to the board of directors or

to propose matters that can be acted upon at a stockholders’ meeting. These provisions may discourage

or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of

directors or otherwise attempting to obtain control of our company.

• Our board of directors may issue, without stockholder approval, shares of undesignated preferred stock.

The ability to issue undesignated preferred stock makes it possible for our board of directors to issue

preferred stock with voting or other rights or preferences that could impede the success of any attempt to

acquire us.

As a Delaware corporation, we are also subject to certain Delaware anti-takeover provisions. Under Delaware

law, a corporation may not engage in a business combination with any holder of 15% or more of its capital stock

unless the holder has held the stock for three years or, among other things, the board of directors has approved the

transaction. Our board of directors could rely on Delaware law to prevent or delay an acquisition of us.

ITEM 1B. UNRESOLVED STAFF COMMENTS

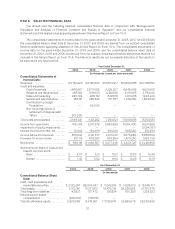

On April 24, 2008, we received a comment letter from the Securities and Exchange Commission (SEC)

related to various issues with respect to our public filings, including our accounting of payments related to

distribution arrangements. We responded to the SEC on May 14, 2008. Subsequently, on June 12, 2008, August 11,

2008, October 9, 2008, December 12, 2008 and February 5, 2009, we received additional comment letters from

the SEC on these and other matters. We responded to these comment letters on July 9, 2008, September 5,

2008, October 31, 2008 and January 9, 2009, respectively, and provided the SEC with supplemental analyses and

information requested by the SEC in these comment letters.

32