GNC 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

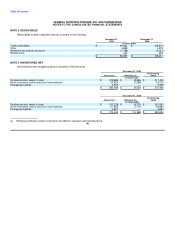

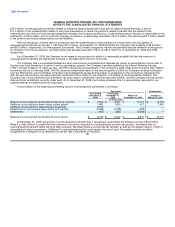

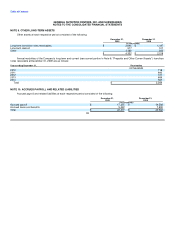

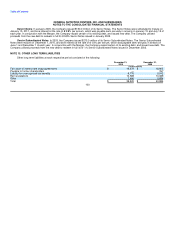

NOTE 6. PREPAIDS AND OTHER CURRENT ASSETS

Other current assets at each respective period consisted of the following:

December 31, December 31,

2009 2008

(in thousands)

Current portion of franchise note receivables $ 718 $ 871

Less: allowance for doubtful accounts — (240)

Prepaid rent 13,397 12,992

Prepaid insurance 4,452 5,590

Prepaid income tax 9,737 11,138

Prepaid payroll tax 923 3,684

Other current assets 12,992 13,917

$ 42,219 $ 47,952

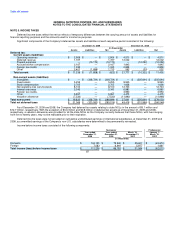

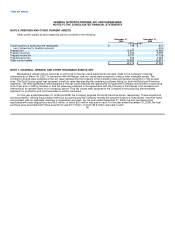

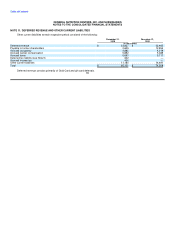

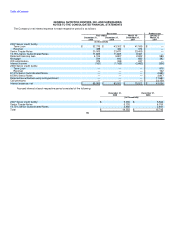

NOTE 7. GOODWILL, BRANDS, AND OTHER INTANGIBLE ASSETS, NET

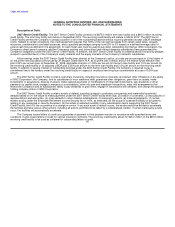

Management utilized various resources in arriving at its final fair value adjustments that were made to the Company's financial

statements as of March 16, 2007. In connection with the Merger, final fair values were assigned to various other intangible assets. The

Company's brands were assigned a final fair value representing the longevity of the Company name and general recognition of the product

lines. The Gold Card program was assigned a final fair value representing the underlying customer listing, for both the Retail and Franchise

segments. The retail agreements were assigned a final fair value reflecting the opportunity to expand the Company stores within a major drug

store chain and on military facilities. A final fair value was assigned to the agreements with the Company's franchisees, both domestic and

international, to operate stores for a contractual period. Final fair values were assigned to the Company's manufacturing and wholesale

segments for production and continued sales to certain customers.

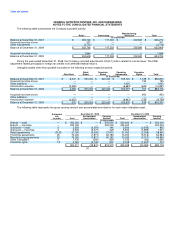

For the year ended December 31, 2009 and 2008, the Company acquired 53 and 33 franchise stores, respectively. These acquisitions

are accounted for utilizing the purchase method of accounting and the Company records the acquired inventory, fixed assets, franchise rights

and goodwill, with an applicable reduction to receivables and cash. For the year ended December 31, 2009, the total purchase prices

associated with these acquisitions was $9.3 million, of which $2.5 million was paid in cash. For the year ended December 31, 2008, the total

purchase price associated with these acquisitions was $1.7 million, of which $0.3 million was paid in cash.

90