GNC 2010 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

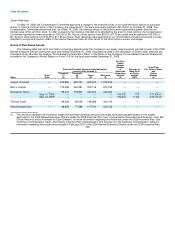

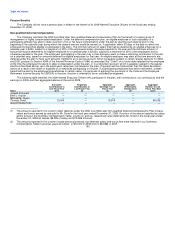

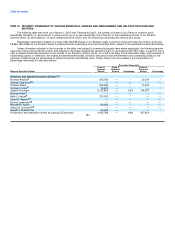

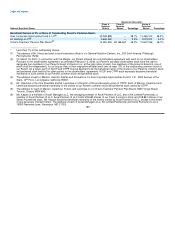

Potential Termination or Change-in-Control Payments

The following tables summarize the value of the compensation that 2009 Named Executive Officers would have received if they had

terminated employment on December 31, 2009 under the circumstances shown or if we had undergone a change in control on such date. The

tables exclude (1) compensation amounts accrued through December 31, 2009 that would be paid in the normal course of continued

employment, such as accrued but unpaid salary, and (2) vested account balances under our 401(k) Plan that are generally available to all of

our salaried employees. Where applicable, the amounts reflected for the prorated annual incentive compensation in 2009 are the amounts that

were actually paid to the 2009 Named Executive Officers in February 2010 under the 2009 Incentive Plan, since the hypothetical termination

date is the last day of the fiscal year for which the bonus is to be determined.

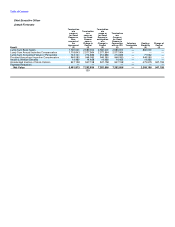

Where applicable, the information in the tables uses a fair market value per share of $6.50 as of December 31, 2009 for GNC Parent

Corporation's common stock. Since the Merger, the Compensation Committee has used a valuation methodology in which the fair market value

of the common stock is based on our business enterprise value and, in situations deemed appropriate by the Parent Compensation Committee,

may be discounted to reflect the lack of marketability associated with the common stock.

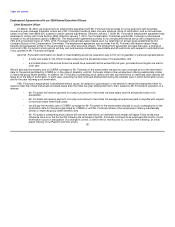

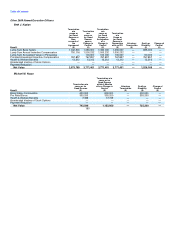

The termination and change in control arrangements for our 2009 Named Executive Officers and other senior employees are generally

based on form employment agreements. As such, these arrangements generally are uniform and not highly negotiated. The amounts payable

in connection with termination and change in control events are tied to our officers' respective base salaries and annual bonuses, and therefore

are proportionately higher for the more senior and highly compensated officers. Similarly, the termination and change in control arrangements

for our Chief Executive Officer and President generally provide for higher payments than those for other officers. These provisions were

negotiated with our most senior officers, and deemed appropriate by the Compensation Committee, to both attract and retain the individuals

and to ensure that their long-term interests are aligned with those of the Company. Specifically, the change in control provisions are designed

to reflect the expectations of the Company Board with respect to the manner in which the Company will be operated over the life of the

employment agreements and to be consistent with our peer companies. Similarly, the termination provisions, which provide for lump sum

payments of salary and bonus, and in some instances, acceleration of stock options, are designed to preserve the value of the long-term

compensation arrangements for Mr. Fortunato and Ms. Kaplan to ensure the continued alignment of their interests with those of the Company.

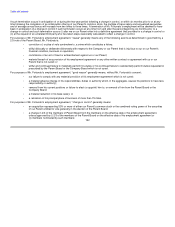

Because the amounts payable in connection with termination and change in control events are generally based on the formula set forth in

the form employment agreements, the Compensation Committee does not generally consider the amounts when establishing the compensation

of its named executive officers. The Compensation Committee, together with the Company, established the terms of the foregoing

arrangements to address and conform to our overall compensation objectives in attracting and retaining the caliber of executives that are

integral to our growth: market competitiveness; maintaining management continuity, particularly through periods of uncertainty related to

change in control events; providing our key personnel with the assurance of fair and equitable treatment following a change in management

control and other events; and ensuring that management is held to high standards of integrity and performance.

158