GNC 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

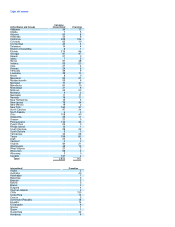

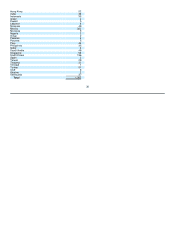

Table of Contents

• difficulty in operating our manufacturing facility abroad and procuring supplies from overseas suppliers;

• exchange controls;

• problems entering international markets with different cultural bases and consumer preferences; and

• fluctuations in foreign currency exchange rates.

Any of these risks could have a material adverse effect on our international operations and our growth strategy.

Franchise regulations could limit our ability to terminate or replace under-performing franchises, which could adversely impact

franchise revenues.

Our franchise activities are subject to federal, state, and international laws regulating the offer and sale of franchises and the governance

of our franchise relationships. These laws impose registration, extensive disclosure requirements, and bonding requirements on the offer and

sale of franchises. In some jurisdictions, the laws relating to the governance of our franchise relationship impose fair dealing standards during

the term of the franchise relationship and limitations on our ability to terminate or refuse to renew a franchise. We may, therefore, be required to

retain an under-performing franchise and may be unable to replace the franchisee, which could adversely impact franchise revenues. In

addition, we cannot predict the nature and effect of any future legislation or regulation on our franchise operations.

We are not insured for a significant portion of our claims exposure, which could materially and adversely affect our operating income

and profitability.

We have procured insurance independently for the following areas: (1) general liability; (2) product liability; (3) directors and officers

liability; (4) property insurance; (5) workers' compensation insurance; and (6) various other areas. We are self-insured for other areas,

including: (1) medical benefits; (2) workers' compensation coverage in New York, with a stop loss of $250,000; (3) physical damage to our

tractors, trailers, and fleet vehicles for field personnel use; and (4) physical damages that may occur at company-owned stores. We are not

insured for some property and casualty risks due to the frequency and severity of a loss, the cost of insurance, and the overall risk analysis. In

addition, we carry product liability insurance coverage that requires us to pay deductibles/retentions with primary and excess liability coverage

above the deductible/retention amount. Because of our deductibles and self-insured retention amounts, we have significant exposure to

fluctuations in the number and severity of claims. We currently maintain product liability insurance with a retention of $3.0 million per claim with

an aggregate cap on retained loss of $10.0 million. As a result, our insurance and claims expense could increase in the future. Alternatively, we

could raise our deductibles/retentions, which would increase our already significant exposure to expense from claims. If any claim exceeds our

coverage, we would bear the excess expense, in addition to our other self-insured amounts. If the frequency or severity of claims or our

expenses increase, our operating income and profitability could be materially adversely affected. See Item 3, "Legal Proceedings."

25