GNC 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

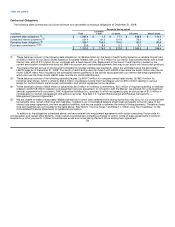

Table of Contents

Off Balance Sheet Arrangements

As of December 31, 2009 and 2008, we had no relationships with unconsolidated entities or financial partnerships, such as entities often

referred to as structured finance or special purpose entities, which would have been established for the purpose of facilitating off balance sheet

arrangements, or other contractually narrow or limited purposes. We are, therefore, not materially exposed to any financing, liquidity, market, or

credit risk that could arise if we had engaged in such relationships.

We had a balance of unused barter credits on account with a third-party barter agency, which were generated by exchanging inventory

with a third-party barter vendor. In exchange, the barter vendor supplied us with barter credits. We did not record a sale on the transaction as

the inventory sold was for expiring products that were previously fully reserved for on our balance sheet. In accordance with the standard on

nonmonetary transactions, a sale is recorded based on either the value given up or the value received, whichever is more easily determinable.

The value of the inventory was determined to be zero, as the inventory was fully reserved. Therefore, these credits were not recognized on the

balance sheet and would only have been realized if we purchased services or products through the bartering company. The barter credits

expired as of March 31, 2009.

Effect of Inflation

Inflation generally affects us by increasing costs of raw materials, labor, and equipment. We do not believe that inflation had any material

effect on our results of operations in the periods presented in our consolidated financial statements.

Critical Accounting Estimates

You should review the significant accounting policies described in the notes to our consolidated financial statements under the heading

Basis of Presentation and Summary of Significant Accounting Policies'' included elsewhere in this report.

Use of Estimates

Certain amounts in our financial statements require management to use estimates, judgments, and assumptions that affect the reported

amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the periods

presented. Our accounting policies are described in the notes to our consolidated financial statements under the heading Basis of Presentation

and Summary of Significant Accounting Policies'' included elsewhere in this report. Our critical accounting policies and estimates are described

in this section. An accounting estimate is considered critical if:

• the estimate requires management to make assumptions about matters that were uncertain at the time the estimate was made;

• different estimates reasonably could have been used; or

• changes in the estimate that would have a material impact on our financial condition or our results of operations are likely to

occur from period to period.

Management believes that the accounting estimates used are appropriate and the resulting balances are reasonable. However, actual

results could differ from the original estimates, requiring adjustments to these balances in future periods.

59