GNC 2010 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

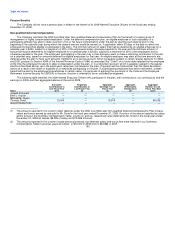

Table of Contents

At the beginning of 2008, the Compensation Committee established a development plan to be implemented by Mr. Fortunato.

Mr. Fortunato's objectives under the plan were in addition to his ongoing responsibilities as Chief Executive Officer. Among Mr. Fortunato's

primary objectives were the completion of the restructuring and development of the Company's senior management team through the attraction,

hiring and retention of qualified personnel and development of leadership capabilities. At the conclusion of 2008, the Compensation Committee

determined that Mr. Fortunato's performance met a significant number of the pre-determined objectives and awarded Mr. Fortunato a bonus of

$90,000.

During the first quarter of 2009, the Compensation Committee determined to implement a similar incentive program for Mr. Fortunato for

fiscal year 2009. Under this program, Mr. Fortunato was eligible to receive an additional discretionary bonus of up to $200,000 based on the

achievement of certain non-financial objectives. Among the primary objectives was ongoing executive leadership development, including

through enhanced time management strategies and the implementation of collaborative approaches, and achievement of the Company's

strategic initiatives. Throughout the year, Mr. Fortunato provided reports to, and received input and feedback from, the Compensation

Committee regarding his efforts to achieve the established objectives and complete the required actions. At the conclusion of 2009, the

Compensation Committee determined that Mr. Fortunato's performance met a significant number of the pre-determined objectives and awarded

Mr. Fortunato a bonus of $100,000.

During the first quarter of 2010, the Compensation Committee determined that, following the conclusion of fiscal year 2010, it will

evaluate Mr. Fortunato's performance for fiscal year 2010 and determine whether any discretionary bonus is warranted. In addition, effective

January 1, 2010, the Compensation Committee granted Mr. Fortunato a merit-based increase in his annual base salary to $886,000.

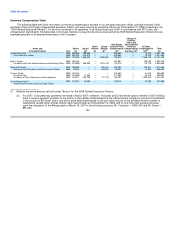

See the Summary Compensation Table for more information regarding Mr. Fortunato's compensation.

Accounting and Tax Considerations

As a general matter, the Compensation Committee reviews and considers the various tax and accounting implications of compensation

vehicles utilized by the Company.

Our Parent Company's stock option grant policies have been impacted by the implementation of Financial Accounting Standards Board

Accounting Standards Codification Topic 718 ("FASB ASC 718") (formerly known as FAS 123R), which it adopted in the first quarter of fiscal

year 2006. Under this accounting pronouncement, we are required to value unvested stock options granted prior to our adoption of FASB ASC

718 under the fair value method and expense those amounts in our income statement over the stock option's remaining vesting period.

Since neither our equity securities nor the equity securities of our direct or indirect parent companies are publicly traded, we are not

currently subject to any limitations under Internal Revenue Code Section 162(m). While we are not required to do so, we have structured our

compensation programs in a manner to generally comply with Internal Revenue Code Section 162(m). Under Section 162(m) of the Internal

Revenue Code, a limitation was placed on tax deductions of any publicly traded corporation for individual compensation to certain executives of

such corporation exceeding $1,000,000 in any taxable year, unless the compensation is performance-based. Had we been subject to Section

162(m) in 2007, we might have been subject to deduction limitations with respect to some of our Named Executive Officers because of

discretionary bonus payments paid in March 2007 to all optionholders whose options vested in 2007 entitling them to receive payment pursuant

to the terms of a November 2006 dividend and bonuses paid in March 2007 in connection with the completion of the Merger. These bonus

payments were not performance-based. 143