GNC 2010 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

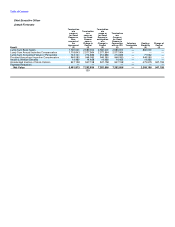

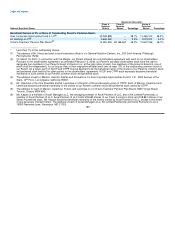

(7) Mr. Kaplan is a Senior Partner in the Private Equity Group of Ares and member of Ares Partners Management Company LLC, both of

which indirectly control ACOF. Mr. Kaplan disclaims beneficial ownership of the shares owned by ACOF, except to the extent of any

pecuniary interest therein.

(8) Mr. Schwartz is a Principal in the Private Equity Group of Ares, which indirectly controls ACOF. Mr. Schwartz disclaims beneficial

ownership of the shares owned by ACOF, except to the extent of any pecuniary interest therein.

(9) Reflects shares owned by ACOF. The general partner of ACOF is ACOF Management II, L.P. ("ACOF Management II") and the general

partner of ACOF Management II is ACOF Operating Manager II, L.P. ("ACOF Operating Manager II"). ACOF Operating Manager II is

indirectly owned by Ares which, in turn, is indirectly controlled by Ares Partners Management Company, LLC ("APMC" and, together with

ACOF, ACOF Management II, ACOF Operating Manager II and Ares the "Ares Entities"). Antony P. Ressler is the Manager of APMC.

Each of Mr. Ressler, the Ares Entities (other than ACOF, with respect to the shares owned by ACOF) and the partners, members and

managers thereof, disclaims beneficial ownership of these shares, except to the extent of any pecuniary interest therein. The address of

each Ares Entity is 2000 Avenue of the Stars, 12th Floor, Los Angeles, CA 90067.

(10) The address of KL Holdings LLC is 1250 Fourth Street, Santa Monica, California 90401.

(11) The address of Ontario Teachers' Pension Plan Board is 5650 Yonge Street, Toronto, Ontario M2M 4H5.

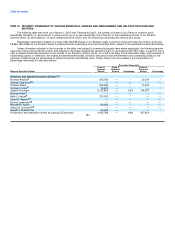

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE.

Management Services Agreement

Upon completion of the Merger, we entered into a management services agreement with our Parent. Under the agreement, our Parent

agreed to provide us and our subsidiaries with certain services in exchange for an annual fee of $1.5 million, as well as customary fees for

services rendered in connection with certain major financial transactions, plus reimbursement of expenses and a tax gross-up relating to a non-

tax deductible portion of the fee. Under the terms of the management services agreement, we have agreed to provide customary

indemnification to our Parent and its affiliates and those providing services on its behalf. In addition, upon completion of the Merger, we

incurred an aggregate fee of $10.0 million, plus reimbursement of expenses, payable to our Parent for services rendered in connection with the

Merger. In 2009, we paid $1.5 million under this agreement.

Stockholders' Agreement

Upon completion of the Merger, our Parent entered into a stockholders agreement with each of its stockholders, which includes certain of

our directors, employees, and members of our management and our principal stockholders. The stockholders agreement was amended and

restated as of February 12, 2008. Through a voting agreement, the amended and restated stockholders agreement gives each of ACOF and

OTPP, our Parent's principal stockholders, the right to designate four members of our Parent's board of directors (or, at the sole option of each,

five members of the board of directors, one of which shall be independent) for so long as they or their respective affiliates each own at least

10% of the outstanding common stock of our Parent. The voting agreement also provides for election of our Parent's then-current chief

executive officer to our Parent's board of directors. Under the terms of the amended and restated stockholders agreement, certain significant

corporate actions require the approval of a majority of directors on the board of directors, including a majority of the directors designated by

ACOF and a majority of the directors designated by OTPP. The amended and restated stockholders agreement also contains significant

transfer restrictions and certain rights of first offer, tag-along, and drag-along rights. In addition, the amended and restated stockholders

agreement contains registration rights that require our Parent to register common stock held by the stockholders who are parties to the

stockholders agreement in the event our Parent registers for sale, either for its own account or for the account of others, shares of its common

stock. 166