GNC 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

agreement, $11.3 million of additional consideration was paid as a result of the Company filing its 2008 consolidated federal tax return. The

Merger agreement requires payments to former shareholders and optionholders in lieu of income tax payments made for utilizing net operating

losses ("NOL's") created as a result of the Merger.

In connection with the Merger on March 16, 2007, the Company issued $300.0 million aggregate principal amount of Senior Floating

Rate Toggle Notes due 2014 and $110.0 million aggregate principal amount of 10.75% Senior Subordinated Notes due 2015. In addition, the

Company obtained a senior credit facility comprised of a $675.0 million term loan facility and a $60.0 million revolving credit facility. The

Company borrowed the entire $675.0 million under the term loan facility and $10.5 million under the revolving credit facility to fund a portion of

the acquisition price. The Company utilized proceeds from the new debt to repay its December 2003 senior credit facility, its 8 5/8% senior

notes issued in January 2005, and its 8 1/2% senior subordinated notes issued in December 2003. The Company contributed the remainder of

the debt proceeds, after payment of fees and expenses, to a newly formed, wholly owned subsidiary, which then loaned such net proceeds to

GNC Parent Corporation. GNC Parent Corporation used those proceeds, together with the equity contributions, to repay GNC Parent

Corporation's outstanding floating rate senior PIK notes issued in November 2006, pay the merger consideration, and pay fees and expenses

related to the Merger transactions.

In connection with the Merger, the Company recognized charges of $34.6 million in the period ending March 15, 2007. In addition, the

Company recognized compensation charges associated with the Merger of $15.3 million in the period ending March 15, 2007.

Pursuant to the Merger agreement, as amended, GNC Acquisition Inc. was merged with and into GNC Parent Corporation with GNC

Parent Corporation surviving the Merger. Subsequently on March 16, 2007, GNC Parent was converted into a Delaware limited liability

company and renamed GNC Parent LLC.

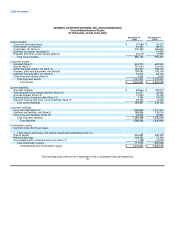

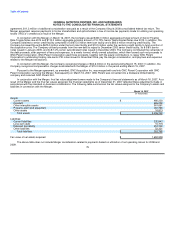

In conjunction with the Merger, final fair value adjustments were made to the Company's financial statements as of March 16, 2007. As a

result of the Merger and the final fair values assigned, the financial statements as of December 31, 2007 reflected these adjustments made in

accordance with the standard on business combinations. The following table summarizes the fair values assigned to the Company's assets and

liabilities in connection with the Merger.

March 16, 2007

(in thousands)

Assets:

Current assets $ 480,230

Goodwill 626,259

Other intangible assets 901,661

Property, plant and equipment 181,765

Other assets 16,813

Total assets $ 2,206,728

Liabilities:

Current liabilities 232,943

Long-term debt 10,773

Deferred tax liability 257,732

Other liabilities 52,321

Total liabilities $ 553,769

Fair value of net assets acquired $ 1,652,959

The above table does not include Merger consideration related to payments based on utilization of net operating losses for 2008 and

2009. 75