GNC 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Market risk represents the risk of changes in the value of market risk sensitive instruments caused by fluctuations in interest rates, foreign

exchange rates and commodity prices. Changes in these factors could cause fluctuations in the results of our operations and cash flows. In the

ordinary course of business, we are primarily exposed to foreign currency and interest rate risks. We do not use derivative financial instruments

in connection with these commodity market risks.

We are exposed to market risks from interest rate changes on our variable rate debt. Although changes in interest rates do not impact

our operating income, the changes could affect the fair value of our interest rate swaps and interest payments. As of December 31, 2009, we

had fixed rate debt of $117.2 million and variable rate debt of $942.6 million. In conjunction with the Merger, we entered into interest rate

swaps, effective April 2, 2007, which effectively convert a portion of the variable LIBOR component of the effective interest rate on two

$150.0 million notional portions of our debt under our $675.0 million Senior Credit Facility to a fixed rate over a specified term. Each of these

$150.0 million notional amounts has a three month LIBOR tranche conforming to the interest payment dates on the term loan. During

September 2008, we entered into two new forward agreements with start dates of the expiration dates of the pre-existing interest rate swap

agreements (April 2009 and April 2010). In September 2008, we also entered into a new interest rate swap agreement with an effective date of

September 30, 2008 that effectively converted an additional notional amount of $100.0 million of debt from a floating to a fixed interest rate. The

$100.0 million notional amount has a three month LIBOR tranche conforming to the interest payment dates on the term loan. In June 2009 we

entered into a new swap agreement with an effective date of September 15, 2009. The $150.0 million notional amount has a six month LIBOR

tranche conforming to the interest payment dates on the Senior Notes.

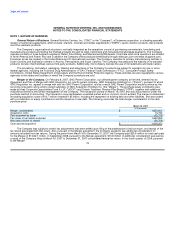

These agreements are summarized in the following table:

Total Notional

Derivative Amount Term Counterparty Pays Company Pays

Interest Rate Swap $150.0 million April 2007-April 2010 3 month LIBOR 4.90%

Interest Rate Swap $150.0 million April 2009-April 2011 3 month LIBOR 3.07%

Forward Interest Rate Swap $150.0 million April 2010-April 2011 3 month LIBOR 3.41%

Interest Rate Swap $100.0 million September 2008-September 2011 3 month LIBOR 3.31%

Interest Rate Swap $150.0 million September 2009-September 2012 6 month LIBOR 2.68%

Based on our variable rate debt balance as of December 31, 2009, a 1% change in interest rates would increase or decrease our annual

interest cost by $3.9 million.

Foreign Exchange Rate Risk

We are subject to the risk of foreign currency exchange rate changes in the conversion from local currencies to the U.S. dollar of the

reported financial position and operating results of our non-U.S. based subsidiaries. We are also subject to foreign currency exchange rate

changes for purchases of goods and services that are denominated in currencies other than the U.S. dollar. The primary currency to which we

are exposed to fluctuations is the Canadian Dollar. The fair value of our net foreign investments and our foreign denominated payables would

not be materially affected by a 10% adverse change in foreign currency exchange rates for the periods presented.

65