GNC 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

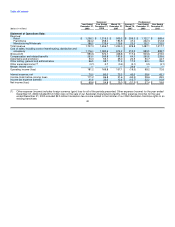

Operating Income

As a result of the foregoing, consolidated operating income increased $11.4 million or 6.7% to $181.2 million for the year ended

December 31, 2009 compared to $169.8 million for the same period in 2008. Operating income, as a percentage of net revenue, was 10.6% for

the year ended December 31, 2009 and 10.3% for the year ended December 31, 2008.

Retail. Operating income increased $12.2 million, or 8.7%, to $153.1 million for the year ended December 31, 2009 compared to

$140.9 million for the same period in 2008. The increase was primarily the result of higher dollar margins on increased sales volumes and

reduced advertising spending, partially offset by increases in occupancy costs, compensation costs and other SG&A expenses.

Franchise. Operating income is unchanged at $80.8 million for each of the years ended December 31, 2009 and 2008.

Manufacturing/Wholesale. Operating income increased $6.1 million, or 9.0%, to $73.5 million for the year ended December 31, 2009

compared to $67.4 million for the same period in 2008. This increase was primarily the result of increased margins from our South Carolina

manufacturing facility, partially offset by decreases in Rite Aid license fee revenue.

Warehousing and Distribution Costs. Unallocated warehousing and distribution costs decreased $0.6 million, or 1.3%, to $53.6 million for

the year ended December 31, 2009 compared to $54.2 million for the same period in 2008. The decrease was primarily due to decreases in

fuel costs.

Corporate Costs. Corporate overhead costs increased $7.5 million, or 11.7%, to $72.6 million for the year ended December 31, 2009

compared to $65.1 million for the same period in 2008. The increase was primarily due to an increase in compensation expense and

professional fees in 2009. In addition, 2008 compensation expense includes a $1.1 million reduction due to a change in our vacation policy

effective March 31, 2008.

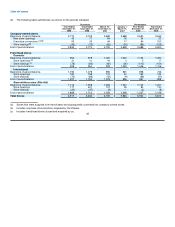

Interest Expense

Interest expense decreased $13.0 million, or 15.7%, to $70.0 million for the year ended December 31, 2009 compared to $83.0 million for

the same period in 2008. This decrease was primarily attributable to decreases in interest rates on our variable rate debt in 2009 as compared

to 2008 and $25.3 million in principal payments during 2009.

Income Tax Expense

We recognized $41.6 million of income tax expense (or 37.4% of pre-tax income) during the year ended December 31, 2009 compared to

$32.0 million (or 36.9% of pre-tax income) for the same period of 2008. For the year ended December 31, 2009, a $0.5 million discrete tax

benefit was recorded while a $2.0 million discrete tax benefit was recorded for the year ended December 31, 2008.

Net Income

As a result of the foregoing, consolidated net income increased $14.8 million to $69.6 million for the year ended December 31, 2009

compared to $54.8 million for the same period in 2008. 50