GNC 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Recently Issued Accounting Pronouncements

In June 2009, the Financial Accounting Standards Board ("FASB") issued a standard on Generally Accepted Accounting Principles. This

standard establishes the FASB Accounting Standards Codification (the "Codification") as the single source of authoritative nongovernmental

accounting principles generally accepted in the United States of America ("U.S. GAAP"). The Codification is effective for interim and annual

periods ending after September 15, 2009. The adoption of this standard did not have any impact on the Company's financial statements.

In June 2009, the SEC issued a staff accounting bulletin ("SAB") that revises or rescinds portions of the interpretive guidance included in

the codification of SABs in order to make the interpretive guidance consistent with U.S. GAAP. The principal revisions include deletion of

material no longer necessary or that has been superseded because of the issuance of new standards. The Company adopted this SAB during

the second quarter of 2009; the adoption did not have any impact on its consolidated financial statements.

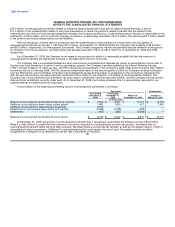

Fair Value

In September 2006, the FASB issued new standards on fair value measurements and disclosures. These new standards define fair

value, establish a framework for measuring fair value in U.S. GAAP, and expand disclosures about fair value measurements. The new standard

applies under other accounting pronouncements that require or permit fair value measurements and, accordingly, does not require any new fair

value measurements. The original standard was initially effective as of January 1, 2008, but in February 2008 the FASB delayed the

effectiveness date for applying this standard to nonfinancial assets and nonfinancial liabilities that are not at fair value in the financial

statements. The standard was effective for fiscal years beginning after November 15, 2007, except for nonfinancial assets and liabilities that are

recognized or disclosed at fair value in the financial statements on a nonrecurring basis, for which application has been deferred for one year.

The Company adopted this new standard in the first quarter of fiscal 2008 for financial assets and liabilities. See Note 23, "Fair Value

Measurements," to our consolidated financial statements included in this report.

In February 2007, the FASB issued a new standard on financial instruments that amends a previously issued standard. This standard

expands the use of fair value accounting but does not affect existing standards which require assets or liabilities to be carried at fair value. The

objective of the standard is to improve financial reporting by providing companies with the opportunity to mitigate volatility in reported earnings

caused by measuring related assets and liabilities differently without having to apply complex hedge accounting provisions. Under the standard,

a company may elect to use fair value to measure eligible items at specified election dates and report unrealized gains and losses on items for

which the fair value option has been elected in earnings at each subsequent reporting date. Eligible items include, but are not limited to,

accounts and loans receivable, available-for-sale and held-to-maturity securities, equity method investments, accounts payable, guarantees,

issued debt and firm commitments. The new standard was effective for fiscal years beginning after November 15, 2007. The adoption of this

standard did not affect the financial statements as the Company did not elect to use the fair value option.

In October 2008, the FASB issued a new standard on determining the fair value of a financial asset. This standard clarifies the

application of accounting standards in a market that is not active and provides an example to illustrate key considerations in determining the fair

value of a financial asset when the market for that financial asset is not active. The new standard was effective upon issuance for financial

statements that have not been issued. The adoption of this new standard did not have any impact on the Company's financial assets and

liabilities.

In August 2009, the FASB issued an update to the standard on fair value measurements and disclosures. This update provides guidance

on the manner in which the fair value of liabilities should be determined. This update is effective for annual periods ending after September 15,

2009. The adoption of this standard did not have any impact on the Company's financial statements.

83