GNC 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

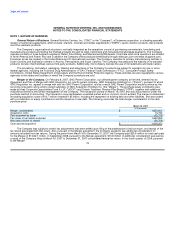

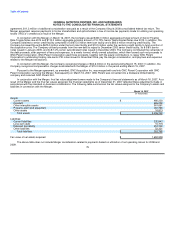

The Company leases an approximately 300,000 square-foot-facility in Greenville, South Carolina where the majority of its proprietary

products are manufactured. The Company also leases a 630,000 square foot complex located in Anderson, South Carolina, for packaging,

materials receipt, lab testing, warehousing, and distribution. Both the Greenville and Anderson facilities are leased on a long-term basis

pursuant to "fee-in-lieu-of-taxes" arrangements with the counties in which the facilities are located, but the Company retains the right to

purchase each of the facilities at any time during the lease for $1.00, subject to a loss of tax benefits. As part of a tax incentive arrangement,

the Company assigned the facilities to the counties and leases them back under operating leases. The Company leases the facilities from the

counties where located, in lieu of paying local property taxes. Upon exercising its right to purchase the facilities back from the counties, the

Company will be subject to the applicable taxes levied by the counties. In accordance with the standards on the accounting for leases, the

purchase option in the lease agreements prevent sale-leaseback accounting treatment. As a result, the original cost basis of the facilities

remains on the balance sheet and continues to be depreciated.

The Company leases a 210,000 square foot distribution center in Leetsdale, Pennsylvania and a 112,000 square foot distribution center

in Phoenix, Arizona. The Company also has operating leases for its fleet of distribution tractors and trailers and fleet of field management

vehicles. In addition, the Company also has a minimal amount of leased office space in California, Florida, and Canada. The expense

associated with leases that have escalating payment terms is recognized on a straight-line basis over the life of the lease. See Note 15, "Long-

Term Lease Obligations."

Contingencies. In accordance with the standards on contingencies the Company accrues a loss contingency if it is probable and can be

reasonably estimated or a liability had been incurred at the date of the financial statements if those financial statements have not been issued.

If both of the conditions above are not met, or if an exposure to loss exists in excess of the amount accrued, disclosure of the contingency shall

be made when there is at least a reasonable possibility that a loss or an additional loss may have been incurred. The Company accrues costs

that are part of legal settlements when the settlement is probable.

Pre-Opening Expenditures. The Company recognizes the cost associated with the opening of new stores as incurred. These costs are

charged to expense and are not material for the periods presented. Franchise store pre-opening costs are incurred by the franchisees.

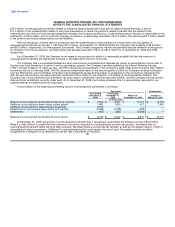

Deferred Financing Fees. Costs related to the financing of the Senior Subordinated Notes issued in December 2003, 8 5/8% Senior

Notes and the December 2003 senior credit facility were capitalized and were being amortized over the term of the respective debt. As of

March 15, 2007, the remaining deferred financing fees were written off as the debt was extinguished as a part of the Merger. In conjunction with

the Merger, $29.3 million in costs related to the financing of new debt were capitalized and are being amortized over the life of the new debt.

Accumulated amortization as of December 31, 2009 and 2008 were $10.9 million and $6.8 million, respectively.

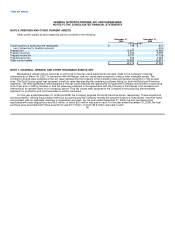

Income Taxes. The Company accounts for income taxes in accordance with the standards on income taxes. As prescribed by these

standards, the Company utilizes the asset and liability method of accounting for income taxes. Under the asset and liability method, deferred

tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial statements

carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted

tax rates in effect for the year in which those temporary differences are expected to be recovered or settled. See Note 5, "Income Taxes."

For the year ended December 31, 2009 the Company will file a consolidated federal income tax return. For state income tax purposes,

the Company will file on both a consolidated and separate return basis in the states in which it conducts business. The Company filed in a

consistent manner in 2008 and 2007.

The Company adopted the updates on the provisions of the standards on income taxes on January 1, 2007 related to the accounting for

uncertainty in income taxes. As a result of the implementation, the Company recognized an adjustment of $0.4 million to retained earnings for

the liability for unrecognized income tax benefits, net of the deferred tax effect. It is the

80