GNC 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

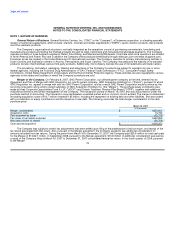

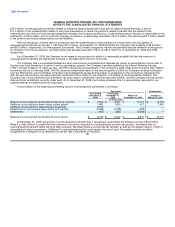

Cost of Sales. The Company purchases products directly from third party manufacturers as well as manufactures its own products. The

Company's cost of sales includes product costs, costs of warehousing and distribution and occupancy costs. The cost of manufactured

products includes depreciation expense related to the manufacturing facility and related equipment.

Vendor Allowances. The Company enters into two main types of arrangements with certain vendors, the most significant of which

results in the Company receiving credits as sales rebates based on arrangements with such vendors. The Company also enters into

arrangements with certain vendors through which the Company receives rebates for purchases during the year typically based on volume

discounts. As the right of offset exists under these arrangements, rebates received under both arrangements are recorded as a reduction in the

vendors' accounts payable balances on the balance sheet and represent the estimated amounts due to GNC under the rebate provisions of

such contracts. Rebates are presented as a reduction in accounts payable. The corresponding rebate income is recorded as a reduction of cost

of goods sold based on inventory turnover, in accordance with the provisions of the standard on accounting by a reseller for cash consideration

received from a vendor. For volume rebates, the appropriate level of such income is derived from the level of actual purchases made by GNC

from suppliers. The amount recorded as a reduction to cost of goods sold was $34.1 million for the year ended December 31, 2009,

$29.3 million for the year ended December 31, 2008, $20.9 million for the period from March 16 to December 31, 2007 and $6.6 million for the

period from January 1 to March 15, 2007.

Distribution and Shipping Costs. The Company bills franchisees and third-party customers shipping and transportation costs and

reflects these charges in revenue. The unreimbursed costs that are associated with these costs are included in cost of sales.

Research and Development. Research and development costs arising from internally generated projects are expensed by the Company

as incurred. The Company recognized $0.4 million for the year ended December 31, 2009, $0.9 million for the year ended December 31, 2008,

$0.5 million for the period from March 16 to December 31, 2007, and $0.1 million in research and development costs for the period January 1 to

March 15, 2007. These costs are included in Other SG&A costs in the accompanying financial statements.

Advertising Expenditures. The Company recognizes advertising, promotion and marketing program costs the first time the advertising

takes place with exception to the costs of producing advertising, which are expensed as incurred during production. The Company administers

national advertising funds on behalf of its franchisees. In accordance with the franchisee contracts, the Company collects advertising fees from

the franchisees and utilizes the proceeds to coordinate various advertising and marketing campaigns. The Company recognized $50.0 million

for the year ended December 31, 2009, $55.1 million for the year ended December 31, 2008, $35.0 million for the period March 16 to

December 31, 2007, and $20.5 million for the period January 1 to March 15, 2007, net of approximately $11.0 million annually from the national

advertising fund.

Merger Related Costs. For the period January 1 to March 15, 2007, Merger related costs of $34.6 million includes costs incurred by

GNC Parent LLC, and recognized by us, in relation to the Merger. These costs were comprised of selling-related expenses of $26.4 million, a

contract termination fee paid to our previous owner of $7.5 million and other costs of $0.7 million.

Leases. The Company has various operating leases for company-owned and franchised store locations and equipment. Store leases

generally include amounts relating to base rental, percent rent and other charges such as common area maintenance fees and real estate

taxes. Periodically, the Company receives varying amounts of reimbursements from landlords to compensate the Company for costs incurred in

the construction of stores. These reimbursements are amortized by the Company as an offset to rent expense over the life of the related lease.

The Company determines the period used for the straight-line rent expense for leases with option periods and conforms it to the term used for

amortizing improvements. 79