GNC 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

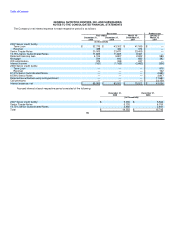

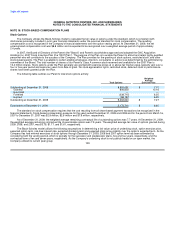

NOTE 14. FINANCIAL INSTRUMENTS

At December 31, 2009 and 2008, the Company's financial instruments consisted of cash and cash equivalents, receivables, franchise

notes receivable, accounts payable, certain accrued liabilities and long-term debt. The carrying amount of cash and cash equivalents,

receivables, accounts payable and accrued liabilities approximates their fair value because of the short maturity of these instruments. Based on

the interest rates currently available and their underlying risk, the carrying value of the franchise notes receivable approximates their fair value.

These fair values are reflected net of reserves, which are recognized according to Company policy. The Company determined the estimated fair

values of its debt by using currently available market information and estimates and assumptions where appropriate. Accordingly, as

considerable judgment is required to determine these estimates, changes in the assumptions or methodologies may have an effect on these

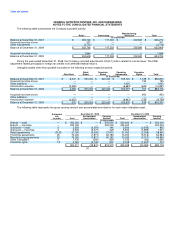

estimates. The actual and estimated fair values of the Company's financial instruments are as follows:

December 31, 2009 December 31, 2008

Carrying Fair Carrying Fair

Amount Value Amount Value

(in thousands)

Cash and cash equivalents $ 75,089 $ 75,089 $ 42,307 $ 42,307

Receivables 94,355 94,355 89,413 89,413

Franchise notes receivable 3,364 3,364 1,828 1,828

Accounts payable 95,904 95,904 123,577 123,577

Long term debt 1,059,809 977,718 1,084,746 702,392

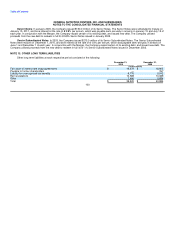

NOTE 15. LONG-TERM LEASE OBLIGATIONS

The Company enters into operating leases covering its retail store locations. The Company is the primary lessor of the majority of all

leased retail store locations and sublets the locations to individual franchisees. The leases generally provide for an initial term of between five

and ten years, and may include renewal options for varying terms thereafter. The leases require minimum monthly rental payments and a pro

rata share of landlord allocated common operating expenses. Most retail leases also require additional rentals based on a percentage of sales

in excess of specified levels ("Percent Rent"). According to the individual lease specifications, real estate taxes, insurance and other related

costs may be included in the rental payment or charged in addition to rent. Other lease expenses relate to and include distribution facilities,

transportation equipment, data processing equipment and automobiles.

As the Company is the primary lessee for the majority of the franchise store locations, it is ultimately liable for the lease payments to the

landlord. The Company makes the payments to the landlord directly, and then bills the franchisee for reimbursement of this cost. If a franchisee

defaults on its sub-lease and its sub-lease is terminated, the Company has in the past converted, and expects in the future to, convert any such

franchise store into a corporate store and fulfill the remaining lease obligation.

101