GNC 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

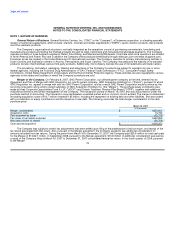

Company's policy to recognize interest and penalties related to uncertain tax positions as a component of income tax expense. See Note 5,

"Income Taxes," for additional information regarding the change in unrecognized tax benefits.

Self-Insurance. The Company has procured insurance for such areas as: (1) general liability; (2) product liability; (3) directors and

officers liability; (4) property insurance; and (5) ocean marine insurance. The Company is self-insured for such areas as: (1) medical benefits;

(2) worker's compensation coverage in the State of New York with a stop loss of $250,000; (3) physical damage to the Company's tractors,

trailers and fleet vehicles for field personnel use; and (4) physical damages that may occur at the corporate store locations. The Company is not

insured for certain property and casualty risks due to the frequency and severity of a loss, the cost of insurance and the overall risk analysis.

The Company carries product liability insurance with a retention of $3.0 million per claim with an aggregate cap on retained losses of

$10.0 million. The Company carries general liability insurance with retention of $110,000 per claim with an aggregate cap on retained losses of

$600,000. The majority of the Company's workers' compensation and auto insurance are in a deductible/retrospective plan. The Company

reimburses the insurance company for the workers compensation and auto liability claims, subject to a $250,000 and $100,000 loss limit per

claim, respectively.

As part of the medical benefits program, the Company contracts with national service providers to provide benefits to its employees for all

medical, dental, vision and prescription drug services. The Company then reimburses these service providers as claims are processed from

Company employees. The Company maintains a specific stop loss provision of $250,000 per individual per plan year with a maximum lifetime

benefit limit of $2.0 million per individual. The Company has no additional liability once a participant exceeds the $2.0 million ceiling. The

Company's liability for medical claims is included as a component of accrued benefits in Note 10, "Accrued Payroll and Related Liabilities," and

was $2.0 million and $2.2 million as of December 31, 2009 and 2008, respectively.

Stock Compensation. The Company utilizes the Black-Scholes model to calculate the fair value of options under this standard, which is

consistent with disclosures previously included in prior year financial statements under the original stock compensation standard. The resulting

compensation cost is recognized in the Company's financial statements over the option vesting period.

Foreign Currency. For all foreign operations, the functional currency is the local currency. In accordance with the standard on foreign

currency matters, assets and liabilities of those operations, denominated in foreign currencies, are translated into U.S. dollars using period-end

exchange rates, and income and expenses are translated using the average exchange rates for the reporting period. Gains or losses resulting

from foreign currency transactions are included in results of operations.

Financial Instruments and Derivatives. On January 1, 2009, the Company adopted the revised accounting standards on disclosure of

derivative instruments and hedging activities. This new standard expands the current disclosure requirements. This new standard provides for

an enhanced understanding of (1) how and why an entity uses derivative instruments, (2) how derivative instruments and related hedged items

are accounted for under previous standards and their related interpretations, and (3) how derivative instruments affect an entity's financial

position, financial performance, and cash flows.

As part of the Company's financial risk management program, it uses certain derivative financial instruments. The Company does not

enter into derivative transactions for speculative purposes and holds no derivative instruments for trading purposes. The Company uses

derivative financial instruments to reduce its exposure to market risk for changes in interest rates primarily in respect of its long term debt

obligations. The Company tries to manage its interest rate risk in order to balance its exposure to both fixed and floating rates while minimizing

its borrowing costs. Floating-to-fixed interest rate swap agreements, designated as cash flow hedges of interest rate risk, are entered into from

time to time to hedge our exposure to interest rate changes on a portion of the Company's floating rate debt. These interest rate swap

agreements convert a portion of the Company's floating rate debt to fixed rate debt. Interest rate floors designated as cash flow hedges involve

the receipt of variable-rate amounts from a counterparty if interest rates fall below the strike rate on the contract in exchange for an upfront

premium. The Company records 81