GNC 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

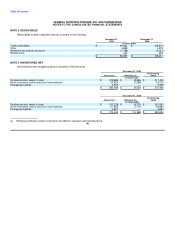

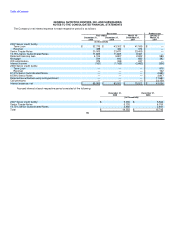

NOTE 5. INCOME TAXES

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amount of assets and liabilities for

financial reporting purposes and the amounts used for income tax purposes.

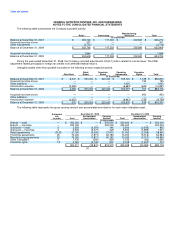

Significant components of the Company's deferred tax assets and liabilities at each respective period consisted of the following:

December 31, 2009 December 31, 2008

(in thousands)

Assets Liabilities Net Assets Liabilities Net

Deferred tax:

Current assets (liabilities):

Operating reserves $ 2,906 $ — $ 2,906 $ 4,510 $ — $ 4,510

Deferred revenue 1,727 — 1,727 12,002 — 12,002

Prepaid expenses — (10,170) (10,170) — (10,292) (10,292)

Accrued worker compensation 2,167 — 2,167 1,845 — 1,845

Foreign tax credits 1,035 — 1,035 2,858 — 2,858

Other 3,401 (1,688) 1,713 562 (30) 532

Total current $ 11,236 $ (11,858) $ (622) $ 21,777 $ (10,322) $ 11,455

Non-current assets (liabilities):

Intangibles $ — $ (308,724) $ (308,724) $ — $ (305,644) $ (305,644)

Fixed assets 5,255 — 5,255 9,945 — 9,945

Stock compensation 2,705 — 2,705 1,638 — 1,638

Net operating loss carryforwards 8,100 — 8,100 12,743 — 12,743

Interest rate swap 5,343 — 5,343 6,880 — 6,880

Foreign tax credits. — — — 3,950 — 3,950

Other 5,957 — 5,957 4,475 — 4,475

Valuation allowance (7,530) — (7,530) (11,990) — (11,990)

Total non-current $ 19,830 $ (308,724) $ (288,894) $ 27,641 $ (305,644) $ (278,003)

Total net deferred taxes $ 31,066 $ (320,582) $ (289,516) $ 49,418 $ (315,966) $ (266,548)

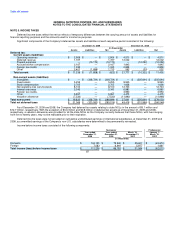

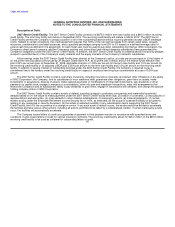

As of December 31, 2009 and 2008, the Company had deferred tax assets relating to state NOLs in the amount of $8.1 million and

$12.7 million, respectively. With the exception of $0.6 million and $0.8 million of deferred tax assets as of December 31, 2009 and 2008,

respectively, a valuation allowance was provided for all the state NOLs as the Company currently believes that these NOLs, with lives ranging

from five to twenty years, may not be realizable prior to their expiration.

Deferred income taxes were not provided on cumulative undistributed earnings of international subsidiaries, at December 31, 2009 and

2008, as unremitted earnings of the Company's non-U.S. subsidiaries were determined to be permanently reinvested.

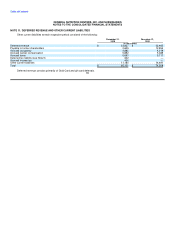

Income before income taxes consisted of the following components:

Successor Predecessor

Year ended Year ended March 16- January 1-

December 31, December 31, December 31, March 15,

2009 2008 2007 2007

(in thousands)

Domestic $ 104,155 $ 79,840 $ 25,607 $ (63,672)

Foreign 7,083 6,941 5,977 1,661

Total income (loss) before income taxes $ 111,238 $ 86,781 $ 31,584 $ (62,011)

87