GNC 2010 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

• Driving top-line performance in each of our business segments by attracting new customers through product innovation and

the introduction of new, scientifically backed products, improved product assortment, effective marketing campaigns designed

to increase traffic and awareness of the GNC brand, and price competitiveness;

• Investing in key infrastructure areas for future growth, including e-commerce and international development; and

• Generating efficiencies and cost savings in the everyday operations of the business that will allow us to leverage profit

margins on modest revenue growth.

We will continue to seek improvements in each of the business segments and position ourselves for long term growth.

Related Parties

Management Services Agreement. Upon consummation of the Merger, the Company entered into a management services agreement

with our Parent. Under the agreement, our Parent provides the Company and its subsidiaries with certain services in exchange for an annual

fee of $1.5 million, as well as customary fees for services rendered in connection with certain major financial transactions, plus reimbursement

of expenses and a tax gross-up relating to a non-tax deductible portion of the fee. The Company provides customary indemnifications to our

Parent and its affiliates and those providing services on its behalf. In addition, upon consummation of the Merger, the Company incurred an

aggregate fee of $10.0 million, plus reimbursement of expenses, payable to our Parent for services rendered in connection with the Merger. For

each of the years ended December 31, 2008 and 2009, $1.5 million was paid pursuant to this agreement.

Credit Facility. Upon consummation of the Merger, the Company entered into a $735.0 million credit agreement, under which various

fund portfolios related to one of our sponsors, Ares, are lenders. As of December 31, 2009, certain affiliates of Ares held approximately

$62.1 million of term loans under the Company's Senior Credit Facility.

Lease Agreements. General Nutrition Centres Company, a wholly owned subsidiary of the Company, is party to 21 lease agreements, as

lessee, with Cadillac Fairview Corporation, as lessor, with respect to properties located in Canada (the "Lease Agreements"). Cadillac Fairview

Corporation is a direct, wholly owned subsidiary of OTPP, one of the principal stockholders of Parent. For the years ended December 31, 2009

and 2008, the Company paid $2.4 million and $2.5 million, respectively, under the Lease Agreements. Each lease was negotiated in the

ordinary course of business on an arm's length basis.

Product Purchases. During our 2009 fiscal year, we purchased certain fish oil and probiotics products manufactured by Lifelong Nutrition,

Inc. ("Lifelong") for resale under our proprietary brand name WELLbeING. Carmen Fortino, who serves as one of our directors, is the Managing

Director, a member of the Board of Directors and a stockholder of Lifelong. The aggregate value of the products we purchased from Lifelong

was $3.3 million for the 2009 fiscal year.

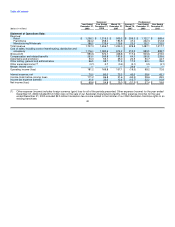

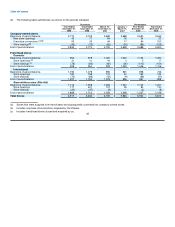

Results of Operations

The following information presented as of December 31, 2009, 2008, and 2007 and for the years ended December 31, 2009 and 2008,

for the period March 16, 2007 to December 31, 2007, and for the period January 1 to March 15, 2007 was derived from our audited

consolidated financial statements and accompanying notes.

The following information may contain financial measures other than in accordance with generally accepted accounting principles, and

should not be considered in isolation from or as a substitute for our historical consolidated financial statements. In addition, the adjusted

combined operating results may not reflect the actual results we would have achieved absent the adjustments and may not be predictive of

future results of operations. We present this information because we use it to monitor and evaluate our ongoing operating results and trends,

and believe it provides investors with an understanding of our operating performance over comparative periods.

46