GNC 2010 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

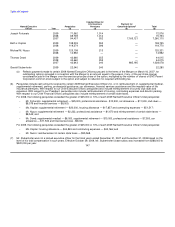

(b) For 2008: (i) payments we made in September 2008 pursuant to the Merger agreement of additional consideration in lieu of income

tax payments in respect of net operating losses created as a result of the Merger to each of Messrs. Fortunato and Dowd, based on

the number of outstanding vested option shares held by Messrs. Fortunato and Dowd as of the Merger; (ii) a one-time discretionary

bonus in respect of performance in 2008 in the following amounts: Mr. Fortunato — $90,000; and (iii) a one-time signing bonus to

Ms. Kaplan of $250,000.

(c) For 2009: represents (i) a discretionary bonus paid to Mr. Fortunato for meeting additional performance targets, including personnel

initiatives as described in "Compensation Discussion and Analysis — Chief Executive Officer Compensation" and (ii) a one-time

discretionary bonus paid to Mr. Stubenhofer in October 2009.

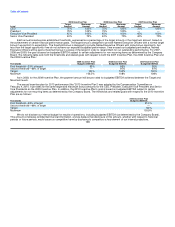

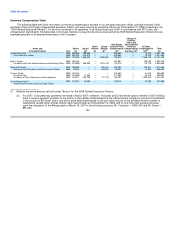

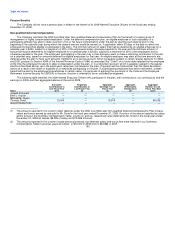

(2) Reflects the aggregate grant date fair value of option awards granted during the fiscal years ended December 31, 2008 and

December 31, 2007 which have been computed in accordance with FASB ASC Topic 718. No stock options were granted during the

fiscal year ended December 31, 2009.

On May 14, 2009, the Compensation Committee repriced the exercise prices of 150,000 of Mr. Nuzzo's stock options from $9.57 to $7.70

per share and 150,000 of his stock options from $14.35 to $11.55 per share. The incremental fair value of such stock options is reported

in this column in accordance with FASB ASC Topic 718. For more information, please see "Option Repricing" below.

For additional information, see Note 18 under the heading "Stock-Based Compensation Plans" of the Notes to Consolidated Financial

Statements included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2009. The amounts reflect

the accounting expense for these awards and do not correspond to the actual value that may be recognized by such persons with respect

to these awards.

(3) Reflects, as applicable, annual incentive compensation paid in March 2008 with respect to performance in 2007 pursuant to the 2007

Incentive Plan, annual incentive compensation paid in February 2009 with respect to performance in 2008 pursuant to our 2008 Incentive

Plan and annual incentive compensation paid in February 2010 with respect to performance in 2009 pursuant to our 2009 Incentive Plan.

Our results of operations for 2007, 2008 and 2009 exceeded the target goals for the target bonus payable for each applicable year, but

were less than the maximum goal thresholds for the maximum bonus payable, to each 2007 Named Executive Officer under the 2007

Incentive Plan, each 2008 Named Executive Officer under the 2008 Incentive Plan and each 2009 Named Executive Officer under the

2009 Incentive Plan, respectively. See "Compensation Discussion and Analysis—How We Chose Amounts and/or Formulas for Each

Element" for information about the Incentive Plans.

(4) Represents the above-market or preferential portion of the change in value of the executive officer's account under our GNC Live Well

Later Non-qualified Deferred Compensation Plan. See "Non-qualified Deferred Compensation" under the Non-qualified Deferred

Compensation Table for a description of our deferred compensation plan.

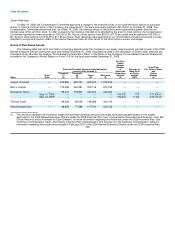

(5) The components of all other compensation for the 2009 Named Executive Officers are set forth in the following table:

146