GNC 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

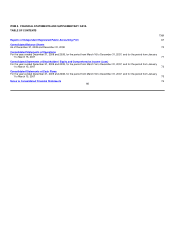

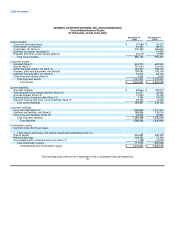

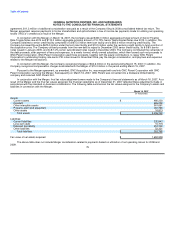

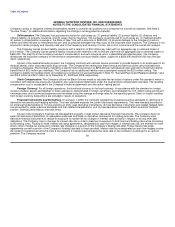

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(in thousands)

Successor Predecessor

Year ended

March 16- January 1-

December 31, December 31, December 31, March 15,

2009 2008 2007 2007

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income $ 69,619 $ 54,780 $ 18,984 $ (51,314)

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating

activities:

Depreciation expense 36,906 31,562 20,810 6,510

Deferred fee writedown — early debt extinguishment 11,680

Amortization of intangible assets 9,759 10,891 9,191 866

Amortization of deferred financing fees 4,104 3,907 2,921 589

Amortization of original issue discount 374 339 247 —

Increase in provision for inventory losses 11,151 14,406 10,400 2,247

Non-cash stock-based compensation 2,855 2,594 1,907 4,124

(Decrease) increase in provision for losses on accounts receivable (2,540) 253 (335) (39)

Decrease (increase) in net deferred taxes 21,431 24,371 9,303 (3,874)

Changes in assets and liabilities:

(Increase) decrease in receivables (3,488) (5,371) (10,752) 1,676

Increase in inventory, net (15,661) (48,248) (6,377) (2,128)

(Increase) decrease in franchise note receivables, net (314) 1,008 2,587 912

Increase (decrease) in accrued income taxes 2,777 (10,495) 12,619 (4,967)

Decrease (increase) in other assets 4,187 (6,259) (7,474) 3,394

(Decrease) increase in accounts payable (28,119) 22,075 (986) (387)

(Decrease) increase in interest payable (1,193) (2,365) 18,110 (7,531)

Increase (decrease) in accrued liabilities 2,109 (16,083) 10,882 (12,682)

Net cash provided by (used in) operating activities 113,957 77,365 92,037 (50,924)

CASH FLOWS FROM INVESTING ACTIVITIES:

Capital expenditures (28,682) (48,666) (28,851) (5,693)

Acquisition of the Company (11,268) (10,842) (1,642,061) —

Franchise store conversions 239 404 77 —

Acquisition of intangibles — (1,000) — —

Store acquisition costs (2,463) (321) (489) (555)

Net cash used in investing activities (42,174) (60,425) (1,671,324) (6,248)

CASH FLOWS FROM FINANCING ACTIVITIES:

Issuance of new equity — — 552,291 —

Return of capital to Parent company (278) (832) (314) —

Contribution from selling shareholders — — — 463,393

Dividend payment (13,600) — — —

Borrowings from new revolving credit facility — 5,375 10,500 —

Payments on new revolving credit facility (5,375) — (10,500) —

Borrowings from new senior credit facility — — 675,000 —

Proceeds from issuance of new senior sub notes — — 110,000 —

Proceeds from issuance of new senior notes — — 297,000 —

Redemption of 8 5/8% senior notes — — — (150,000)

Redemption of 8 1/2% senior notes — — — (215,000)

Payment of 2003 senior credit facility — — — (55,290)

Payments on long-term debt (19,952) (7,974) (6,021) (334)

Financing fees (45) — (29,298) —

Net cash (used in) provided by financing activities (39,250) (3,431) 1,598,658 42,769

Effect of exchange rate on cash 249 (56) (29) (165)

Net increase (decrease) in cash 32,782 13,453 19,342 (14,568)

Beginning balance, cash 42,307 28,854 9,512 24,080

Ending balance, cash $ 75,089 $ 42,307 $ 28,854 $ 9,512

The accompanying notes are an integral part of the consolidated financial statements.

73