GNC 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 18. STOCK-BASED COMPENSATION PLANS

Stock Options

The Company utilizes the Black-Scholes model to calculate the fair value of options under the standard, which is consistent with

disclosures previously included in prior year financial statements under the previous standard for stock compensation. The resulting

compensation cost is recognized in the Company's financial statements over the option vesting period. At December 31, 2009, the net

unrecognized compensation cost was $8.8 million and is expected to be recognized over a weighted average period of approximately

2.4 years.

In 2007, the Board of Directors of the Parent (the "Board") and Parent's stockholders approved and adopted the GNC Acquisition

Holdings Inc. 2007 Stock Incentive Plan (the "2007 Plan"). The purpose of the Plan is to enable the Parent to attract and retain highly qualified

personnel who will contribute to the success of the Company. The Plan provides for the granting of stock options, restricted stock, and other

stock-based awards. The Plan is available to certain eligible employees, directors, consultants or advisors as determined by the administering

committee of the Board. The total number of shares of our Parent's Class A common stock reserved and available for the 2007 Plan is

10.4 million shares. Stock options under the Plan generally are granted with exercise prices at or above fair market value, typically vest over a

four or five-year period and expire ten years from date of grant. No stock appreciation rights, restricted stock, deferred stock or performance

shares have been granted under the Plan.

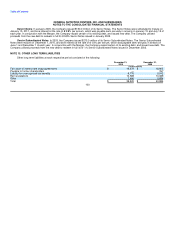

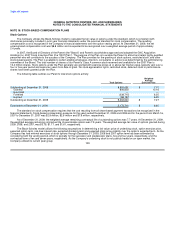

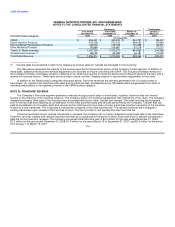

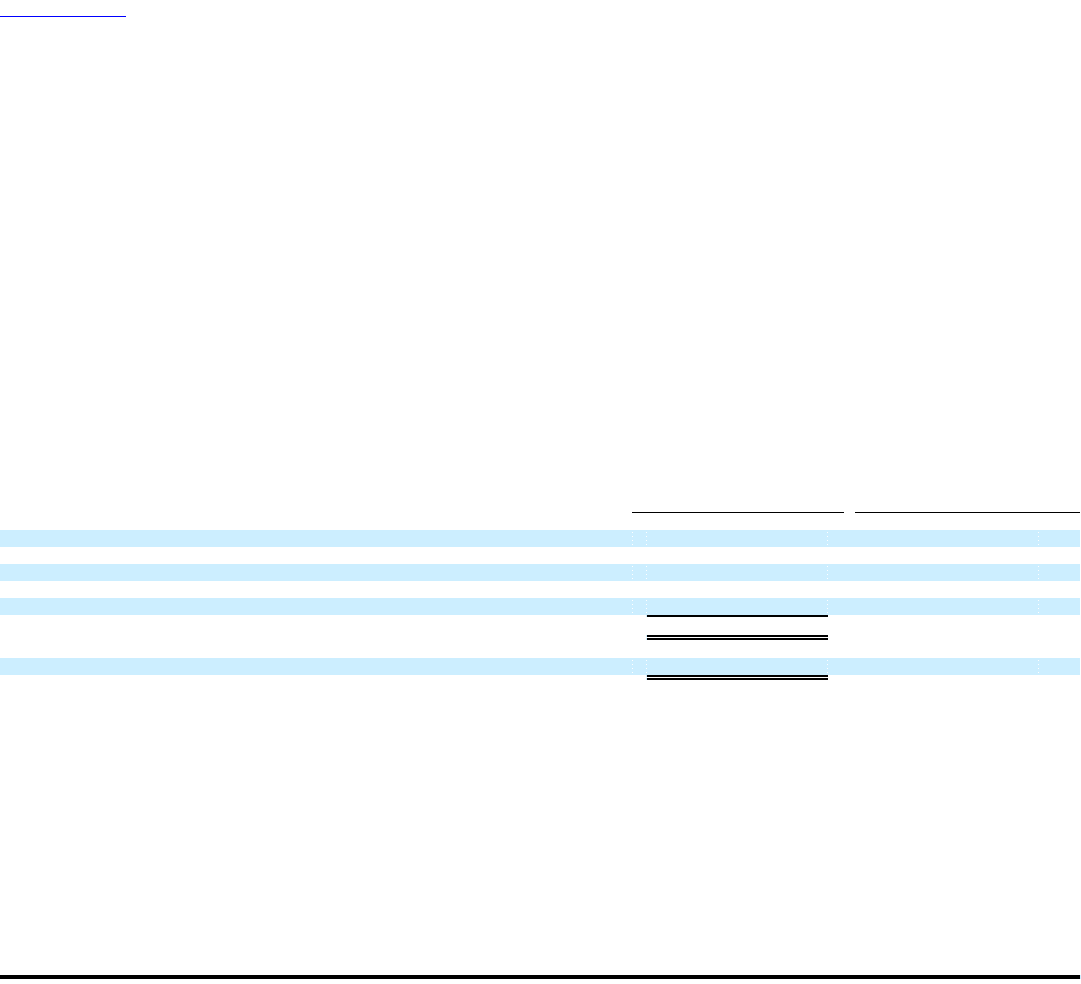

The following table outlines our Parent's total stock options activity:

Weighted

Average

Total Options Exercise Price

Outstanding at December 31, 2008 8,883,692 $ 7.10

Granted 806,850 10.16

Exercised — —

Forfeited (338,715) 6.25

Expired (88,187) 6.25

Outstanding at December 31, 2009 9,263,640 $ 7.27

Exercisable at December 31, 2009 3,173,710 $ 6.65

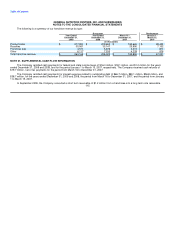

The standard on stock compensation requires that the cost resulting from all share-based payment transactions be recognized in the

financial statements. Stock-based compensation expense for the years ended December 31, 2009 and 2008 and for the period from March 16,

2007 to December 31, 2007 was $2.9 million, $2.6 million and $1.9 million, respectively.

As of December 31, 2009, the weighted average remaining contractual life of outstanding options was 7.7 years. At December 31, 2009,

the weighted average remaining contractual life of exercisable options was 7.9 years. The weighted average fair value of options granted during

2009, 2008, and 2007, was $3.19, $1.17, and $1.61, respectively.

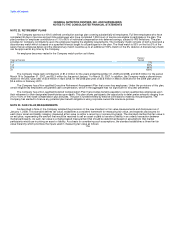

The Black-Scholes model utilizes the following assumptions in determining a fair value: price of underlying stock, option exercise price,

expected option term, risk-free interest rate, expected dividend yield, and expected stock price volatility over the option's expected term. As the

Company has had minimal exercises of stock options through December 31, 2009, 2008 and 2007 option term has been estimated by

considering both the vesting period, which is typically for the successor and predecessor plans, five and four years, respectively, and the

contractual term of ten and seven years, respectively. As the Company's underlying stock is not publicly traded on an open market, the

Company utilized its current peer group 109