GNC 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

-

181

-

182

-

183

-

184

-

185

-

186

-

187

-

188

-

189

-

190

-

191

-

192

-

193

-

194

-

195

-

196

-

197

-

198

-

199

-

200

-

201

-

202

-

203

-

204

-

205

-

206

-

207

-

208

-

209

-

210

-

211

-

212

-

213

-

214

-

215

-

216

-

217

-

218

-

219

-

220

-

221

-

222

-

223

-

224

-

225

-

226

-

227

-

228

-

229

-

230

-

231

-

232

-

233

-

234

-

235

-

236

-

237

-

238

-

239

-

240

GNC HOLDINGS, INC.

10-K

Annual report pursuant to section 13 and 15(d)

Filed on 03/11/2010

Filed Period 12/31/2009

Table of contents

-

Page 1

GNC HOLDINGS, INC.

10-K

Annual report pursuant to section 13 and 15(d) Filed on 03/11/2010 Filed Period 12/31/2009

-

Page 2

...Smaller reporting company o (Do not check if a smaller reporting company) Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes þ No

As of March 1, 2010, all of the registrant's common equity was privately held, and there was no public market...

-

Page 3

-

Page 4

... Related Transactions and Director Independence Principal Accountant Fees and Services 129 134 164 166 169 Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Selected Financial Data Management's Discussion and Analysis of Financial Condition...

-

Page 5

...statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to our financial condition, results of operations and business. Forward-looking statements may relate to our plans, objectives, goals, strategies, future events, future revenues or performance, capital...

-

Page 6

...herbal supplements ("VMHS") products, sports nutrition products, and diet products. We believe that the strength of our GNC® brand, which is distinctively associated with health and wellness, combined with our stores and website, give us broad access to consumers and uniquely position us to benefit...

-

Page 7

...") Ontario Teachers' Pension Plan Board ("OTPP"), certain institutional investors, certain of our directors, and certain former stockholders of GNC Parent Corporation, including members of our management. Refer to Note 1, "Nature of Business," and Item 12, "Security Ownership of Certain Beneficial...

-

Page 8

..., since 1999, the employee contribution for a family health insurance policy had risen 128%. Additionally, according to the Nutrition Business Journal's Supplement Business Report 2009, a report by Information Resources Inc. reports that 25% of consumers indicate that they are cutting back on doctor...

-

Page 9

...Journal's Supplement Business Report 2009. As of December 31, 2009, there were 6,917 GNC store locations globally, including 2,665 company-owned stores in the United States (all 50 states, the District of Columbia, and Puerto Rico); 167 company-owned stores in Canada; 909 domestic franchised stores...

-

Page 10

... with Rite Aid to open our GNC franchised store-within-a-store locations. Through this strategic alliance, we generate revenues from fees paid by Rite Aid for new store-within-a-store openings, sales to Rite Aid of our products at wholesale prices, the manufacture of Rite Aid private label products...

-

Page 11

...day the card is purchased and during the first seven days of every month for a year. Gold Card members also receive personalized mailings and e-mails with product news, nutritional information, and exclusive offers. Products are delivered to our retail stores through our distribution centers located...

-

Page 12

... typically offer a broad selection of sports nutrition products, such as protein and weight gain powders, sports drinks, sports bars, and high potency vitamin formulations, including GNC brands such as Pro Performance, Pro Performance AMP and popular third-party products. Diet Products Diet products...

-

Page 13

... revenues primarily from sales of products to customers at our company-owned stores in the United States and Canada, and in the United States through our website, www.gnc.com. Locations As of December 31, 2009, we operated 2,832 company-owned stores across all 50 states and in Canada, Puerto Rico...

-

Page 14

... franchise revenues for the year ended December 31, 2009. In 2009, new franchisees in the United States were required to pay an initial fee of $40,000 for a franchise license. Existing GNC franchise operators may purchase an additional franchise license for a $30,000 fee. We typically offer limited...

-

Page 15

... generate less revenue from franchises outside the United States due to lower international royalty rates and the franchisees purchasing a smaller percentage of products from us compared to our domestic franchisees. Franchisees in international locations enter into development agreements with us...

-

Page 16

... Rite Aid to open GNC franchised store-within-a-store locations. As of December 31, 2009, we had 1,869 store-within-astore locations. Through this strategic alliance, we generate revenues from sales to Rite Aid of our products at wholesale prices, the manufacture of Rite Aid private label products...

-

Page 17

... the world by jurisdiction and by individual product. Insurance and Risk Management We purchase insurance to cover standard risks in the nutritional supplements industry, including policies to cover general products liability, workers' compensation, auto liability, and other casualty and property...

-

Page 18

...the immediate execution of a series of actions against ephedra products making unsubstantiated claims about sports performance enhancement. In addition, many states proposed regulations and three states enacted laws restricting the promotion and distribution of ephedra-containing dietary supplements...

-

Page 19

... rule took effect April 12, 2004 and banned the sale of dietary supplement products containing ephedra. Similarly, the FDA issued a consumer advisory in 2002 with respect to dietary supplements that contain the ingredient Kava Kava, and the FDA is currently investigating adverse effects associated...

-

Page 20

... as a dietary supplement company as part of the existing registration requirements and update this information annually, provide a list of all dietary supplement products they sell and a copy of the labels and update this information annually, and report all adverse events related to dietary...

-

Page 21

... sold by franchised stores are purchased by franchisees directly from other vendors and these products do not flow through our distribution centers. Although franchise contracts contain strict requirements for store operations, including compliance with federal, state, and local laws and regulations...

-

Page 22

... to terminate or not renew a franchise without good cause; interfere with the right of free association among franchisees; disapprove the transfer of a franchise; discriminate among franchisees with regard to franchise terms and charges, royalties, and other fees; and place new stores near existing...

-

Page 23

... we have complied with, and are currently complying with, our environmental obligations pursuant to environmental and health and safety laws and regulations and that any liabilities for noncompliance will not have a material adverse effect on our business or financial performance. However, it is...

-

Page 24

... market. For example, when the trend in favor of low-carbohydrate products developed, we experienced increased competition for our diet products from supermarkets, drug stores, mass merchants and other food companies, which adversely affected sales of our diet products. Our international competitors...

-

Page 25

...meet the changing needs of our customers in a timely manner, some of our products could become obsolete, which could have a material adverse effect on our revenues and operating results. We depend on the services of key executives and changes in our management team could affect our business strategy...

-

Page 26

...unauthorized version of a "health claim." See Item 1, "Business - Government Regulation - Product Regulation" for additional information. Any of these actions could prevent us from marketing particular dietary supplement products or making certain claims or statements of nutritional support for them...

-

Page 27

... months of 2009. We provided refunds or gift cards to consumers who returned these products to our stores. In the second quarter we experienced a reduction in sales and margin due to this recall as a result of accepting returns of products from customers and a loss of sales as a replacement product...

-

Page 28

... pre-recall levels, strong sales in our core sports, vitamins and herbs, along with other new third party diet products, helped to mitigate the Hydroxycut sales decline. Our operations are subject to environmental and health and safety laws and regulations that may increase our cost of operations or...

-

Page 29

... to identify additional markets in the United States and other countries that are not currently saturated with the products we offer. If we are unable to open additional franchised locations, we will have to sustain additional growth internally by attracting new and repeat customers to our existing...

-

Page 30

... strategy. Franchise regulations could limit our ability to terminate or replace under-performing franchises, which could adversely impact franchise revenues. Our franchise activities are subject to federal, state, and international laws regulating the offer and sale of franchises and the governance...

-

Page 31

... operations to pay principal and interest on our debt, thereby reducing the availability of our cash flow to fund working capital, research and development efforts, capital expenditures, and other business activities; increase our vulnerability to general adverse economic and industry conditions; 26...

-

Page 32

... are subject to a number of qualifications and exceptions. If additional debt is added to our current level of debt, the risks described above would increase. We require a significant amount of cash to service our debt. Our ability to generate cash depends on many factors beyond our control and...

-

Page 33

...Senior Credit Facility and the indentures governing the Senior Toggle Notes and the 10.75% Senior Subordinated Notes may be affected by changes in our operating and financial performance, changes in general business and economic conditions, adverse regulatory developments, or other events beyond our...

-

Page 34

...our franchised stores in the remaining international markets are owned or leased directly by our franchisees. No single store is material to our operations. As of December 31, 2009, our company-owned and franchised stores in the United States and Canada (excluding store-within-a-store locations) and...

-

Page 35

Table of Contents

United States and Canada

CompanyOwned Retail

Franchise

Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota ...

-

Page 36

Hong Kong India Indonesia Israel Kuwait Lebanon Malaysia Mexico Mongolia Nigeria Oman Pakistan Panama Peru Philippines Qatar Saudi Arabia Singapore South Korea Spain Taiwan Thailand Trinidad Turkey UAE Ukraine Venezuela Total

52 36 35 2 5 6 49 322 3 2 2 6 5 44 35 4 49 58 136 2 29 30 1 57 6 1 37 1,...

-

Page 37

... at a distribution center in Canada. We lease three small regional sales offices in Fort Lauderdale, Florida; Tustin, California; and Mississauga, Ontario. None of the regional sales offices is larger than 6,500 square feet. Our 253,000 square-foot corporate headquarters in Pittsburgh, Pennsylvania...

-

Page 38

...related to" bankruptcy jurisdiction, as one of the manufacturers supplying it with Andro Products, and from whom it sought indemnity, MuscleTech Research and Development, Inc. ("MuscleTech"), had filed for bankruptcy. We were successful in removing the New Jersey, New York, Pennsylvania, and Florida...

-

Page 39

... market research; (3) using our Gold Card program to collect information on franchised store customers and then soliciting business from such customers; (4) underselling its franchised stores by selling products through the GNC website at prices below or close to the wholesale price, thereby forcing...

-

Page 40

... Health Sciences, USA, Inc., et al., State Court of Oklahoma County, CJ-2009-10759 (filed October 30, 2009); Lucretia Ballou v. Muscletech Research and Development, Inc., et al., U.S. District Court, Western District of Louisiana, 09CV1996 (filed December 3, 2009); Clinton Davis v. GNC Corporation...

-

Page 41

... Health Sciences Group, et al., Supreme Court of the State of New York, Kings County (filed January 22, 2010); Casey Slyter v. GNC Corporation, et al., U.S. District Court, District of Kansas, 10CV2065 (filed January 29, 2010); and Debra Rutherford, et al. v. Muscletech Research and Development...

-

Page 42

... Fraud Claims. Beginning in May 2009, a series of false labeling and consumer fraud cases (listed below) were filed in California in connection with label claims of non-GNC products sold in the Company's stores Michael Gonzales and Zia Nawabi, et al. v. Maximum Human Performance, Inc., et al...

-

Page 43

... common stock. See Item 12, "Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters" included in this report. Dividends In July 2009, our board of directors declared a $13.6 million dividend to our direct parent company, GNC Corporation, with a payment date of...

-

Page 44

..., David Berg joined the Company as its Executive Vice President of Global Business Development and Chief Operating Officer, International. In connection with his employment, our Parent's Compensation Committee granted Mr. Berg certain options ("Preferred Stock Options") to purchase 12,750 shares of...

-

Page 45

... the period during which General Nutrition Centers, Inc. was owned by Apollo. On February 8, 2007, our parent corporation entered into an Agreement and Plan of Merger with GNC Acquisition Inc. and its parent company, GNC Acquisition Holdings, Inc., pursuant to which GNC Acquisition Inc. agreed to...

-

Page 46

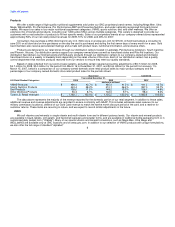

...

Statement of Operations Data: Revenue: Retail Franchising Manufacturing/Wholesale Total revenue Cost of sales, including costs of warehousing, distribution and occupancy Gross profit Compensation and related benefits Advertising and promotion Other selling, general and administrative Other expense...

-

Page 47

...-current long-term debt Stockholder's equity Other Data: Net cash provided by (used in) operating activities Net cash used in investing activities Net cash (used in) provided by financing activities Capital expenditures Number of stores (at end of period): Company-owned stores (3) Franchised stores...

-

Page 48

... 31, 2005

Company-owned stores Beginning of period balance New store openings Franchise conversions (a)(b) Store closings(b) End of period balance Franchised stores Domestic Beginning of period balance Store openings (b) Store closings (c) End of period balance International Beginning of period...

-

Page 49

... to third parties, generally for third-party private label brands, and the sale of our proprietary and third-party products to and through Rite Aid and www.drugstore.com. License fee revenue from the opening of GNC franchised store-within-a-store locations within Rite Aid stores is also recorded in...

-

Page 50

... franchise business is aligned with our corporate operating standards, and key performance indicators to our domestic franchise stores are consistent with our company store results. We continue to see growth in sales of our GNC brand products, particularly in the higher margin Pro Performance brand...

-

Page 51

... our presence globally, with the addition of 117 and 112 net new locations in 2009 and 2008, respectively. For 2009, the international franchise business recognized a 9.8% increase in revenue, compared with 2008, primarily on the strength of higher product sales. Our manufacturing strategy is...

-

Page 52

... 2009 fiscal year, we purchased certain fish oil and probiotics products manufactured by Lifelong Nutrition, Inc. ("Lifelong") for resale under our proprietary brand name WELLbeING. Carmen Fortino, who serves as one of our directors, is the Managing Director, a member of the Board of Directors and...

-

Page 53

... 1 - March 15, 2007

Revenues: Retail Franchise Manufacturing / Wholesale Total net revenues Operating expenses: Cost of sales, including warehousing, distribution and occupancy costs Compensation and related benefits Advertising and promotion Other selling, general and administrative expenses...

-

Page 54

... revenues associated with Rite Aid increased by $1.4 million. This increase was due to increases in wholesale and consignment sales to Rite Aid of $4.6 million, partially offset by lower initial and renewal license fee revenue of $3.2 million as a result of Rite Aid opening 197 fewer franchise store...

-

Page 55

... of increased sales volumes and raw materials costs. Consolidated product costs, as a percentage of net revenue, were 49.2% for the year ended December 31, 2009 as compared to 48.9% for the year ended December 31, 2008. Warehousing and distribution costs. Warehousing and distribution costs increased...

-

Page 56

... result of increased margins from our South Carolina manufacturing facility, partially offset by decreases in Rite Aid license fee revenue. Warehousing and Distribution Costs. Unallocated warehousing and distribution costs decreased $0.6 million, or 1.3%, to $53.6 million for the year ended December...

-

Page 57

...plant by $46.6 million, and revenues associated with Rite Aid increased by $11.4 million due primarily due to increased license fees as a result of Rite Aid opening 401 stores for the year ended December 31, 2008 as opposed to 101 stores for the 2007 Successor Period. Cost of Sales Consolidated cost...

-

Page 58

...is primarily due to comparing a 366 day period to a 291 day period. Secondarily, full-time and part-time wages increased to support an increased sales volume and store base. Compensation and related benefits, as a percentage of net revenues, was 15.1% for the year ended December 31, 2008 compared to...

-

Page 59

... period to a 291 day period. Additionally, the increase in operating income was the result of improved margins on our third-party contract sales and increases in Rite Aid license fee revenue. Warehousing and distribution costs. Unallocated warehousing and distribution costs increased $13.5 million...

-

Page 60

... of cash in the near future will be debt service requirements, capital expenditures and working capital requirements. In July 2009, our board of directors declared a $13.6 million dividend to our direct parent company, GNC Corporation, with a payment date of August 30, 2009. GNC Acquisition Holdings...

-

Page 61

..., fewer company-financed franchise store openings and more store closings. Accrued liabilities increased by $29.0 million, primarily the result of increases in accrued interest on debt and increases in accrued payroll. Cash Used in Investing Activities We used cash from investing activities of...

-

Page 62

...based on a defined leverage ratio) of excess cash flow (as defined in the agreement) for each fiscal year must be used to pay down outstanding borrowings. GNC Corporation, our direct parent company, and our existing and future direct and indirect domestic subsidiaries have guaranteed our obligations...

-

Page 63

...have elected to pay cash interest. The Senior Notes are treated as having been issued with original issue discount for U.S. federal income tax purposes. We may redeem some or all of the Senior Notes at any time, at specified redemption prices. If we experience certain kinds of changes in control, we...

-

Page 64

... of required spending for website redesign and $10.8 million related to a management services agreement. In connection with the Merger, we entered into a management services agreement with our parent, GNC Acquisition Holdings Inc., pursuant to which we agreed to pay an annual fee of $1.5 million...

-

Page 65

... balance sheet and would only have been realized if we purchased services or products through the bartering company. The barter credits expired as of March 31, 2009. Effect of Inflation Inflation generally affects us by increasing costs of raw materials, labor, and equipment. We do not believe that...

-

Page 66

...of management's forecasts of market conditions, industry trends, and competition. We are also subject to volatile changes in specific product demand as a result of unfavorable publicity, government regulation, and rapid changes in demand for new and improved products or services. Accounts Receivable...

-

Page 67

... near future, however, recent global events could have a negative effect on our business and operating results which could affect the valuation of our intangibles. Leases We have various operating leases for company-owned and franchised store locations and equipment. Store leases generally include...

-

Page 68

... uncertain tax positions each quarter based on factors including, but not limited to, changes in facts or circumstances, changes in tax law, effectively settled issues under audit, and new audit activity. Such a change in recognition or measurement would result in the recognition of a tax benefit or...

-

Page 69

... research and development and restructuring costs. In addition, under this standard, changes in an acquired entity's deferred tax assets and uncertain tax positions after the measurement period will impact the acquirer's income tax expense. The standard provides guidance regarding what information...

-

Page 70

...instruments, how derivative instruments and related hedged items are accounted for and how derivative instruments and related hedged items affect a company's financial position, financial performance, and cash flows. The new standard was effective for interim and annual periods beginning on or after...

-

Page 71

... rates would increase or decrease our annual interest cost by $3.9 million. Foreign Exchange Rate Risk We are subject to the risk of foreign currency exchange rate changes in the conversion from local currencies to the U.S. dollar of the reported financial position and operating results of our non...

-

Page 72

...Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheets As of December 31, 2009 and December 31, 2008 Consolidated Statements of Operations For the years...Equity and Comprehensive Income (Loss) For the years... Statements of Cash Flows For the years ended December ...

-

Page 73

... of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was...

-

Page 74

... control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or...

-

Page 75

...and of cash flows present fairly, in all material respects, the financial position of General Nutrition Centers, Inc. and its subsidiaries (the "Company") for the period from January 1, 2007 to March 15, 2007 in conformity with accounting principles generally accepted in the United States of America...

-

Page 76

...term assets: Goodwill (Note 7) Brands (Note 7) Other intangible assets, net (Note 7) Property, plant and equipment, net (Note 8) Deferred financing fees, net (Note 2) Other long-term assets (Note 9) Total long-term assets Total assets Current liabilities: Accounts payable Accrued payroll and related...

-

Page 77

... January 1March 15, 2007

Revenue Cost of sales, including costs of warehousing, distribution and occupancy Gross profit Compensation and related benefits Advertising and promotion Other selling, general and administrative Foreign currency loss (gain) Merger-related costs (Note 1) Operating income...

-

Page 78

...-cash stock-based compensation Capital contribution from selling ...cash flow hedges, net of tax of $2,051 Foreign currency translation adjustments Comprehensive income GNC Corporation investment in General Nutrition Centers, Inc. Return of capital to GNC Corporation Non-cash stock-based compensation...

-

Page 79

... Acquisition of the Company Franchise store conversions Acquisition of intangibles Store acquisition costs Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES: Issuance of new equity Return of capital to Parent company Contribution from selling shareholders Dividend payment...

-

Page 80

... and Puerto Rico and in addition the Company offers products domestically through www.gnc.com and www.drugstore.com. Franchise stores are located in the United States and 47 international countries. The Company operates its primary manufacturing facilities in South Carolina and distribution centers...

-

Page 81

..., together with the equity contributions, to repay GNC Parent Corporation's outstanding floating rate senior PIK notes issued in November 2006, pay the merger consideration, and pay fees and expenses related to the Merger transactions. In connection with the Merger, the Company recognized charges of...

-

Page 82

...been prepared by the Company in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") and with the instructions to Form 10-K and Regulation S-X. The Company's normal reporting period is based on a calendar year. The financial statements as of December...

-

Page 83

... Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Inventories. Inventory components consist of raw materials, finished product and packaging supplies. Inventories are stated at the lower of cost or market on a first in/first out basis. Cost is...

-

Page 84

... the discounts associated with the Gold Card program to the revenue deferral during the twelve month membership period. For an annual fee, the card provides customers with a 20% discount on all products purchased, both on the date the card is purchased and certain specified days of every month. The...

-

Page 85

... of selling-related expenses of $26.4 million, a contract termination fee paid to our previous owner of $7.5 million and other costs of $0.7 million. Leases. The Company has various operating leases for company-owned and franchised store locations and equipment. Store leases generally include...

-

Page 86

... of legal settlements when the settlement is probable. Pre-Opening Expenditures. The Company recognizes the cost associated with the opening of new stores as incurred. These costs are charged to expense and are not material for the periods presented. Franchise store pre-opening costs are incurred...

-

Page 87

...tax positions as a component of income tax expense. See Note 5, "Income Taxes," for additional information regarding the change in unrecognized tax benefits. Self-Insurance. The Company has procured insurance for such areas as: (1) general liability; (2) product liability; (3) directors and officers...

-

Page 88

... comprehensive income (loss), net of tax. The Company measures hedge effectiveness by assessing the changes in the fair value or expected future cash flows of the hedged item. The ineffective portions, if any, are recorded in interest expense in the current period. Derivatives designated as hedging...

-

Page 89

...generally accepted in the United States of America ("U.S. GAAP"). The Codification is effective for interim and annual periods ending after September 15, 2009. The adoption of this standard did not have any impact on the Company's financial statements. In June 2009, the SEC issued a staff accounting...

-

Page 90

...instruments, how derivative instruments and related hedged items are accounted for and how derivative instruments and related hedged items affect a company's financial position, financial performance, and cash flows. The new standard was effective for interim and annual periods beginning on or after...

-

Page 91

... of a tax position of an entity's status, including its status as a pass-through entity, eliminates certain disclosure requirements for non-public entities, and provides application for pass-through entities. The adoption of this standard did not have any impact on the Company's financial statements...

-

Page 92

...) - (9,554) $

December 31, 2008

311,422 53,515 5,555 370,492

Gross cost

Reserves (a) (in thousands)

Net Carrying Value

Finished product ready for sale Work-in-process, bulk product and raw materials Packaging supplies

$ $

311,218 $ 57,995 4,827 374,040 $

(9,275) $ (1,111) - (10,386) $

301...

-

Page 93

... of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS NOTE 5. INCOME TAXES Deferred income taxes reflect the net tax effects of temporary differences between the carrying amount of assets and liabilities for financial reporting purposes and...

-

Page 94

...new standard on income taxes which applies to all open tax positions accounted for in accordance with previously issued standards on income taxes. This interpretation is intended to result in increased relevance and comparability in financial reporting of income taxes and to provide more information...

-

Page 95

... the next 12 months. The Company files a consolidated federal tax return and various consolidated and separate tax returns as prescribed by the tax laws of the state and local jurisdictions in which it and its subsidiaries operate. The Company has been audited by the Internal Revenue Service, ("IRS...

-

Page 96

... brands were assigned a final fair value representing the longevity of the Company name and general recognition of the product lines. The Gold Card program was assigned a final fair value representing the underlying customer listing, for both the Retail and Franchise segments. The retail agreements...

-

Page 97

... of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS The following table summarizes the Company's goodwill activity:

Retail Franchising Manufacturing/ Wholesale (in thousands) Total

Balance at December 31, 2007 Acquired franchise stores Other...

-

Page 98

... houses the Company's corporate headquarters. The Company occupies the majority of the available lease space of the building. The general partner is responsible for the operation and management of the property and reports the results of the partnership to the Company. The Company has consolidated...

-

Page 99

...$ $

1,197 511 810 2,518

Annual maturities of the Company's long term and current (see current portion in Note 6, "Prepaids and Other Current Assets") franchise notes receivable at December 31, 2009 are as follows:

Years ending December 31, Receivables (in thousands)

2010 2011 2012 2013 2014 Total...

-

Page 100

... Payable to former shareholders Accrued occupancy Accrued worker compensation Accrued taxes Deferred tax liability (see Note 5) Accrued income tax Other current liabilities Total Deferred revenue consists primarily of Gold Card and gift card deferrals. 94

$

$

33,837 2,625 4,882 5,892 5,683 622...

-

Page 101

...

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS NOTE 12. LONG-TERM DEBT / INTEREST In conjunction with the Merger, the Company repaid certain of its existing debt and issued new debt. The new debt, which was entered into or issued on the closing...

-

Page 102

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS The Company's net interest expense for each respective period is as follows:

Successor Year ended December 31, December 31, 2009 2008 (in thousands) March 16December 31, 2007 ...

-

Page 103

... on a defined leverage ratio) of excess cash flow (as defined in the agreement) for each fiscal year must be used to pay down outstanding borrowings. GNC Corporation, the Company's direct parent company, and the Company's existing and future direct and indirect domestic subsidiaries have guaranteed...

-

Page 104

...the Company's subsidiaries' ability to declare or pay dividends to its stockholders. In accordance with the terms of the Senior Toggle Notes purchase agreement and the offering memorandum, these notes were required to be exchanged for publicly registered exchange notes within 210 days after the sale...

-

Page 105

... to declare or pay dividends to the Company's stockholders. In accordance with the terms of the 10.75% Senior Subordinate Notes purchase agreement and the offering memorandum, these notes were required to be exchanged for publicly registered exchange notes within 210 days after the sale of these...

-

Page 106

... mature on December 1, 2010, and bore interest at the rate of 8 1/2% per annum, which was payable semi-annually in arrears on June 1 and December 1 of each year. In conjunction with the Merger, the Company repaid certain of its existing debt, and issued new debt. The Company utilized proceeds from...

-

Page 107

... to the landlord directly, and then bills the franchisee for reimbursement of this cost. If a franchisee defaults on its sub-lease and its sub-lease is terminated, the Company has in the past converted, and expects in the future to, convert any such franchise store into a corporate store and fulfill...

-

Page 108

... is engaged in various legal actions, claims and proceedings arising in the normal course of business, including claims related to breach of contracts, products liabilities, intellectual property matters and employment-related matters resulting from the Company's business activities. As with most...

-

Page 109

...New York based on "related to" bankruptcy jurisdiction, as one of the manufacturers supplying it with Andro Products, and from whom it sought indemnity, MuscleTech Research and Development, Inc. ("MuscleTech"), had filed for bankruptcy. The Company was successful in removing the New Jersey, New York...

-

Page 110

... market research; (3) using our Gold Card program to collect information on franchised store customers and then soliciting business from such customers; (4) underselling its franchised stores by selling products through the GNC website at prices below or close to the wholesale price, thereby forcing...

-

Page 111

... use and consumption of Hydroxycut-branded products Michael Owens and Donna Owens v. Iovate Health Sciences USA, Inc., et al., Superior Court of the State of California, County of Los Angeles, BC413006 (filed May 1, 2009); Eva M. Stasiak v. Iovate Health Sciences USA, Inc., et al., Superior Court...

-

Page 112

... Health Sciences Group, et al., Supreme Court of the State of New York, Kings County (filed January 22, 2010); Casey Slyter v. GNC Corporation, et al., U.S. District Court, District of Kansas, 10CV2065 (filed January 29, 2010); and Debra Rutherford, et al. v. Muscletech Research and Development...

-

Page 113

.... The future purchase commitments consisted of $9.7 million of advertising, inventory commitments and spending for website redesign, $10.8 million management services agreement and bank fees. Other commitments related to the Company's business operations cover varying periods of time and are not...

-

Page 114

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS In addition to the foregoing, the Company is subject to numerous federal, state, local, and foreign environmental and health and safety laws and regulations governing its operations, ...

-

Page 115

... compensation cost was $8.8 million and is expected to be recognized over a weighted average period of approximately 2.4 years. In 2007, the Board of Directors of the Parent (the "Board") and Parent's stockholders approved and adopted the GNC Acquisition Holdings Inc. 2007 Stock Incentive Plan...

-

Page 116

... In 2006, the Board of Directors of the Company and GNC Corporation approved and adopted the GNC Corporation 2006 Omnibus Stock Incentive Plan (the "2006 Plan"). In 2003 the boards approved and adopted the GNC Corporation (f/k/a General Nutrition Centers Holding Company) 2003 Omnibus Stock...

-

Page 117

... key financial information for each of the Company's business segments, identifiable by the distinct operations and management of each: Retail, Franchising, and Manufacturing/Wholesale. The Retail segment includes the Company's corporate store operations in the United States, Canada and its www.gnc...

-

Page 118

... Franchise Manufacturing/Wholesale Unallocated corporate and other costs: Warehousing and distribution costs Corporate costs Merger-related costs Sub total unallocated corporate and other costs Total operating income (loss) Interest expense, net Income before income taxes Income tax expense (benefit...

-

Page 119

...3,323 184,940

$ $

$ $

$ $ $ $ $

$ $ $ $ $

The following table represents sales by general product category. The category "Other" includes other wellness products sales from the Company's point of sales system and certain required accounting adjustments of $5.7 million for 2009, $4.7 million for...

-

Page 120

... product sales to franchisees, royalties, franchise fees and interest income on the financing of the franchise locations. The Company enters into franchise agreements with initial terms of ten years. The Company charges franchisees three types of flat franchise fees associated with stores: initial...

-

Page 121

...Product sales Royalties Franchise fees Other Total franchise revenue

$

$

217,920 35,561 4,570 6,117 264,168

$

$

209,662 35,147 5,676 7,535 258,020

$

$

160,665 25,990 3,013 4,228 193,896

$

$

38,409 7,102 810 916 47,237

NOTE 21. SUPPLEMENTAL CASH FLOW INFORMATION The Company remitted cash...

-

Page 122

... NUTRITION CENTERS, INC. AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS NOTE 22. RETIREMENT PLANS The Company sponsors a 401(k) defined contribution savings plan covering substantially all employees. Full time employees who have completed 30 days of service and part time employees...

-

Page 123

... Company entered into a services agreement with its ultimate Parent, GNC Acquisition Holdings Inc ("Holdings"). Under the agreement, Holdings agreed to provide the Company and its subsidiaries with certain services in exchange for an annual fee of $1.5 million, as well as customary fees for services...

-

Page 124

... of the directors of the Company and its Parent, is the Managing Director, a member of the Board of Directors and a stockholder of Lifelong. The aggregate value of the products the Company purchased from Lifelong was $3.3 million for the 2009 fiscal year. Predecessor: Management Service Fees. As of...

-

Page 125

... its corporate structure effective January 1, 2009. Certain guarantor subsidiaries were merged into General Nutrition Centers, Inc. (the "Parent/Issuer"), which remained the Parent/Issuer after the reorganization; certain other guarantor subsidiaries were merged into each other. Supplemental...

-

Page 126

... Brands Property, plant and equipment, net Investment in subsidiaries Other assets Total assets Current liabilities Current liabilities Intercompany payables Total current liabilities Long-term debt Deferred tax liabilities Other long-term liabilities Total liabilities Total stockholder's equity...

-

Page 127

... Brands Property, plant and equipment, net Investment in subsidiaries Other assets Total assets Current liabilities Current liabilities Intercompany payables Total current liabilities Long-term debt Deferred tax liabilities Other long-term liabilities Total liabilities Total stockholder's equity...

-

Page 128

...ended December 31, 2009

Eliminations

Consolidated

Revenue Cost of sales, including costs of warehousing, distribution and occupancy Gross profit Compensation and related benefits Advertising and promotion Other selling, general and administrative Subsidiary (income) expense Other (income) expense...

-

Page 129

...-Guarantor Subsidiaries (in thousands)

Eliminations

Consolidated

Revenue Cost of sales, including costs of warehousing, distribution and occupancy Gross profit Compensation and related benefits Advertising and promotion Other selling, general and administrative Subsidiary (income) expense Other...

-

Page 130

.../distribution Acquisition of the Company Other investing Net cash provided by (used in) investing activities CASH FLOWS FROM FINANCING ACTIVITIES: GNC Corporation investment in General Nutrition Centers, Inc Dividend payment Financing fees Other financing Net cash used in financing activities Effect...

-

Page 131

...investing activities CASH FLOWS FROM FINANCING ACTIVITIES: GNC Corporation investment in General Nutrition Centers, Inc Other financing Net cash provided by (used in) financing activities Effect of exchange rate on cash Net increase (decrease) in cash Beginning balance, cash Ending balance, cash 125...

-

Page 132

... ACTIVITIES: CASH FLOWS FROM INVESTING ACTIVITIES: Capital expenditures Investment/distribution Acquisition of the Company Other investing Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES: GNC Corporation investment in General Nutrition Centers, Inc Issuance of new equity...

-

Page 133

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Supplemental Condensed Consolidating Statements of Cash Flows

Predecessor Period ended March 15, 2007 Parent/ Issuer Combined Combined Guarantor Non-Guarantor Subsidiaries Subsidiaries ...

-

Page 134

... with generally accepted accounting principles. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, has assessed the effectiveness of...

-

Page 135

...39 35

Director and Chief Executive Officer Director, President and Chief Merchandising and Marketing Officer Executive Vice President, Chief Financial Officer Executive Vice President of Global Business Development, Chief Operating Officer, International Executive Vice President of Store Operations...

-

Page 136

...the President and Chief Operating Officer, International Division for the United Kingdom based office equipment and solutions company Danka Business Systems. In the later part of the 90's Mr. Berg had served as Danka's Executive Vice President overseeing worldwide legal, corporate development, human...

-

Page 137

...Retail Operations for the Southeast United States since November 2003. Mr. Green began his employment with GNC in 1983 and has served in various retail, marketing and franchising positions with the Company, including Division Merchandise Manager and Vice President of Retail Sales. Guru Ramanathan Ph...

-

Page 138

... Fortino held several management positions for Loblaw Companies Ltd., including Senior Vice President - Supply Chain & Logistics. Michael F. Hines became one of our directors in November 2009. Mr. Hines was Executive Vice President and Chief Financial Officer of Dick's Sporting Goods, Inc. from 1995...

-

Page 139

...common stock of our Parent. The stockholders agreement also provides for election of our Parent's then-current chief executive officer to our Parent's board of directors. Our Parent's board of directors intends for our board of directors and the board of directors of GNC Corporation to have the same...

-

Page 140

... process and compensation structure for our other executive officers; and the compensation structure and annual compensation for the directors on our board of directors and the board of directors of our Parent (together, the "Company Board") and committee service by non-employee directors.

In...

-

Page 141

... reviewed this report, which generally indicated that our top nine executives receive market compensation, the Compensation Committee did not rely on this report or use it for benchmarking purposes in determining the current or future compensation of our Named Executive Officers. Our Compensation...

-

Page 142

... on the Named Executive Officer's base salary upon termination because of death or disability, termination by us without cause, or termination by the Named Executive Officer for good reason; a prorated payment of annual incentive compensation for the year in which employment is terminated if a bonus...

-

Page 143

... bonus amounts expressed as a percentage of his or her annual base salary. The respective percentages are determined by position and level of responsibility and are stated in the annual incentive plan adopted by the Compensation Committee. The employment agreements of our Chief Executive Officer and...

-

Page 144

... by the Company Board. The thresholds and related goals with respect to the 2010 Incentive Plan are as follows:

Thresholds 2010 Incentive Plan Budgeted EBITDA

First threshold-33% of target Second threshold-66% of target Target Maximum

91.5% - 100% 103.9%

We do not disclose our internal budget for...

-

Page 145

... the 2010 Incentive Plan, while possible to achieve for our Named Executive Officers, will present a significant challenge. Generally, an annual performance bonus is payable only if the Named Executive Officer is employed by us on the date payment is made. Stock Options. We believe that equity-based...

-

Page 146

..., and to receive benefits under, any benefit plans, arrangements, or policies available to employees generally or to our executive officers generally. The fringe benefits for our Chief Executive Officer and President were negotiated in connection with their employment agreements and in some respects...

-

Page 147

... benefits plan; an automobile allowance in an annual amount equal to $5,000; an allowance for professional assistance in an annual amount equal to $3,500; a supplemental retirement allowance in an annual amount equal to $10,000 ($25,000 for our Chief Executive Officer); a financial planning and tax...

-

Page 148

... our current Named Executive Officers are currently eligible to participate in the 401(k) plan. The Company maintains the GNC Live Well Later Non-qualified Deferred Compensation Plan for the benefit of a select group of management or highly compensated employees. Under the deferred compensation plan...

-

Page 149

...equity securities of our direct or indirect parent companies are publicly traded, we are not currently subject to any limitations under Internal Revenue Code Section 162(m). While we are not required to do so, we have structured our compensation programs in a manner to generally comply with Internal...

-

Page 150

... Named Executive Officers served as a director or member of the compensation committee of another entity whose executive officers served on our Company Board or Compensation Committee. Compensation Committee Report The members of the Compensation Committee have reviewed and discussed with management...

-

Page 151

... SEC rules, the compensation described in this table does not include medical or group life insurance received by the 2009 Named Executive Officers that are available generally to all salaried employees of the Company.

Change in Pension Value and Non-Equity Non-qualified Stock Option Incentive Plan...

-

Page 152

... please see "Option Repricing" below. For additional information, see Note 18 under the heading "Stock-Based Compensation Plans" of the Notes to Consolidated Financial Statements included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2009. The amounts reflect the...

-

Page 153

...the number of shares of GNC Parent Corporation common stock subject to the option and subject to reduction for required withholding tax.

(6)

Perquisites include cash amounts received by certain 2009 Named Executive Officers for, or in reimbursement of, supplemental medical, supplemental retirement...

-

Page 154

... under the heading "Stock-Based Compensation Plans" of the Notes to the Company's Consolidated Financial Statements included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2009.

All Other Option Awards: Number of Securities Underlying Options (#)

Name

Grant Date...

-

Page 155

... the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2009.

Outstanding Equity Awards at Fiscal Year-End The table below sets forth information regarding exercisable and unexercisable option awards granted to the 2009 Named Executive Officers under our 2007 Stock Plan and...

-

Page 156

... of its 2009 Named Executive Officers for the fiscal year ending December 31, 2009. Non-qualified Deferred Compensation The Company maintains the GNC Live Well Later Non-qualified Deferred Compensation Plan for the benefit of a select group of management or highly compensated employees. Under the...

-

Page 157

... annual goals established by the Company Board or the Compensation Committee. The employment agreement also provides that Mr. Fortunato will receive certain fringe benefits and perquisites similar to those provided to our other executive officers. The employment agreement provides that upon a change...

-

Page 158

... of or during the two-year period following a change in control, or within six months prior to or at any time following the completion of an initial public offering of our Parent's common stock, the multiple of base salary and annualized perquisites and of average annual bonus will increase from two...

-

Page 159

...attainment of certain goals established jointly in good faith by the Chief Executive Officer and Ms. Kaplan. The employment agreement also provides that Ms. Kaplan will receive certain fringe benefits and perquisites similar to those provided to our other executive officers. Upon a change in control...

-

Page 160

... the two-year period following a change in control, or within six months prior to or at any time following the completion of an initial public offering of our Parent's common stock, then Ms. Kaplan will receive payment of a lump sum amount equal to two times her base salary and the annualized value...

-

Page 161

... we exceed the annual goals determined by the Company Board or the Compensation Committee, and to certain fringe benefits and perquisites similar to those provided to our other executive officers. The employment agreements also provide for certain benefits upon termination of employment. Upon death...

-

Page 162

... power of the securities of our Parent entitled to vote generally in the election of the Parent Board; a change in 2/3 of the members of Parent Board from the members on the effective date of the executive's employment agreement, unless approved by (i) 2/3 of the members of the Parent Board on the...

-

Page 163

Table of Contents

General The employment agreements for all of our 2009 Named Executive Officers contain: • • terms of confidentiality concerning trade secrets and confidential or proprietary information which may not be disclosed by the executive except as required by court order or applicable...

-

Page 164

... by the Parent Compensation Committee, may be discounted to reflect the lack of marketability associated with the common stock. The termination and change in control arrangements for our 2009 Named Executive Officers and other senior employees are generally based on form employment agreements. As...

-

Page 165

...

Chief Executive Officer Joseph Fortunato

Termination w/o cause or for Good Reason or Nonrenewal of the Agreement ($) Termination w/o cause or for Good Reason upon a Change in Control ($) Termination w/o cause or for Good Reason in anticipation of a Change in Control ($)

Benefit

Termination...

-

Page 166

... Good Reason in Connection with an IPO ($)

Voluntary Termination ($)

Death or Disability ($)

Change of Control ($)

Lump Sum Base Salary Lump Sum Annual Incentive Compensation Lump Sum Annualized Value or Perquisites Prorated Annualized Incentive Compensation Health & Welfare Benefits Accelerated...

-

Page 167

...w/o cause or for Good Reason within 6 Months after a Change in Control ($)

Benefit

Termination w/o cause or for Good Reason ($)

Voluntary Termination ($)

Death or Disability ($)

Change of Control ($)

Base Salary Continuation Pro Rata Bonus Health & Welfare Benefits Accelerated Vesting of Stock...

-

Page 168

... information with respect to compensation for our directors for 2009. Norman Axelrod, David B. Kaplan, Jeffery B. Schwartz, Lee Sienna, Josef Prosperi and Michele J. Buchignani were each appointed as members of the Company Board effective as of March 16, 2007. As stated above, any employee employed...

-

Page 169

... serve as members of the Company Board, but neither receives any compensation for serving as a director.

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)

Name

Fees Earned or Paid in Cash ($)

Stock Awards ($)

Option Awards ($)1,2

Non-Equity Incentive Plan Compensation...

-

Page 170

...March 1, 2010 (the "Ownership Date"), the number of shares of our Parent's common stock beneficially owned by (1) each person or group known by us to own beneficially more than 5% of the outstanding shares of our Parent's common stock, (2) each director, (3) each named executive officer, and (4) all...

-

Page 171

...than 1% of the outstanding shares. The address of Mr. Hines and each current executive officer is c/o General Nutrition Centers, Inc., 300 Sixth Avenue, Pittsburgh, Pennsylvania 15222. On March 16, 2007, in connection with the Merger, our Parent entered into a stockholders agreement with each of our...

-

Page 172

... election of our Parent's then-current chief executive officer to our Parent's board of directors. Under the terms of the amended and restated stockholders agreement, certain significant corporate actions require the approval of a majority of directors on the board of directors, including a majority...

-

Page 173

... as a director and as our President and Chief Merchandising and Marketing Officer, is a member of Axcel Managers LLC, the managing member of Axcel Partners III LLC, and of SK Limited Partnership, a member of Axcel Partners III LLC. Stock Purchase Agreement In February 2010, Holdings, GNC and Guru...

-

Page 174

... to the Company's directors, executive officers, including Chief Executive Officer, and senior financial officers. In addition, the Company has adopted a Code of Ethical Business Conduct for all employees. Our Code of Ethics is posted on our website at www.gnc.com on the Corporate Governance page of...

-

Page 175

... for payment security compliance by PricewaterhouseCoopers. In accordance with policies adopted by our audit committee, all audit and non-audit related services to be performed by our independent public accountants must be approved in advance by the audit committee or by a designated member of the...

-

Page 176

...report: (1) Financial statements filed in Part II, Item 8 of this report: • • Report of Independent Registered Public Accounting Firm. Consolidated Balance Sheets As of December 31, 2009 and December 31, 2008. • Consolidated Statements of Operations For the year...of Cash Flows For the year ended...

-

Page 177

...10,955 $ 2,344 (1,309) 11,990 $

7,191 3,764 - 10,955

$ $

13,231 130 (6,170) 7,191

(1)

These balances are the total allowance for doubtful accounts for trade accounts receivable and the current and long-term franchise note receivable and also includes our returns for our wholesale customers. 171

-

Page 178

... by reference from statements and reports previously filed by the Company or our Parent with the SEC pursuant to Rule 12b-32 under the Exchange Act: 3.1 Certificate of Incorporation of General Nutrition Centers, Inc. (f/k/a Apollo GNC Holding, Inc.) (the "Company"). (Incorporated by reference to...

-

Page 179

...Incentive Stock Option Agreement Pursuant to the GNC Acquisition Holdings Inc. 2007 Stock Incentive Plan. (Incorporated by reference to Exhibit 10.13 to the Company's Annual Report on Form 10-K (File No. 333-114502), filed March 14, 2008.) 10.15 Amended and Restated Employment Agreement, dated as of...

-

Page 180

... August 9, 2004.) †10.22 Amendment to the GNC/Rite Aid Retail Agreement, effective as of May 1, 2004, between General Nutrition Sales Corporation and Rite Aid Hdqtrs Corp. (Incorporated by reference to Exhibit 10.26 to the Company's Pre-Effective Amendment No. 1 to its Registration Statement on...

-

Page 181

...above.) 10.29 Amended and Restated GNC/Rite Aid Retail Agreement, dated as of July 31, 2007, by and between Nutra Sales Corporation (f/k/a General Nutrition Sales Corporation) and Rite Aid Hdqtrs. Corp. (Incorporated by reference to Exhibit 10.34 to the Company's Pre-Effective Amendment No. 1 to its...

-

Page 182

... by the undersigned, thereunto duly authorized. GENERAL NUTRITION CENTERS, INC. By: /s/ Joseph Fortunato Joseph Fortunato Chief Executive Officer Dated: March 11, 2010 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on...

-

Page 183

Table of Contents

By:

/s/ David B. Kaplan David B. Kaplan Director Dated: March 8, 2010

By:

/s/ Romeo Leemrijse Romeo Leemrijse Director Dated: March 8, 2010

By:

/s/ Jeffrey B. Schwartz Jeffrey B. Schwartz Director Dated: March 8, 2010 177

-

Page 184

Exhibit 3.4 SECOND AMENDED AND RESTATED BYLAWS OF GENERAL NUTRITION CENTERS, INC. A Delaware Corporation Effective April 24, 2008

-

Page 185

... Meetings by Means of Conference Telephone Committees Compensation Interested Directors ARTICLE IV OFFICERS Section 1 Section 2 Section 3 Section 4 Section 5 Section 6 Section 7 General Election Voting Securities Owned by the Corporation Chairman of the Board of Directors Chief Executive Officer...

-

Page 186

... Notice ARTICLE VII GENERAL PROVISIONS

12 12

Section 1 Section 2 Section 3 Section 4

Dividends Disbursements Fiscal Year Corporate Seal ARTICLE VIII ...Employees and Agents ARTICLE IX MISCELLANEOUS

13 14 14 14 15 15 15 15 16 16 16 16

Section 1 Section 2

Amendments Entire Board of Directors...

-

Page 187

... shall be held on such date and at such time as shall be designated from time to time by the Board of Directors. Any other proper business may be transacted at the Annual Meeting of Stockholders. Section 3 Special Meetings. Unless otherwise required by law or by the certificate of incorporation of...

-

Page 188

... act for such stockholder as proxy. Execution may be accomplished by the stockholder or such stockholder's authorized officer, director, employee or agent signing such writing or causing such person's signature to be affixed to such writing by any reasonable means, including, but not limited to, by...

-

Page 189

... consents signed by a sufficient number of holders to take action are delivered to the Corporation by delivery to its registered office in the State of Delaware, its principal place of business, or an officer or agent of the Corporation having custody of the book in which proceedings of meetings of...

-

Page 190

... without a meeting, when no prior action by the Board of Directors is required by applicable law, shall be the first date on which a signed written consent setting forth the action taken or proposed to be taken is delivered to the Corporation by delivery to its registered office in the State of...

-

Page 191

... as may from time to time be determined by the Board of Directors. Special meetings of the Board of Directors may be called by the Chairman, if there be one, the Chief Executive Officer, the President, or by any director. Notice thereof stating the place, date and hour of the meeting shall be given...

-

Page 192

... appoint any person to act as secretary of the meeting. Section 6 Resignations and Removals of Directors. Any director of the Corporation may resign at any time, by giving notice in writing to the Chairman of the Board of Directors, the Chief Executive Officer, the President or the Secretary of the...

-

Page 193

... at each meeting of the Board of Directors or a stated salary for service as director, payable in cash or securities. No such payment shall preclude any director from serving the Corporation in any other capacity and receiving compensation therefor. Members of special or standing committees...

-

Page 194

... signature of the Chief Executive Officer is required, the Chairman of the Board of Directors shall possess the same power as the Chief Executive Officer to sign all contracts, certificates and other instruments of the Corporation which may be authorized by the Board of Directors. During the absence...

-

Page 195

... of Directors, have general supervision of the business of the Corporation and shall see that all orders and resolutions of the Board of Directors are carried into effect. The Chief Executive Officer shall execute all bonds, mortgages, contracts and other instruments of the Corporation requiring...

-

Page 196

... the Chief Executive Officer and the Board of Directors, at its regular meetings, or when the Board of Directors so requires, an account of all transactions as Treasurer and of the financial condition of the Corporation. If required by the Board of Directors, the Treasurer shall give the Corporation...

-

Page 197

... signed by, or in the name of the Corporation (i) by the Chairman of the Board of Directors, the Chief Executive Officer, the President or a Vice President and (ii) by the Treasurer or an Assistant Treasurer, or the Secretary or an Assistant Secretary of the Corporation, certifying the number...

-

Page 198

...convened. Neither the business to be transacted at, nor the purpose of, any Annual or Special Meeting of Stockholders or any regular or special meeting of the directors or members of a committee of directors need be specified in any written waiver of notice unless so required by law, the Certificate...

-

Page 199

.... Section 2 Disbursements. All checks or demands for money and notes of the Corporation shall be signed by such officer or officers or such other person or persons as the Board of Directors may from time to time designate. Section 3 Fiscal Year. The fiscal year of the Corporation shall be fixed by...

-

Page 200

... is based on the records or books of account of the Corporation or another enterprise, or on information supplied to such person by the officers of the Corporation or another enterprise in the course of their duties, or on the advice of legal counsel for the Corporation or another enterprise or on...

-

Page 201

... may purchase and maintain insurance on behalf of any person who is or was a director or officer of the Corporation, or is or was a director or officer of the Corporation serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint...

-

Page 202

.... The term "another enterprise" as used in this Article VIII shall mean any other corporation or any partnership, joint venture, trust, employee benefit plan or other enterprise of which such person is or was serving at the request of the Corporation as a director, officer, employee or agent...

-

Page 203

... or by a majority of the entire Board of Directors then in office. Section 2 Entire Board of Directors. As used in this Article IX and in these Bylaws generally, the term "entire Board of Directors" means the total number of directors which the Corporation would have if there were no vacancies...

-

Page 204

... and carry out (a) the Company's rules, regulations, policies and codes of ethics and/or conduct applicable to its employees generally and in effect from time to time and (b) such rules, regulations, policies, codes of ethics and/or conduct, directions and restrictions as the Board of Directors of...

-

Page 205

..., not to extend the Employment Period. 3. Compensation and General Benefits. 3.1 Base Salary. (a) During the Employment Period, the Company agrees to pay to the Executive an annual base salary in an amount equal to $275,000 (such base salary, as may be adjusted from time to time pursuant to Section...

-

Page 206

... in, and to receive benefits under, (a) any benefit plans, arrangements or policies made available by the Company to its employees generally, subject to and on a basis consistent with the terms, conditions and overall administration of each such plan, arrangement or policy and (b) without limiting...

-

Page 207

...Company-sponsored disability benefit plan program or policy for the period following such date of termination, (A) the Company shall pay to the Executive, guardian or personal representative, as the case may be, the Executive's current Base Salary for the remainder of the Employment Period in effect...

-

Page 208

... current fair market value of a share of Common Stock (as determined by the Board in good faith) and (ii) the number of shares so purchased. 4.3 Termination by the Company Without Cause or Resignation by the Executive For Good Reason. (a) The Company may terminate the Executive's employment without...

-

Page 209

... Board or the Compensation Committee, the Company may pay to the Executive a prorated share of the Annual Bonus pursuant to Section 3.2 hereof (based on the period of actual employment) that the Executive would have been entitled to had the Executive worked the full year during which the termination...

-

Page 210

... Company's designee), for an amount equal to the product of (A) the per share current fair market value of a share of Common Stock (as determined by the Board in good faith) and (B) the number of shares so purchased. (d) As a condition precedent to the Executive's right to receive the benefits set...

-

Page 211

... thirty-five (35) days after the Company receives notice of the Accounting Firm's determination. (iii) The Executive shall give written notice to the Company of any claim by the Internal Revenue Service that, if successful, would require the payment by the Executive of an Excise Tax, such notice to...

-

Page 212

... by the Executive of any material business opportunity of the Company or any of its Affiliates; (vi) any failure to comply with, observe or carry out the Company's rules, regulations, policies and codes of ethics and/or conduct applicable to its employees generally and in effect from time to time...

-

Page 213

...market value of a share of Common Stock (as determined by the Board in good faith) and (B) the number of shares so purchased. 4.5 Resignation from Officer Positions. Upon the termination of the Executive's employment for any reason (unless otherwise agreed in writing by the Company and the Executive...

-

Page 214

..., from any and all officer and/or director positions that the Executive, immediately prior to such termination, (a) held with the Company or any of its Affiliates and (h) held with any other entities at the direction of, or as a result of the Executive's affiliation with, the Company or any of its...

-

Page 215

... or control. (f) Upon termination or expiration of this Agreement, the Executive shall immediately return to the Company all Confidential Information, and all other information and property affecting or relating to the business of the Company Parties, within the Executive's possession, custody or...

-

Page 216

... applications related to any Work Product except with the written consent of the Chief Executive Officer. 5.3 Non-Competition and Non-Solicitation. (a) In consideration of the Confidential Information being provided to the Executive as stated in Section 5.1 hereof, and other good and valuable new...

-

Page 217

... Information, the restrictive covenants of this Section 5.3, as applicable according to their terms, shall remain in full force and effect even in the event of the Executive's involuntary termination from employment, with or without Cause and (v) the Executive has carefully read this Agreement...

-

Page 218

.../or information (A) that any Company Party has voluntarily placed in the public domain, (B) that has been lawfully and independently developed and publicly disclosed by third parties, (C) that constitutes the general non-specialized knowledge and skills gained by the Executive during the Employment...

-

Page 219

production costs, costs of goods sold, costs of supplies and manufacturing materials, non-public financial statements and reports, profit and loss information, margin information and financial performance information; (4) customer related information, such as customer related contracts, engagement ...

-

Page 220

... of employment (the Executive's last day of work for the Company) or (ii) the period during which the Executive is receiving payments from the Company pursuant to Section 4 hereof. (h) "Work Product" means all patents and patent applications, all inventions, innovations, improvements, developments...

-

Page 221

...of the Executive's employment or termination from employment with the Company and/or any aspect of any dispute that is the subject of this Agreement. For the purposes of this Agreement, the term "Media" includes, without limitation, any news organization, station, publication, show, website, web log...

-

Page 222

...absent a separate adjudication to that effect; and (E) the remainder of this Agreement shall continue in full force and effect. (c) Procedure Generally. In the event that the parties fail to settle at the mediation required by this Agreement, and the Company does not exercise its right to opt out of...

-

Page 223

.... In rendering the award, the arbitrator shall state the reasons therefor, including (without limitation) any computations of actual damages or offsets, if applicable. (g) Fees and Costs. In the event of arbitration under the terms of this Agreement, the fees charged by JAMS or other arbitration...

-

Page 224

... with the Company and all goodwill developed with the Company's clients, customers and other business contacts by the Executive during any past employment with Company, as applicable, is the exclusive property of the Company; and (e) all Confidential Information and/or specialized training accessed...

-

Page 225

... follows: If to the Company, to: General Nutrition Centers, Inc. 300 Sixth Avenue Pittsburgh, PA 15222 Attention: Chief Executive Officer If to the Executive, to: Gerald J. Stubenhofer. Jr. at the most recent address of the Executive on file with the Company or to such other address as one party may...

-

Page 226