Express Scripts 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report 97

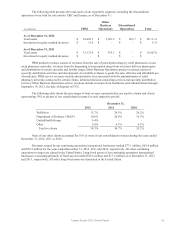

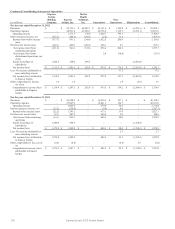

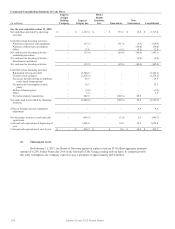

Certain amounts from prior periods have been reclassified to conform to current period presentation:

(i) With respect to the condensed consolidating balance sheet as of December 31, 2011, amounts related to

equity attributable to non-controlling interest have been reclassified from the “Other liabilities” line item

and presented separately from equity attributable to Express Scripts to conform to current period

presentation, as follows:

(in millions)

Non-

Guarantors

Consolidated

Other liabilities

$

(1.6)

$

(1.6)

Non-controlling interest

$

1.6

$

1.6

(ii) With respect to the condensed consolidating statement of operations for the year ended December 31, 2011,

amounts related to net income attributable to non-controlling interest have been reclassified from the

“Operating expenses” line item to the “Net income attributable to non-controlling interest” line item as

follows:

(in millions)

Non-

Guarantors

Consolidated

Operating expenses

$

(2.7)

$

(2.7)

Net income attributable to

non-controlling interest

$

2.7

$

2.7

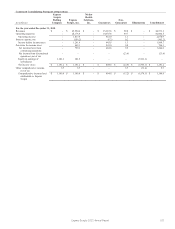

(iii) With respect to the condensed consolidating statement of cash flows for the year ended December 31,

2011, amounts related to distributions paid to non-controlling interest have been reclassified from the “Net

cash flows provided by (used in) operating activities” line item to the “Distributions paid to non-controlling

interest” line item within the cash flows from financing activities section, as follows:

(in millions)

Non-

Guarantors

Consolidated

Net cash flows provided by

(used in) operating

activities

$

1.1

$

1.1

Distributions paid to non-

controlling interest

$

(1.1)

$

(1.1)

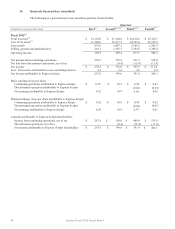

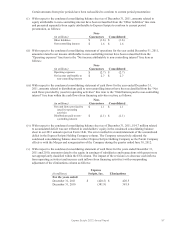

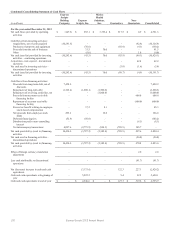

(iv) With respect to the condensed consolidating balance sheet as of December 31, 2011, $14.7 million related

to accumulated deficit was not reflected in stockholders’ equity in the condensed consolidating balance

sheet in our 2011 annual report on Form 10-K. The error resulted in an understatement of the accumulated

deficit in the Express Scripts Holding Company column. The Company retroactively adjusted the

condensed consolidating balance sheet to reflect Express Scripts Holding Company as the Parent Company

effective with the Merger and reorganization of the Company during the quarter ended June 30, 2012.

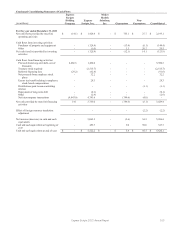

(v) With respect to the condensed consolidating statement of cash flows for the years ended December 31,

2011 and 2010, amounts related to the equity in earnings of subsidiaries and transactions with parent were

not appropriately classified within the ESI column. The impact of the revision is to decrease cash inflows

from operating activities (and increase cash inflows from financing activities) with corresponding

adjustment of the eliminations column as follows:

(in millions)

Express

Scripts, Inc.

Eliminations

For the years ended:

December 31, 2011

$

(420.5)

$

420.5

December 31, 2010

(381.9)

381.9