Express Scripts 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report44

increases were partially offset by a decrease in volume and an increase in the generic fill rate. Additionally, included in the

cost of PBM revenues for the year ended December 31, 2010 is $94.5 million of integration costs related to the acquisition

of NextRx.

PBM gross profit increased $238.5 million, or 8.2%, in 2011 over 2010, based on the various factors described

above.

SG&A for the PBM segment increased $8.4 million in 2011 over 2010. Costs of $62.5 million incurred during

2011 related to the Merger and accelerated spending on certain projects in 2011, discussed above, as well as $11.0 million

related to a proposed settlement of state tax audits, were partially offset by decreases in management compensation and

integration costs of $28.1 million during 2010 related to the acquisition of NextRx.

PBM operating income increased $230.1 million, or 11.1%, in 2011 over 2010, based on the various factors

described above.

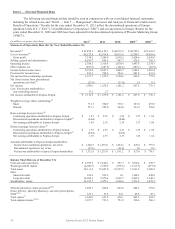

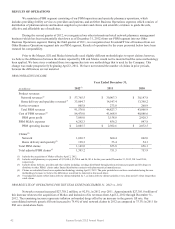

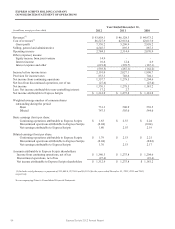

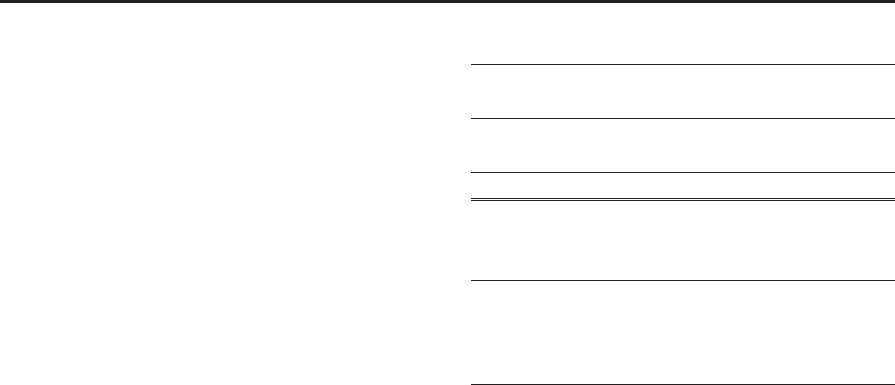

OTHER BUSINESS OPERATIONS OPERATING INCOME

Year Ended December 31,

(in millions)

2012

(1)

2011

2010

Product revenues

$ 2,118.7

$ 1,279.3

$ 1,153.9

Service revenues

163.4

21.3

12.4

Total Other Business Operations revenues

2,282.1

1,300.6

1,166.3

Cost of Other Business Operations revenues

2,049.9

1,249.5

1,128.4

Other Business Operations gross profit

232.2

51.1

37.9

Other Business Operations SG&A expenses

253.4

39.3

39.5

Other Business Operations operating income

$ (21.2)

$ 11.8

$ (1.6)

Claims

Home delivery and specialty—continuing operations

0.8

-

-

Total adjusted Other Business Operations claims—

continuing operations(2)

2.5

-

-

Home delivery and specialty—discontinued operations

4.9

-

-

Total adjusted Other Business Operations claims—

discontinued operations

(2)

14.7

-

-

(1) Our Other Business Operations results for the year ended December 31, 2012 excludes discontinued operations of EAV, UBC, and Europe,

which were included in the Other Business Operations segment in the second and third quarters of 2012 following consummation of the

Merger.

(2) Total adjusted claims reflect home delivery claims multiplied by 3, as home delivery claims typically cover a time period 3 times longer than

retail claims.

OTHER BUSINESS OPERATIONS RESULTS OF OPERATIONS

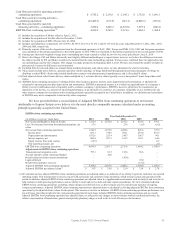

Other Business Operations operating income decreased $33.0 million, or 279.7%, in 2012 over 2011. This

decrease is due primarily to the inclusion of amounts related to Medco, the impact of impairment charges less the gain upon

sale associated with Liberty, netting to a loss of $22.5 million, as discussed in Note 4 – Dispositions and Note 6 – Goodwill

and intangibles, and losses attributed to other international businesses. Offsetting these losses is $14.3 million gain

associated with the sale of ConnectYourCare (“CYC”) as discussed in Note 4 – Dispositions.

Other Business Operations operating income increased $13.4 million in 2011 over 2010. This increase is due to an

increase in volume across all lines of business within the segment, partially offset by cost inflation.

OTHER (EXPENSE) INCOME, NET

Net other expense increased $306.2 million, or 106.6%, in 2012 as compared to 2011 due to the following items:

$85.2 million of financing fees related to the bridge facility and credit agreement (defined below) and senior note interest