Express Scripts 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report 79

78

being redeemed plus, in each case, unpaid interest on the notes being redeemed, accrued to the redemption date. The

February 2012 Senior Notes, issued by Express Scripts, are jointly and severally and fully and unconditionally

(subject to certain customary release provisions, including sale, exchange, transfer or liquidation of the guarantor

subsidiary) guaranteed on a senior unsecured basis by ESI and most of our current and future 100% owned domestic

subsidiaries, including, following the consummation of the Merger, Medco and certain of Medco’s 100% owned

domestic subsidiaries. The net proceeds were used to pay a portion of the cash consideration paid in the Merger and

to pay related fees and expenses.

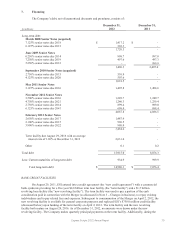

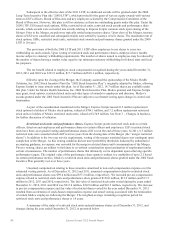

FINANCING COSTS

Financing costs of $13.3 million for the issuance of the June 2009 Senior Notes are being amortized over a

weighted-average period of 5.2 years. Financing costs of $10.9 million for the issuance of the May 2011 Senior

Notes are being amortized over 5 years. Financing costs of $29.9 million for the issuance of the November 2011

Senior Notes are being amortized over a weighted-average period of 12.1 years. Financing costs of $22.5 million for

the issuance of the February 2012 Senior Notes are being amortized over a weighted-average period of 6.2 years.

We incurred financing costs of $91.0 million related to the bridge facility. Financing costs of $26.0 million

were immediately expensed upon entering into the new credit agreement, which reduced the commitments under the

bridge facility by $4.0 billion. The remaining financing costs of $65.0 million related to the bridge facility were

capitalized and were amortized through April 2012. Amortization of the deferred financing costs was accelerated in

proportion to the amount by which alternative financing replaced the commitments under the bridge facility.

Financing costs of $36.1 million related to the term facility and new revolving facility are being amortized

over 4.4 years. In conjunction with our payment of $1,000.0 million on the term loan, we wrote off a proportionate

amount of financing costs.

Deferred financing costs are reflected in other intangible assets, net in the accompanying consolidated

balance sheet.

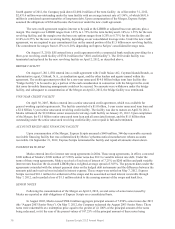

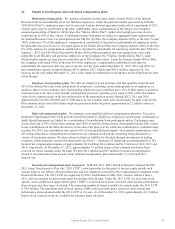

COVENANTS

Our bank financing arrangements contain covenants that restrict our ability to incur additional

indebtedness, create or permit liens on assets and engage in mergers or consolidations. The covenants also include

minimum interest coverage ratios and maximum leverage ratios. The March 2008 Senior Notes are also subject to an

interest rate adjustment in the event of a downgrade in the ratings to below investment grade. At December 31,

2012, we believe we were in compliance in all material respects with all covenants associated with our credit

agreements.

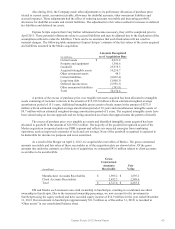

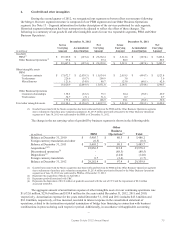

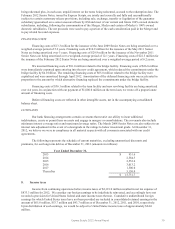

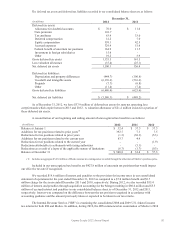

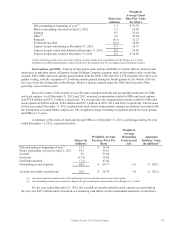

The following represents the schedule of current maturities, excluding unamortized discounts and

premiums, for our long-term debt as of December 31, 2012 (amounts in millions):

Year Ended December 31,

2013

$ 931.6

2014

2,584.3

2015

2,552.6

2016

3,013.2

2017

1,500.0

Thereafter

5,150.0

$ 15,731.7

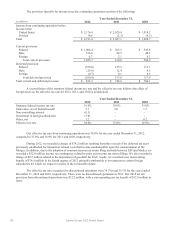

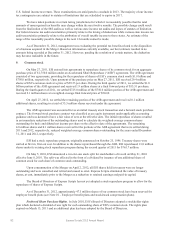

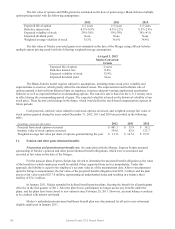

8. Income taxes

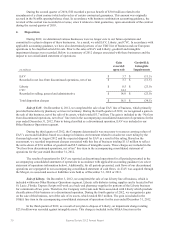

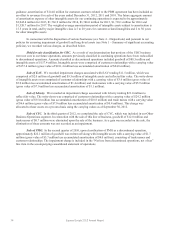

Income from continuing operations before income taxes of $2,191.0 million resulted in net tax expense of

$833.3 million for 2012. We consider our foreign earnings to be indefinitely reinvested, and accordingly have not

recorded a provision for United States federal and state income taxes thereon. Cumulative undistributed foreign

earnings for which United States taxes have not been provided are included in consolidated retained earnings in the

amount of $65.6 million, $53.7 million and $43.7 million as of December 31, 2012, 2011, and 2010, respectively.

Upon distribution of such earnings, we would be subject to United States income taxes of approximately $24.0

million.