Express Scripts 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Express Scripts 2012 Annual Report 45

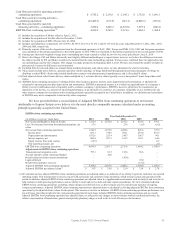

118.7 9

163.4 4

282.1 3

049.9 4

232.2 9

253.4 .5

21.2) 6)

ns .8

.5

ons .9

14.7

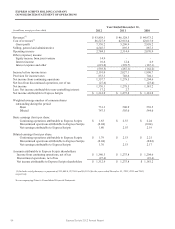

incurred in 2012 prior to the Merger; $12.4 million of financing fees related to the new credit agreement entered into upon

consummation of the Merger; and interest expense incurred subsequent to the Merger related to the new credit agreement,

February 2012 Senior Notes, November 2011 Senior Notes, May 2011 Senior Notes, and senior notes acquired from Medco

on April 2, 2012. These increases were partially offset by the redemption of Medco’s $500.0 million aggregate principal

amount of 7.250% senior notes due 2013, the redemption of ESI’s $1.0 billion aggregate principal amount of 5.250% senior

notes due 2012, early repayment of $1.0 billion associated with the new credit agreement and termination of the bridge

facility. Other net expense includes equity income of $14.9 million attributable to our joint venture, SureScripts, which is

accounted for using the equity method due to our increased consolidated ownership following the Merger.

Net interest expense increased $125.1 million, or 77.1%, in 2011 as compared to 2010 primarily due to $75.5

million of financing fees related to the bridge facility and credit agreement entered into during the third quarter of 2011 and

$29.5 million of bank commitment fees and interest expense related to the May 2011 Senior Notes and November 2011

Senior Notes issued during the second and fourth quarters of 2011, respectively. These increases were partially offset by the

repayment during 2010 of amounts outstanding under our prior credit facility.

For the definitions of the agreements and senior notes referenced above, see “Part II — Item 7 — Management’s

Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources.”

PROVISION FOR INCOME TAXES

Our effective tax rate from continuing operations was 38.0% for the year ended December 31, 2012, compared to

37.0% and 36.9% for 2011 and 2010, respectively. Our effective tax rate inclusive of non-controlling interest and

discontinued operations was 39.2% for the year ended December 31, 2012 which includes the net tax benefit of $8.2

million as discussed below.

During 2012, we recorded a charge of $14.2 million resulting from the reversal of the deferred tax asset previously

established for transaction-related costs that became nondeductible upon the consummation of the Merger. In addition, due

to the adoption of common income tax return filing methods between ESI and Medco, we recorded a $52.0 million income

tax contingency related to prior year income tax return filings. We also recorded a charge of $0.5 million related to the

impairment of goodwill for EAV. Lastly, we recorded a net nonrecurring benefit of $74.9 million in the fourth quarter of

2012 primarily attributable to investments in certain foreign subsidiaries for which we expect to realize in the foreseeable

future.

As of December 31, 2012, management was evaluating the potential tax benefits related to the disposition of a

business acquired in the Merger. Based on information currently available, our best estimate resulted in no amounts being

recorded at December 31, 2012. However, pending the resolution of certain matters, the deduction may become realizable

in the future.

NET LOSS FROM DISCONTINUED OPERATIONS, NET OF TAX

Our Europa Apotheek Venlo B.V. (“EAV”) line of business was sold on December 4, 2012. We also determined

that portions of United BioSource Corporation (“UBC”) subsidiary and our operations in Europe were not core to our future

operations and committed to a plan to dispose of these businesses. These lines of business are classified as discontinued

operations.

The loss from discontinued operations for the year ended December 31, 2012 is due primarily to the impairment

charges associated with EAV totaling $11.5 million to reflect the write-down of $2.0 million of goodwill and $9.5 million

of intangible assets. See Note 6 – Goodwill and Note 4 – Dispositions.

There were no charges for discontinued operations in 2011. The loss from discontinued operations for the year

ended December 31, 2010 is due primarily to the impairment charge (pre-tax) of $28.2 million related to the discontinued

operations of PMG.

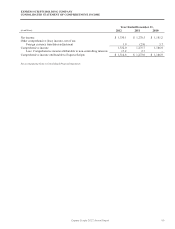

NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTEREST

Net income attributable to non-controlling interest represents the share of net income allocated to members in our

consolidated affiliates. Increases in these amounts are primarily driven by activities of this affiliate being in place for the

full fiscal year, as well as increased profitability.