Express Scripts 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report 69

$ 309.6

$ 154.4

$ 639.2 $ 463.4

5.5 19.8

1.69 0.88

$ $

Also during 2012, the Company made other adjustments to its preliminary allocation of purchase price

related to current assets, accounts receivable, allowance for doubtful accounts, other noncurrent liabilities and

accrued expenses. These adjustments had the effect of reducing accounts receivable and increasing goodwill,

allowance for doubtful accounts and current liabilities. The adjustments to fair value resulted in increases in deferred

tax liabilities and deferred tax assets.

Express Scripts expects that if any further refinements become necessary, they will be completed prior to

April 2013. These potential refinements relate to accrued liabilities and may be adjusted due to the finalization of the

assumptions utilized to value the liabilities. There can be no assurance that such finalization will not result in

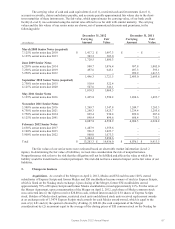

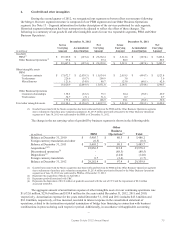

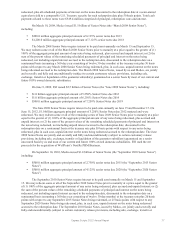

material changes. The following table summarizes Express Scripts’ estimates of the fair values of the assets acquired

and liabilities assumed in the Medco acquisition:

(in millions)

Amounts Recognized

as of Acquisition Date

Current assets

$

6,921.4

Property and equipment

1,390.6

Goodwill

23,978.3

Acquired intangible assets

16,216.7

Other noncurrent assets

48.3

Current liabilities

(9,038.4)

Long-term debt

(3,008.3)

Deferred income taxes

(5,958.3)

Other noncurrent liabilities

(395.9)

Total

$

30,154.4

A portion of the excess of purchase price over tangible net assets acquired has been allocated to intangible

assets consisting of customer contracts in the amount of $15,935.0 million with an estimated weighted-average

amortization period of 15.5 years. Additional intangible assets consist of trade names in the amount of $273.0

million with an estimated weighted-average amortization period of 10 years and miscellaneous intangible assets of

$8.7 million with an estimated weighted-average amortization period of 5 years. The acquired intangible assets have

been valued using an income approach and are being amortized on a basis that approximates the pattern of benefit.

The excess of purchase price over tangible net assets and identified intangible assets acquired has been

allocated to goodwill in the amount of $23,978.3 million. The majority of the goodwill recognized as part of the

Medco acquisition is reported under our PBM segment and reflects our expected synergies from combining

operations, such as improved economies of scale and cost savings. None of the goodwill recognized is expected to

be deductible for income tax purposes and is not amortized.

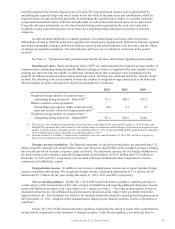

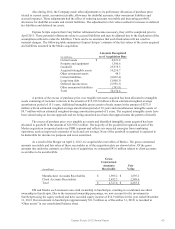

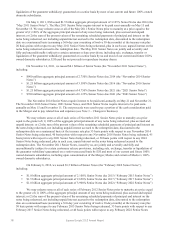

As a result of the Merger on April 2, 2012, we acquired the receivables of Medco. The gross contractual

amounts receivable and fair value of these receivables as of the acquisition date are shown below. Of the gross

amounts due under the contracts as of the date of acquisition, we estimated $43.6 million related to client accounts

receivables to be uncollectible.

(in millions)

Gross

Contractual

Amounts

Receivable

Fair

Value

Manufacturer Accounts Receivables

$

1,895.2

$

1,895.2

Client Accounts Receivables

2,432.2

2,388.6

Total

$

4,327.4

$

4,283.8

ESI and Medco each retained a one-sixth ownership in SureScripts, resulting in a combined one-third

ownership in SureScripts. Due to the increased ownership percentage, we now account for the investment in

SureScripts using the equity method and have recorded equity income of $14.9 million for the year ended December

31, 2012. Our investment in SureScripts (approximately $11.9 million as of December 31, 2012) is recorded in

“Other assets” in our consolidated balance sheet.