Express Scripts 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report 73

ons

72

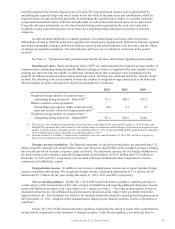

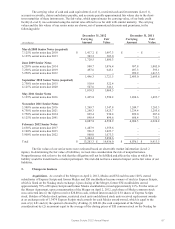

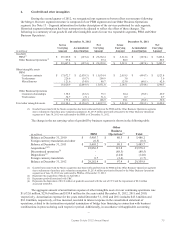

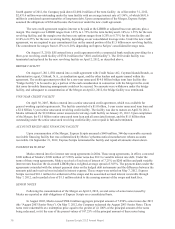

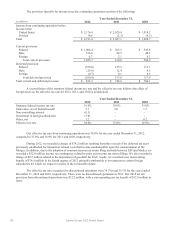

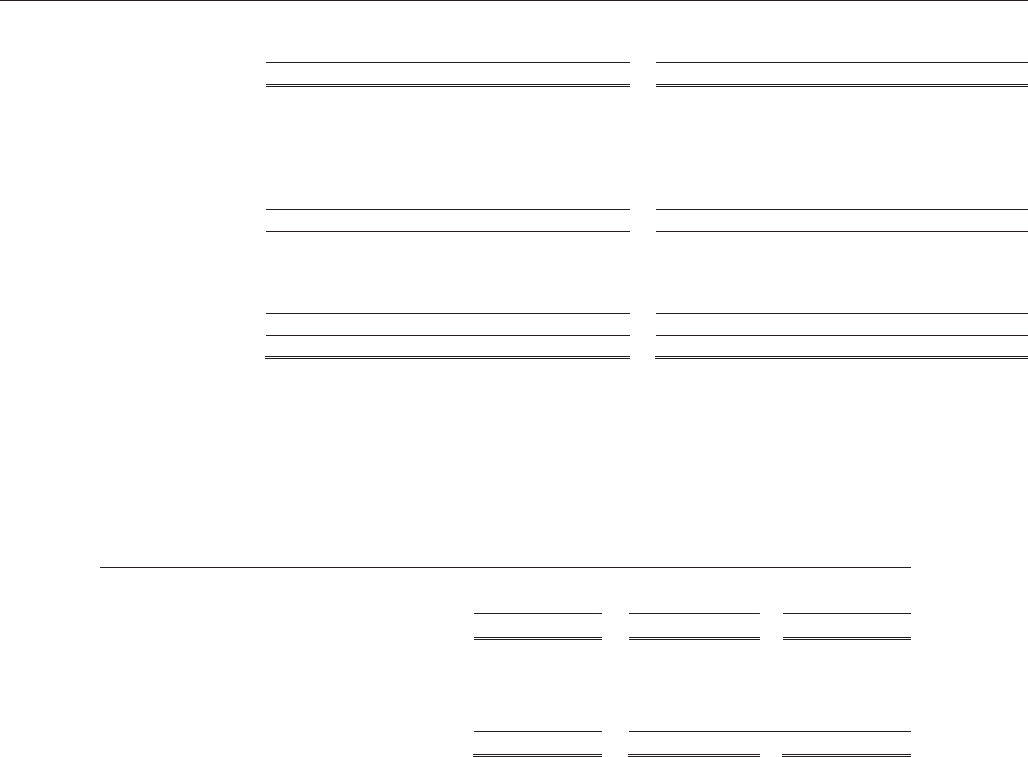

6. Goodwill and other intangibles

During the second quarter of 2012, we reorganized our segments to better reflect our structure following

the Merger. Our new segment structure is composed of our PBM segment and our Other Business Operations

segment. See Note 13 – Segment information for further description of the services performed by each segment.

Historical segment information has been retrospectively adjusted to reflect the effect of these changes. The

following is a summary of our goodwill and other intangible assets for our two reportable segments, PBM and Other

Business Operations:

December 31, 2012

December 31, 2011

(in millions)

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Goodwill

PBM(1)

$ 29,369.8

$ (107.4)

$ 29,262.4

$ 5,512.6

$ (107.4)

$ 5,405.2

Other Business Operations(1)

97.4

-

97.4

80.5

-

80.5

$ 29,467.2

$ (107.4)

$ 29,359.8

$ 5,593.1

$ (107.4)

$ 5,485.7

Other intangible assets

PBM

Customer contracts

$ 17,672.7

$ (2,038.3)

$ 15,634.4

$ 2,018.5

$ (494.7)

$ 1,523.8

Trade names

226.6

(16.7)

209.9

3.6

-

3.6

Miscellaneous

121.6

(34.9)

86.7

123.0

(60.1)

62.9

18,020.9

(2,089.9)

15,931.0

2,145.1

(554.8)

1,590.3

Other Business Operations

Customer relationships

138.5

(63.2)

75.3

68.4

(38.5)

29.9

Trade names

34.7

(3.1)

31.6

0.7

-

0.7

173.2

(66.3)

106.9

69.1

(38.5)

30.6

Total other intangible assets

$ 18,194.1

$ (2,156.2)

$ 16,037.9

$ 2,214.2

$ (593.3)

$ 1,620.9

(1) Goodwill associated with the Medco acquisition has been reallocated between the PBM and the Other Business Operations segments

due to refinement of purchase price valuation assumptions. $1,253.9 million previously allocated to the Other Business Operations

segment as of June 30, 2012 was reallocated to the PBM as of December 31, 2012.

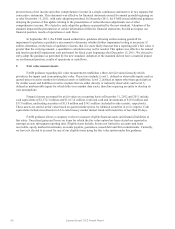

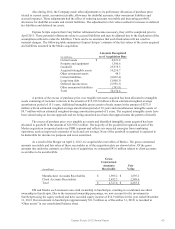

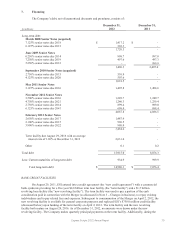

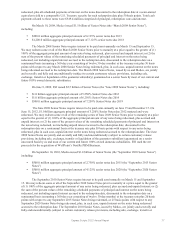

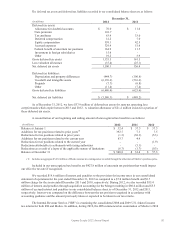

The change in the net carrying value of goodwill by business segment is shown in the following table:

(in millions)

PBM

Other

Business

Operations

(1)

Total

Balance at December 31, 2010

$

5,405.7

$

80.5

$

5,486.2

Foreign currency translation and other

(0.5)

-

(0.5)

Balance at December 31, 2011

$

5,405.2

$

80.5

$

5,485.7

Acquisitions(1)(2)

23,856.5

121.8

23,978.3

Discontinued operations(3)

-

(88.5)

(88.5)

Dispositions(4)

-

(14.0)

(14.0)

Foreign currency translation

0.7

(2.4)

(1.7)

Balance at December 31, 2012

$

29,262.4

$

97.4

$

29,359.8

(1) Goodwill associated with the Medco acquisition has been reallocated between the PBM and the Other Business Operations segments

due to refinement of purchase price valuation assumptions. $1,253.9 million previously allocated to the Other Business Operations

segment as of June 30, 2012 was reallocated to PBM as of December 31, 2012.

(2) Represents the acquisition of Medco in April 2012.

(3) Represents goodwill associated with UBC.

(4) Represents the disposition of $12.0 million of goodwill associated with the sale of CYC and the impairment of $2.0 million

associated with EAV.

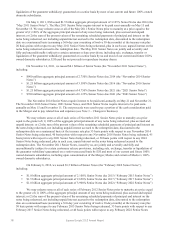

The aggregate amount of amortization expense of other intangible assets for our continuing operations was

$1,632.0 million, $236.0 million and $159.8 million for the years ended December 31, 2012, 2011 and 2010,

respectively. Amortization expense for the years ended December 31, 2012 and 2011 includes $43.6 million and

$81.0 million, respectively, of fees incurred, recorded in interest expense in the consolidated statement of

operations, related to the termination or partial termination of bridge loan financing in connection with business

combinations in process during each respective period. Additionally, in accordance with applicable accounting