Express Scripts 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Express Scripts 2012 Annual Report 47

Additionally, the Company accelerated spending on certain projects to complete them in 2012, in order to create

additional capacity to successfully complete integration activities for the Merger. We intend to continue to invest in

infrastructure and technology, which we believe will provide efficiencies in operations, facilitate growth and enhance the

service we provide to our clients. We expect future capital expenditures will be funded primarily from operating cash flow

or, to the extent necessary, with borrowings under our revolving credit facility, discussed below.

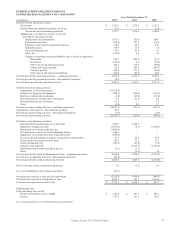

Net cash provided by financing activities by continuing operations decreased $179.0 million from inflows of

$3,029.4 million for the year ended December 31, 2011 to inflows of $2,850.4 million for the year ended December 31,

2012. Cash inflows for 2012 include $3,458.9 million related to the issuance of our February 2012 Senior Notes (defined

below) and $4,000.0 million related to the issuance of our new credit agreement (defined below). These inflows were offset

by repayments of long-term debt totaling $4,868.5 million. Cash outflows also include $103.2 million of deferred financing

fees related to the issuance of our February 2012 Senior Notes and new credit agreement.

In 2012, net cash used in financing activities by discontinued operations increased $26.8 million due to

classification of EAV, UBC and Europe as discontinued operations in 2012, while no businesses were classified as

discontinued operations in 2012.

At December 31, 2012, our sources of capital included a $1.5 billion revolving credit facility (the “new revolving

facility”) (none of which was outstanding at December 31, 2012).

In February 2012, we issued $3.5 billion of Senior Notes (the “February 2012 Senior Notes”), including:

$1.0 billion aggregate principal amount of 2.100% Senior Notes due 2015 (“February 2015 Senior Notes”)

$1.5 billion aggregate principal amount of 2.650% Senior Notes due 2017 (“February 2017 Senior Notes”)

$1.0 billion aggregate principal amount of 3.900% Senior Notes due 2022 (“February 2022 Senior Notes”)

The net proceeds were used to pay a portion of the cash consideration paid in the Merger and to pay related fees

and expenses.

Our current maturities of long-term debt include approximately $303.3 million of senior notes, as well as $631.6

million of term loan payments that are due in 2013. On February 15, 2013, the Board of Directors approved a plan to call

$1.0 billion aggregate principal amount of 6.25% Senior Notes due 2014 in the first half of 2013 using existing cash on

hand. See Note 16 – Subsequent event.

We anticipate that our current cash balances, cash flows from operations and our revolving credit facility will be

sufficient to meet our cash needs and make scheduled payments for our contractual obligations and current capital

commitments. However, if needs arise, we may decide to secure external capital to provide additional liquidity. New

sources of liquidity may include additional lines of credit, term loans, or issuance of notes or common stock, all of which

are allowable, with certain limitations, under our existing credit agreement. While our ability to secure debt financing in the

short term at rates favorable to us may be moderated due to various factors, including the financing incurred in connection

with the Merger, market conditions or other factors, we believe our liquidity options discussed above are sufficient to meet

our cash flow needs.

ACQUISITIONS AND RELATED TRANSACTIONS

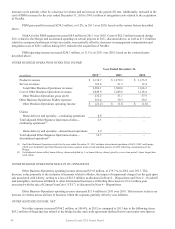

As a result of the Merger on April 2, 2012, Medco and ESI each became 100% owned subsidiaries of Express

Scripts and former Medco and ESI stockholders became owners of stock in Express Scripts, which is listed on the Nasdaq

stock exchange. Upon closing of the Merger, former ESI stockholders owned approximately 59% of Express Scripts and

former Medco stockholders owned approximately 41%. Per the terms of the Merger Agreement, upon consummation of the

Merger on April 2, 2012, each share of Medco common stock was converted into (i) the right to receive $28.80 in cash,

without interest and (ii) 0.81 shares of Express Scripts stock. Holders of Medco stock options, restricted stock units, and

deferred stock units received replacement awards at an exchange ratio of 1.3474 Express Scripts stock awards for each

Medco award owned, which is equal to the sum of (i) 0.81 and (ii) the quotient obtained by dividing (1) $28.80 (the cash

component of the Merger consideration) by (2) an amount equal to the average of the closing prices of ESI common stock

on the Nasdaq for each of the 15 consecutive trading days ending with the fourth complete trading day prior to the

completion of the Merger (see Note 3 – Changes in business).

We regularly review potential acquisitions and affiliation opportunities. We believe available cash resources, bank

financing, additional debt financing or the issuance of additional common stock could be used to finance future acquisitions

or affiliations. There can be no assurance we will make new acquisitions or establish new affiliations in 2013 or thereafter.