Express Scripts 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report 87

2012

r 3

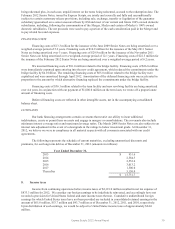

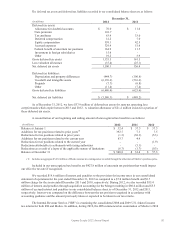

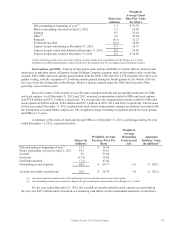

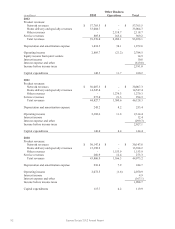

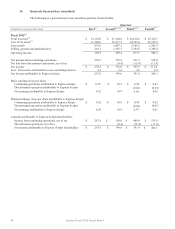

For the year ended December 31, 2012, the net benefit for the Company’s pension and other postretirement

benefit plans consisted of the following components:

(in millions)

2012

(1)

Pension

Benefits

Other

Postretirement

Benefits

Interest cost

$ 0.3

$ 0.1

Actual return on plan assets

(7.0)

-

Net actuarial loss

0.1

0.1

Net (benefit)/cost

$ (6.6)

$ 0.2

(1) Beginning April 2, 2012, the date of the Merger.

Net actuarial gains and losses reflect experience differentials relating to differences between expected and

actual demographic changes, differences between expected and actual healthcare cost increases and the effects of

changes in actuarial assumptions. Net actuarial gains and losses are recorded into net income in the period incurred.

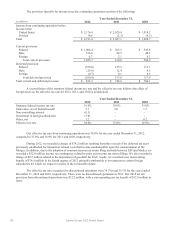

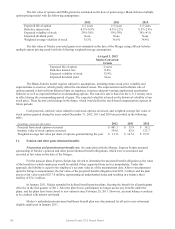

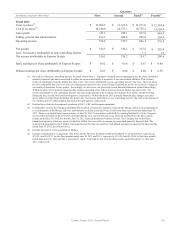

Changes in plan assets, benefit obligation and funded status. Summarized information about the funded

status and the changes in plan assets and projected benefit obligation for the year ended December 31, 2012 is as

follows:

(in millions)

Pension

Benefits

Other

Postretirement

Benefits

Fair value of plan assets at beginning of year

$ -

$ -

Fair value of plan assets assumed in the Merger

217.0

-

Actual return on plan assets

7.0

-

Company contributions

6.1

0.5

Benefits paid

(22.6)

(0.5)

Fair value of plan assets at end of year

207.5

-

Projected benefit obligation at beginning of year

-

-

Benefit obligation assumed in the Merger

291.3

2.9

Interest cost

0.3

0.1

Actuarial losses

0.1

0.1

Benefits paid

(22.6)

(0.5)

Projected benefit obligation at end of year

269.1

2.6

Underfunded status at end of year

$ 61.6

$ 2.6

As a result of the plan freeze, the accumulated benefit obligation and the projected benefit obligation

amounts for the defined benefit pension plan are equal at December 31, 2012.

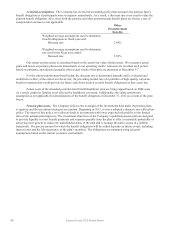

The pension and other postretirement benefits liabilities recognized at December 31, 2012 are as follows:

(in millions)

Pension

Benefits

Other

Postretirement

Benefits

Accrued expenses

$ -

$ 0.5

Other liabilities

61.6

2.1

Total pension and other postretirement liabilities

$ 61.6

$ 2.6