Express Scripts 2012 Annual Report Download - page 80

Download and view the complete annual report

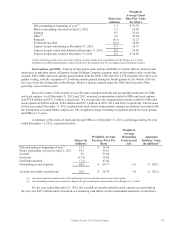

Please find page 80 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Express Scripts 2012 Annual Report78

liquidation of the guarantor subsidiary) guaranteed on a senior basis by most of our current and future 100% owned

domestic subsidiaries.

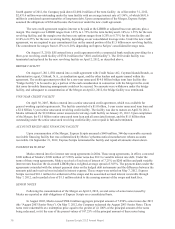

On May 2, 2011, ESI issued $1.5 billion aggregate principal amount of 3.125% Senior Notes due 2016 (the

“May 2011 Senior Notes”). The May 2011 Senior Notes require interest to be paid semi-annually on May 15 and

November 15. We may redeem some or all of the May 2011 Senior Notes prior to maturity at a price equal to the

greater of (1) 100% of the aggregate principal amount of any notes being redeemed, plus accrued and unpaid

interest; or (2) the sum of the present values of the remaining scheduled payments of principal and interest on the

notes being redeemed, not including unpaid interest accrued to the redemption date, discounted to the redemption

date on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the treasury rate plus

20 basis points with respect to any May 2011 Senior Notes being redeemed, plus in each case, unpaid interest on the

notes being redeemed accrued to the redemption date. The May 2011 Senior Notes are jointly and severally and

fully and unconditionally (subject to certain customary release provisions, including sale, exchange, transfer or

liquidation of the guarantor subsidiary) guaranteed on a senior basis by us and most of our current and future 100%

owned domestic subsidiaries. ESI used the net proceeds to repurchase treasury shares.

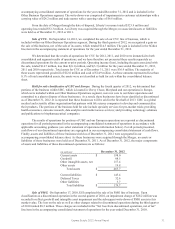

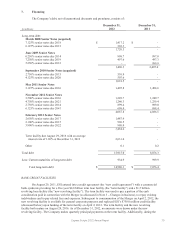

On November 14, 2011, we issued $4.1 billion of Senior Notes (the “November 2011 Senior Notes”),

including:

$900 million aggregate principal amount of 2.750% Senior Notes due 2014 (the “November 2014 Senior

Notes”)

$1.25 billion aggregate principal amount of 3.500% Senior Notes due 2016 (the “November 2016 Senior

Notes”)

$1.25 billion aggregate principal amount of 4.750% Senior Notes due 2021 (the “2021 Senior Notes”)

$700 million aggregate principal amount of 6.125% Senior Notes due 2041 (the “2041 Senior Notes”)

The November 2014 Senior Notes require interest to be paid semi-annually on May 21 and November 21.

The November 2016 Senior Notes, 2021 Senior Notes, and 2041 Senior Notes require interest to be paid semi-

annually on May 15 and November 15. The net proceeds were used to pay a portion of the cash consideration paid

in the Merger and to pay related fees and expenses (see Note 3 – Changes in business).

We may redeem some or all of each series of November 2011 Senior Notes prior to maturity at a price

equal to the greater of (1) 100% of the aggregate principal amount of any notes being redeemed, plus accrued and

unpaid interest; or (2) the sum of the present values of the remaining scheduled payments of principal and interest on

the notes being redeemed, not including unpaid interest accrued to the redemption date, discounted to the

redemption date on a semiannual basis at the treasury rate plus 35 basis points with respect to any November 2014

Senior Notes being redeemed, 40 basis points with respect to any November 2016 Senior Notes being redeemed, 45

basis points with respect to any 2021 Senior Notes being redeemed, or 50 basis points with respect to any 2041

Senior Notes being redeemed, plus in each case, unpaid interest on the notes being redeemed accrued to the

redemption date. The November 2011 Senior Notes, issued by us, are jointly and severally and fully and

unconditionally (subject to certain customary release provisions, including sale, exchange, transfer or liquidation of

the guarantor subsidiary) guaranteed on a senior unsecured basis by ESI and most of our current and future 100%

owned domestic subsidiaries, including upon consummation of the Merger, Medco and certain of Medco’s 100%

owned domestic subsidiaries.

On February 6, 2012, we issued $3.5 billion of Senior Notes (the “February 2012 Senior Notes”),

including:

$1.0 billion aggregate principal amount of 2.100% Senior Notes due 2015 (“February 2015 Senior Notes”)

$1.5 billion aggregate principal amount of 2.650% Senior Notes due 2017 (“February 2017 Senior Notes”)

$1.0 billion aggregate principal amount of 3.900% Senior Notes due 2022 (“February 2022 Senior Notes”)

We may redeem some or all of each series of February 2012 Senior Notes prior to maturity at a price equal

to the greater of (1) 100% of the aggregate principal amount of any notes being redeemed, plus accrued and unpaid

interest; or (2) the sum of the present values of the remaining scheduled payments of principal and interest on the

notes being redeemed, not including unpaid interest accrued to the redemption date, discounted to the redemption

date on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the treasury rate plus

30 basis points with respect to any February 2015 Senior Notes being redeemed, 35 basis points with respect to any

February 2017 Senior Notes being redeemed, or 40 basis points with respect to any February 2022 Senior Notes