Express Scripts 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

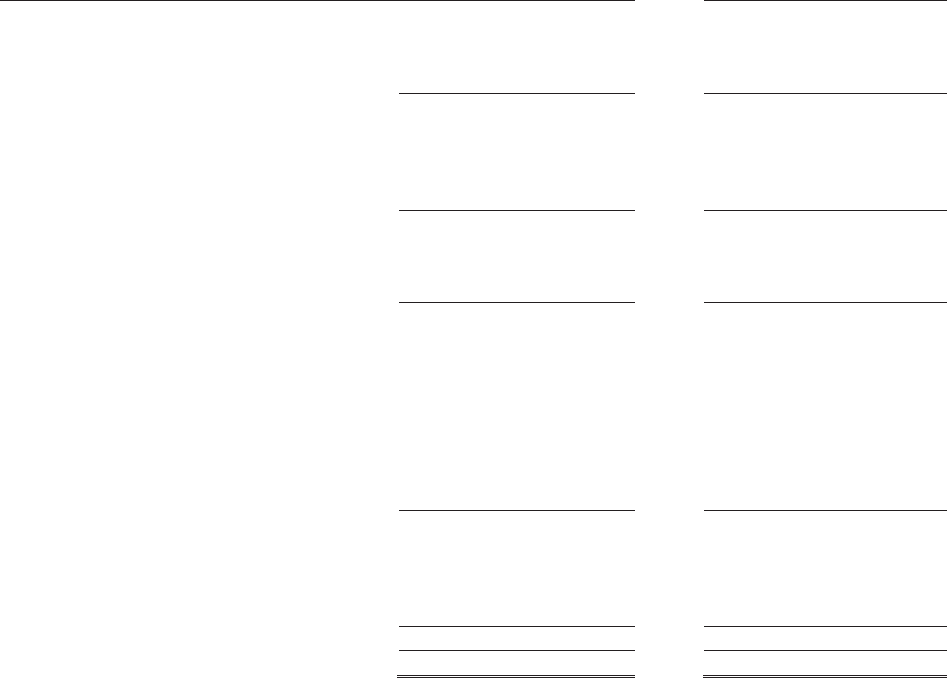

Express Scripts 2012 Annual Report 67

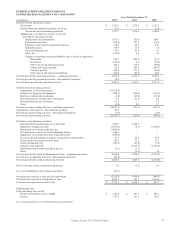

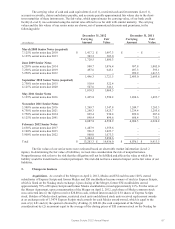

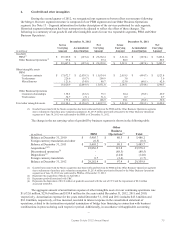

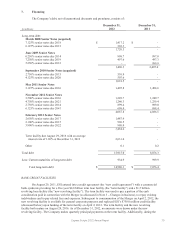

The carrying value of cash and cash equivalents (Level 1), restricted cash and investments (Level 1),

accounts receivable, claims and rebates payable, and accounts payable approximated fair values due to the short-

term maturities of these instruments. The fair value, which approximates the carrying value, of our bank credit

facility (Level 2) was estimated using the current rates offered to us for debt with similar maturity. The carrying

values and the fair values of our senior notes are shown, net of unamortized discounts and premiums, in the

following table:

December 31, 2012

December 31, 2011

(in millions)

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

March 2008 Senior Notes (acquired)

7.125% senior notes due 2018

$

1,417.2

$

1,497.3

$

-

$

-

6.125% senior notes due 2013

303.3

303.0

-

-

1,720.5

1,800.3

-

-

June 2009 Senior Notes

6.250% senior notes due 2014

998.7

1,076.4

997.8

1,085.0

7.250% senior notes due 2019

497.6

645.1

497.3

593.1

5.250% senior notes due 2012

-

-

999.9

1,017.5

1,496.3

1,721.5

2,495.0

2,695.6

September 2010 Senior Notes (acquired)

2.750% senior notes due 2015

510.9

522.4

-

-

4.125% senior notes due 2020

507.6

546.1

-

-

1,018.5

1,068.5

-

-

May 2011 Senior Notes

3.125% senior notes due 2016

1,495.8

1,590.2

1,494.6

1,493.7

November 2011 Senior Notes

3.500% senior notes due 2016

1,249.7

1,347.8

1,249.7

1,265.3

4.750% senior notes due 2021

1,240.3

1,425.7

1,239.4

1,295.8

2.750% senior notes due 2014

899.4

930.8

899.0

907.8

6.125% senior notes due 2041

698.4

894.6

698.4

755.3

4,087.8

4,598.9

4,086.5

4,224.2

February 2012 Senior Notes

2.650% senior notes due 2017

1,487.9

1,559.6

-

-

2.100% senior notes due 2015

996.5

1,023.7

-

-

3.900% senior notes due 2022

980.0

1,073.3

-

-

3,464.4

3,656.6

-

-

Total

$

13,283.3

$

14,436.0

$

8,076.1

$

8,413.5

The fair values of our senior notes were estimated based on observable market information (Level 2

inputs). In determining the fair value of liabilities, we took into consideration the risk of nonperformance.

Nonperformance risk refers to the risk that the obligation will not be fulfilled and affects the value at which the

liability would be transferred to a market participant. This risk did not have a material impact on the fair value of our

liabilities.

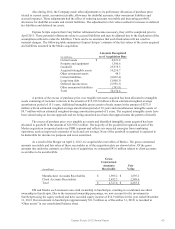

3. Changes in business

Acquisitions. As a result of the Merger on April 2, 2012, Medco and ESI each became 100% owned

subsidiaries of Express Scripts and former Medco and ESI stockholders became owners of stock in Express Scripts,

which is listed on the Nasdaq stock exchange. Upon closing of the Merger, former ESI stockholders owned

approximately 59% of Express Scripts and former Medco stockholders owned approximately 41%. Per the terms of

the Merger Agreement, upon consummation of the Merger on April 2, 2012, each share of Medco common stock

was converted into (i) the right to receive $28.80 in cash, without interest and (ii) 0.81 shares of Express Scripts

stock. Holders of Medco stock options, restricted stock units and deferred stock units received replacement awards

at an exchange ratio of 1.3474 Express Scripts stock awards for each Medco award owned, which is equal to the

sum of (i) 0.81 and (ii) the quotient obtained by dividing (1) $28.80 (the cash component of the Merger

consideration) by (2) an amount equal to the average of the closing prices of ESI common stock on the Nasdaq for