Express Scripts 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2012 Annual Report50

senior unsecured term loan and all associated interest, and the $1.0 billion then outstanding under the senior unsecured

revolving credit facility, were repaid in full and terminated.

See Note 7 – Financing for more information on the five-year credit facility.

ACCOUNTS RECEIVABLE FINANCING FACILITY

Upon consummation of the Merger, Express Scripts assumed a $600 million, 364-day renewable accounts

receivable financing facility that was collateralized by Medco’s pharmaceutical manufacturer rebates accounts receivable.

On September 21, 2012, Express Scripts terminated the facility and repaid all amounts drawn down.

See Note 7 – Financing for more information on the accounts receivable financing facility.

INTEREST RATE SWAP

Medco entered into five interest rate swap agreements in 2004. These swap agreements, in effect, converted $200

million of Medco’s $500 million of 7.250% senior notes due 2013 to variable interest rate debt. Under the terms of these

swap agreements, Medco received a fixed rate of interest of 7.25% on $200 million and paid variable interest rates based on

the six-month LIBOR plus a weighted-average spread of 3.05%. The payment dates under the agreements coincided with

the interest payment dates on the hedged debt instruments and the difference between the amounts paid and received is

included in interest expense. These swaps were settled on May 7, 2012. Express Scripts received $10.1 million for

settlement of the swaps and the associated accrued interest receivable through May 7, 2012 and recorded a loss of $1.5

million related to the carrying amount of the swaps and bank fees.

See Note 7 – Financing for more information on the interest rate swap.

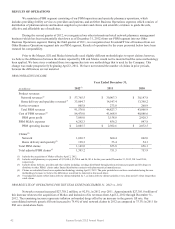

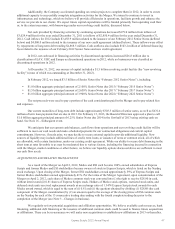

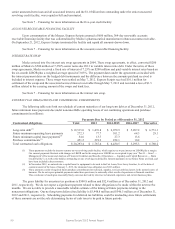

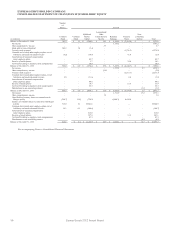

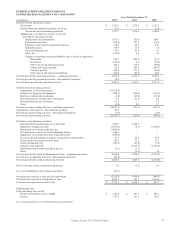

CONTRACTUAL OBLIGATIONS AND COMMERCIAL COMMITMENTS

The following table sets forth our schedule of current maturities of our long-term debt as of December 31, 2012,

future minimum lease payments due under noncancellable operating leases of our continuing operations and purchase

commitments (in millions):

Payments Due by Period as of December 31, 2012

Contractual obligations

Total

2013

2014-2015

2016-2017

Thereafter

Long-term debt(1)

$ 19,515.0

$ 1,476.8

$ 6,079.9

$ 5,207.2

$ 6,751.1

Future minimum operating lease payments

272.3

77.7

101.2

64.3

29.1

Future minimum capital lease payments(2)

54.6

13.7

27.3

13.6

-

Purchase commitments(3)

451.5

219.2

222.1

10.2

-

Total contractual cash obligations

$ 20,293.4

$ 1,787.4

$ 6,430.5

$ 5,295.3

$ 6,780.2

(1) These payments exclude the interest expense on our revolving credit facility, which requires us to pay interest on LIBOR plus a margin.

Our interest payments fluctuate with changes in LIBOR and in the margin over LIBOR we are required to pay (see “Part II — Item 7 —

Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Bank

Credit Facility”), as well as the balance outstanding on our revolving credit facility. Interest payments on our Senior Notes are fixed, and

have been included in these amounts.

(2) In November 2012, we entered into a capital lease for equipment to be used in the Fair Lawn, New Jersey location. As of the date of

commencement of the lease of January 1, 2013, the minimum lease obligation was $54.6 million.

(3) These amounts consist of required future purchase commitments for materials, supplies, services and fixed assets in the normal course of

business. We do not expect potential payments under these provisions to materially affect results of operations or financial condition.

This conclusion is based upon reasonably likely outcomes derived by reference to historical experience and current business plans.

The gross liability for uncertain tax positions is $500.8 million and $32.4 million as of December 31, 2012 and

2011, respectively. We do not expect a significant payment related to these obligations to be made within the next twelve

months. We are not able to provide a reasonable reliable estimate of the timing of future payments relating to the

noncurrent obligations. Our net long-term deferred tax liability is $5,948.8 million and $546.5 million as of December 31,

2012 and 2011, respectively. Scheduling payments for deferred tax liabilities could be misleading since future settlements

of these amounts are not the sole determining factor of cash taxes to be paid in future periods.